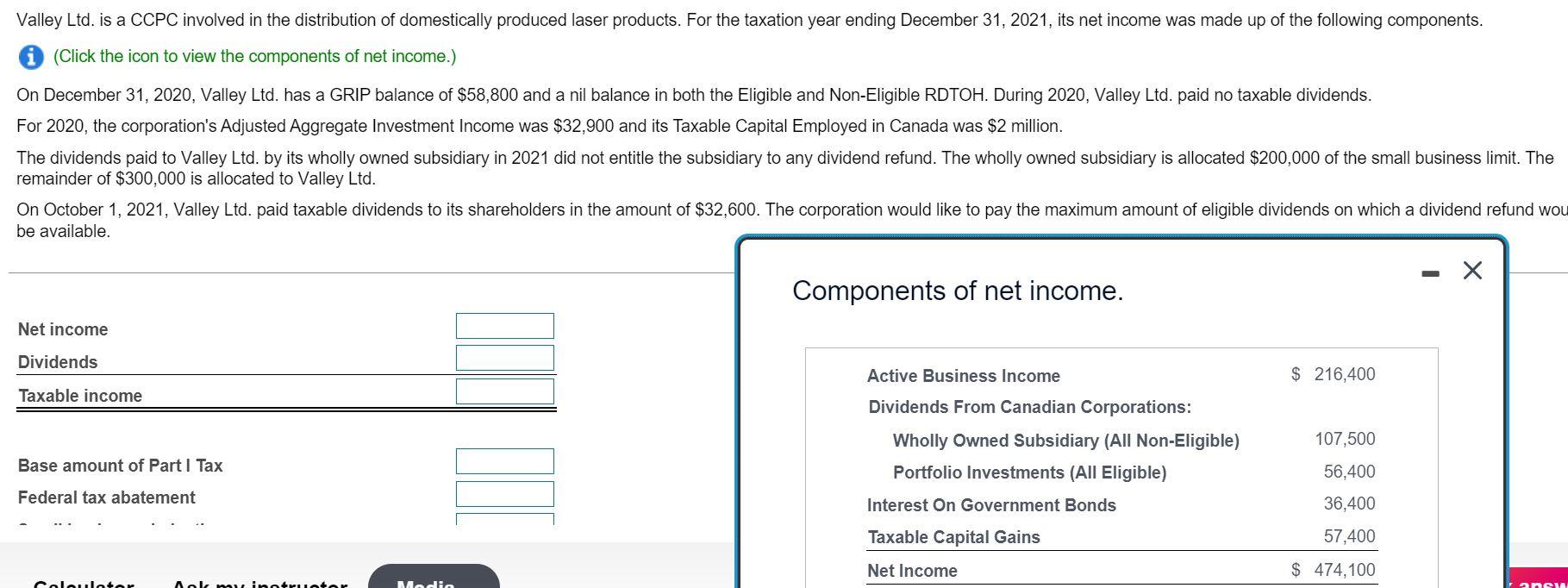

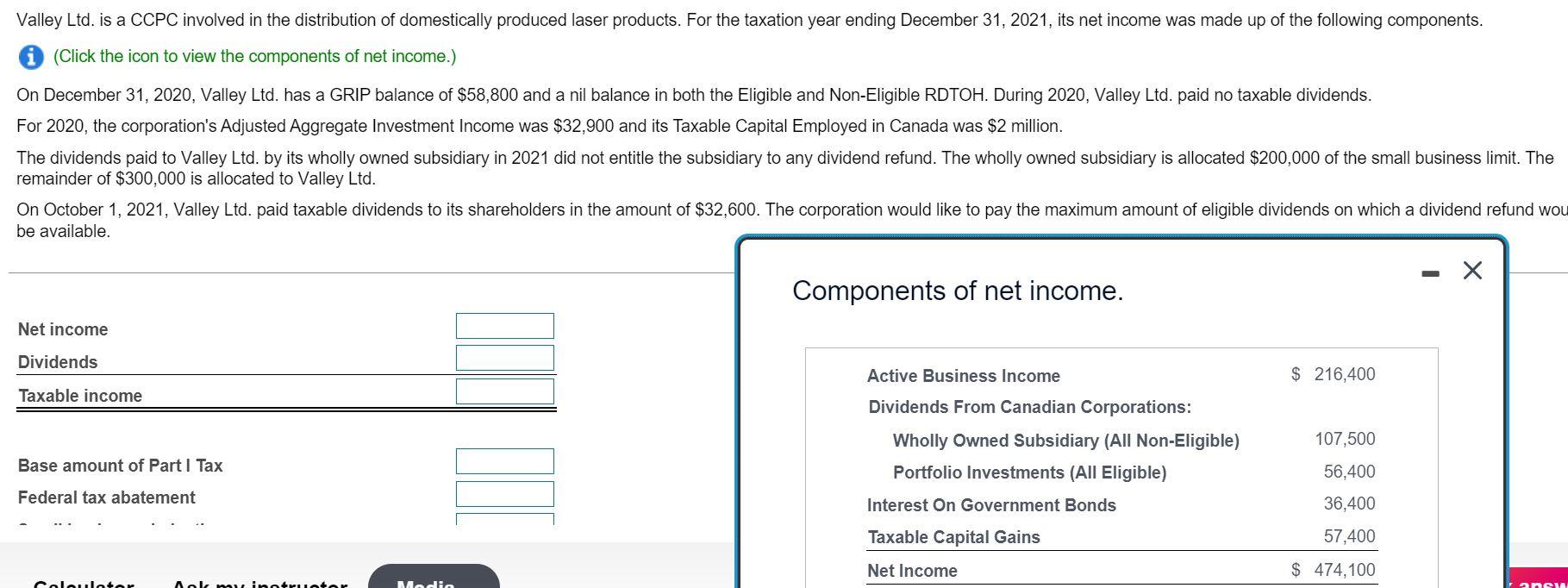

Valley Ltd. is a CCPC involved in the distribution of domestically produced laser products. For the taxation year ending December 31, 2021, its net income was made up of the following components. i (Click the icon to view the components of net income.) On December 31, 2020, Valley Ltd. has a GRIP balance of $58,800 and a nil balance in both the Eligible and Non-Eligible RDTOH. During 2020, Valley Ltd. paid no taxable dividends. For 2020, the corporation's Adjusted Aggregate Investment Income was $32,900 and its Taxable Capital Employed in Canada was $2 million. The dividends paid to Valley Ltd. by its wholly owned subsidiary in 2021 did not entitle the subsidiary to any dividend refund. The wholly owned subsidiary is allocated $200,000 of the small business limit. The remainder of $300,000 is allocated to Valley Ltd. On October 1, 2021, Valley Ltd. paid taxable dividends to its shareholders in the amount of $32,600. The corporation would like to pay the maximum amount of eligible dividends on which a dividend refund wou be available. - X Components of net income. Net income Dividends Active Business Income $ 216,400 Taxable income Dividends From Canadian Corporations: Wholly Owned Subsidiary (All Non-Eligible) Portfolio Investments (All Eligible) 107,500 56,400 Base amount of Part I Tax Federal tax abatement Interest On Government Bonds 36,400 Taxable Capital Gains 57,400 Net Income $ 474,100 Calculator Madio Aok my instructor answ Valley Ltd. is a CCPC involved in the distribution of domestically produced laser products. For the taxation year ending December 31, 2021, its net income was made up of the following components. i (Click the icon to view the components of net income.) On December 31, 2020, Valley Ltd. has a GRIP balance of $58,800 and a nil balance in both the Eligible and Non-Eligible RDTOH. During 2020, Valley Ltd. paid no taxable dividends. For 2020, the corporation's Adjusted Aggregate Investment Income was $32,900 and its Taxable Capital Employed in Canada was $2 million. The dividends paid to Valley Ltd. by its wholly owned subsidiary in 2021 did not entitle the subsidiary to any dividend refund. The wholly owned subsidiary is allocated $200,000 of the small business limit. The remainder of $300,000 is allocated to Valley Ltd. On October 1, 2021, Valley Ltd. paid taxable dividends to its shareholders in the amount of $32,600. The corporation would like to pay the maximum amount of eligible dividends on which a dividend refund wou be available. - X Components of net income. Net income Dividends Active Business Income $ 216,400 Taxable income Dividends From Canadian Corporations: Wholly Owned Subsidiary (All Non-Eligible) Portfolio Investments (All Eligible) 107,500 56,400 Base amount of Part I Tax Federal tax abatement Interest On Government Bonds 36,400 Taxable Capital Gains 57,400 Net Income $ 474,100 Calculator Madio Aok my instructor answ