Question

Valotic Tech Inc. sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division

Valotic Tech Inc. sells electronics over the Internet. The Consumer Products Division is organized as a cost center. The budget for the Consumer Products Division for the month ended January 31, 2016, is as follows:

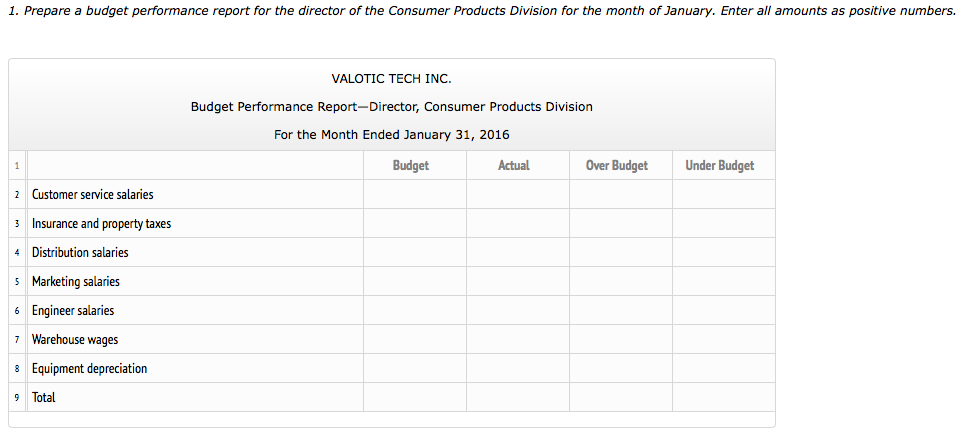

| 1 | Customer service salaries | $546,840.00 |

| 2 | Insurance and property taxes | 114,660.00 |

| 3 | Distribution salaries | 872,340.00 |

| 4 | Marketing salaries | 1,028,370.00 |

| 5 | Engineer salaries | 836,850.00 |

| 6 | Warehouse wages | 586,110.00 |

| 7 | Equipment depreciation | 183,792.00 |

| 8 | Total | $4,168,962.00 |

During January, the costs incurred in the Consumer Products Division were as follows:

| 1 | Customer service salaries | $602,350.00 |

| 2 | Insurance and property taxes | 110,240.00 |

| 3 | Distribution salaries | 861,200.00 |

| 4 | Marketing salaries | 1,085,230.00 |

| 5 | Engineer salaries | 820,008.00 |

| 6 | Warehouse wages | 562,632.00 |

| 7 | Equipment depreciation | 183,610.00 |

| 8 | Total | $4,225,270.00 |

| Required: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 1. | Prepare a budget performance report for the director of the Consumer Products Division for the month of January. Enter all amounts as positive numbers. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

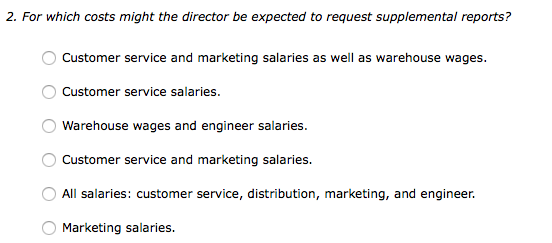

| 2. | For which costs might the director be expected to request supplemental reports?

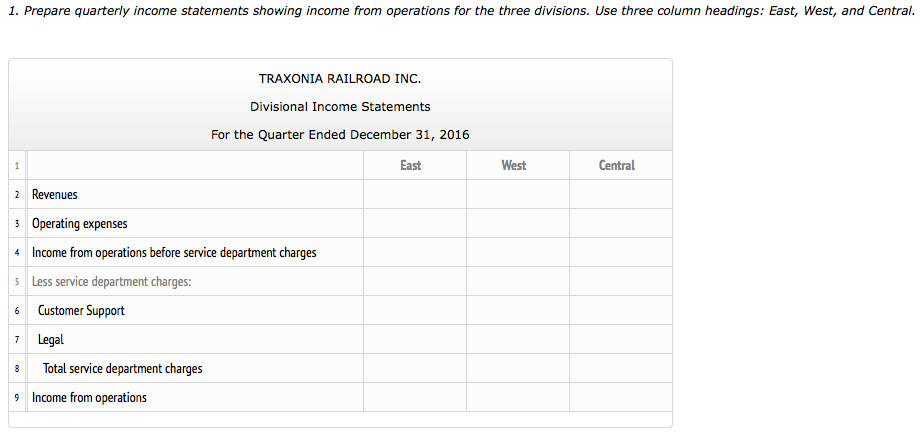

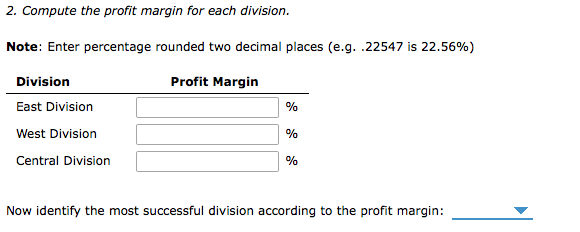

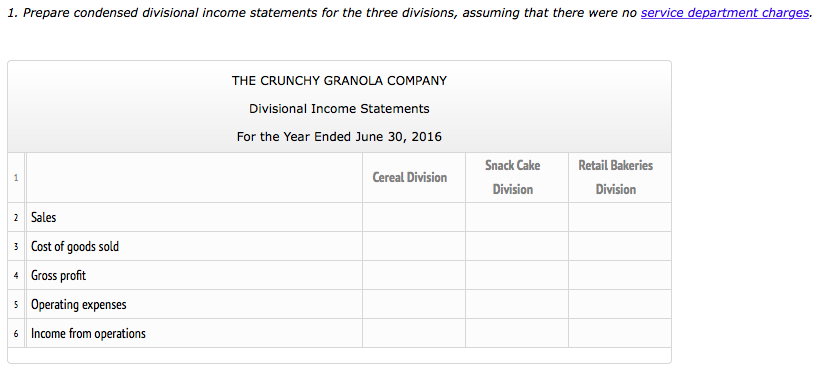

Traxonia Railroad Inc. has three regional divisions organized as profit centers. The chief executive officer (CEO) evaluates divisional performance, using income from operations as a percent of revenues. The following quarterly income and expense accounts were provided from the trial balance as of December 31, 2016:

The company operates three service departments: Shareholder Relations, Customer Support, and Legal. The Shareholder Relations Department conducts a variety of services for shareholders of the company. The Customer Support Department is the companys point of contact for new service, complaints, and requests for repair. The department believes that the number of customer contacts is an activity base for this work. The Legal Department provides legal services for division management. The department believes that the number of hours billed is an activity base for this work. The following additional information has been gathered:

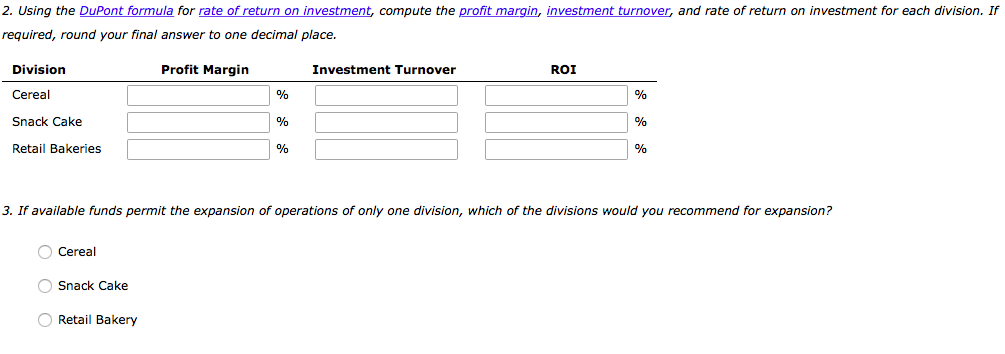

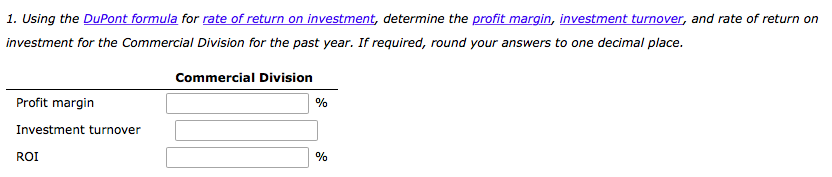

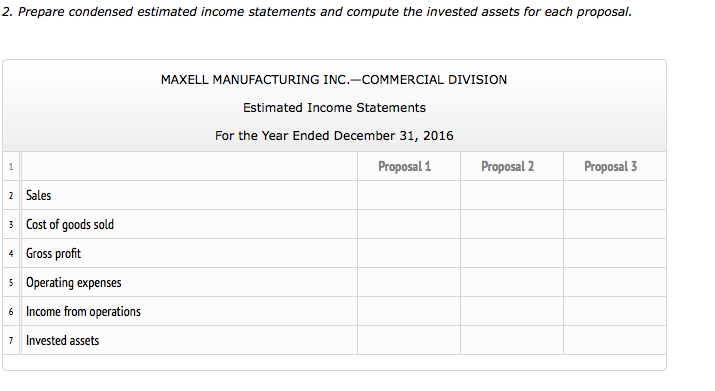

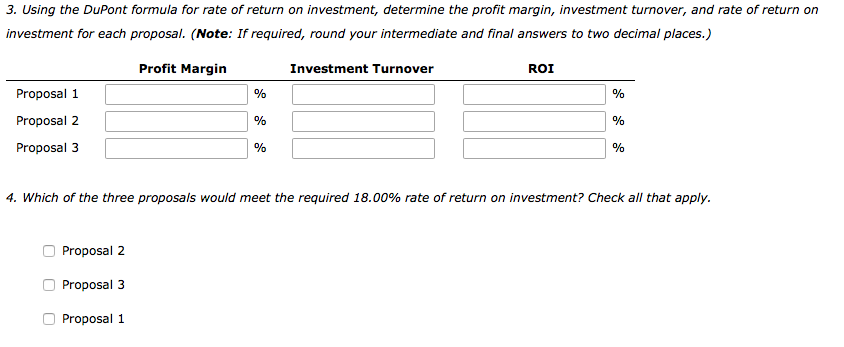

A condensed income statement for the Commercial Division of Maxell Manufacturing Inc. for the year ended December 31, 2016, is as follows:

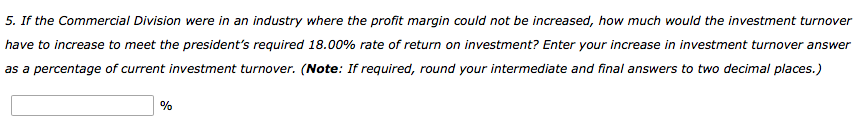

Assume that the Commercial Division received no charges from service departments. The president of Maxell Manufacturing has indicated that the divisions rate of return on a $2,750,000 investment must be increased to at least 18.00% by the end of the next year if operations are to continue. The division manager is considering the following three proposals: Proposal 1: Transfer equipment with a book value of $315,000 to other divisions at no gain or loss and lease similar equipment. The annual lease payments would exceed the amount of depreciation expense on the old equipment by $108,000. This increase in expense would be included as part of the cost of goods sold. Sales would remain unchanged. Proposal 2: Purchase new and more efficient machining equipment and thereby reduce the cost of goods sold by $525,000 after considering the effects of depreciation expense on the new equipment. Sales would remain unchanged, and the old equipment, which has no remaining book value, would be scrapped at no gain or loss. The new equipment would increase invested assets by an additional $1,818,000 for the year. Proposal 3: Reduce invested assets by discontinuing a product line. This action would eliminate sales of $594,000, reduce cost of goods sold by $407,700, and reduce operating expenses by $178,500. Assets of $1,388,000 would be transferred to other divisions at no gain or loss.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started