Question

VALUATION AND COST OF CAPITAL IN AN INTERNATIONAL CONTEXT Vale, a Brazilian-based international mining and shipping conglomerate, is considering the acquisition of several copper mines

VALUATION AND COST OF CAPITAL IN AN INTERNATIONAL CONTEXT

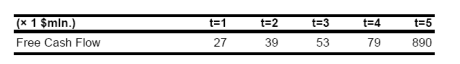

Vale, a Brazilian-based international mining and shipping conglomerate, is considering the acquisition of several copper mines in Indonesia. The firm is trading on the New York Stock Exchange and an equity analyst following the firm wants to value the copper mines in US dollars. The projected free cash flows for the next 5 years (including a terminal value estimate) are summarized below (in $ millions):

The analyst collected the following information in order to estimate the cost of capital for the acquisition:

The analyst furthermore determined that the proportion of revenues that the mines generate from Indonesia equals 40%, whereas the average Indonesian company generates 60% of its revenues from the country. Vale currently has no operations in Indonesia. The marginal corporate tax rate for the mining operations equals 30%, and the target debt ratio for the acquisition equals 20%. The corresponding bond rating for the debt would be A3. With this information, please answer the following questions:

(i) Calculate the dollar-based cost of capital for the acquisition based on information for the US only (that is, without the inclusion of a country risk premium).

(ii) Suppose the analyst wants to include a country risk premium for Indonesia in the cost of equity estimate, which reflects the exposure (lambda) of the mines to the Indonesian economy and furthermore wants to include a sovereign spread for Indonesia in the cost of debt. What is the dollar-based cost of capital for the acquisition taking this country risk into account?

(iii) If we assume that the cash flows from the mines would predominantly depend on global economic conditions, and that there is a 2.5% probability that the mines will be fully expropriated by the Indonesian government shortly after the end of year 4, how should the analyst proceed in valuing the mining operations, and what is the resulting value of the mines based on this new information?

\begin{tabular}{lccccc} \hline(1$m). & t=1 & t=2 & t=3 & t=4 & t=5 \\ \hline Free Cash Flow & 27 & 39 & 53 & 79 & 890 \\ \hline \end{tabular} Bond Yields Market Risk Premium 10-yearUSTreasuryBond10-yearIndonesianGovernmentBond(in$s)10-yearIndonesianGovernmentBond(inRp)A3-rated10-yearUSCorporateBond3.00%5.25%7.00%4.20%HistoricalRiskPremiumUS(1926-2012)StandardDeviation(St.Dev.)USStocksStandardDeviation(St.Dev.)IndonesianStocksSt.Dev.IndonesianGovernmentBonds24.00% Beta Estimates Bond Ratings Beta Vale (relative to S\&P 500) 1.79 US Unlevered Regression Beta Vale 1.25 Local currency rating (\$) Average Unlevered Beta Shipping firms 1.20 Foreign currency rating Baa3 Average Unlevered Beta Mining Firms 1.50 Local currency rating Baa3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started