Valuation Concepts and Methods by Lascano, Baron and Cachero. 2021 edition.

Can we please ask for the step by step solution so that we could review it? Thank you Numbers 5-20

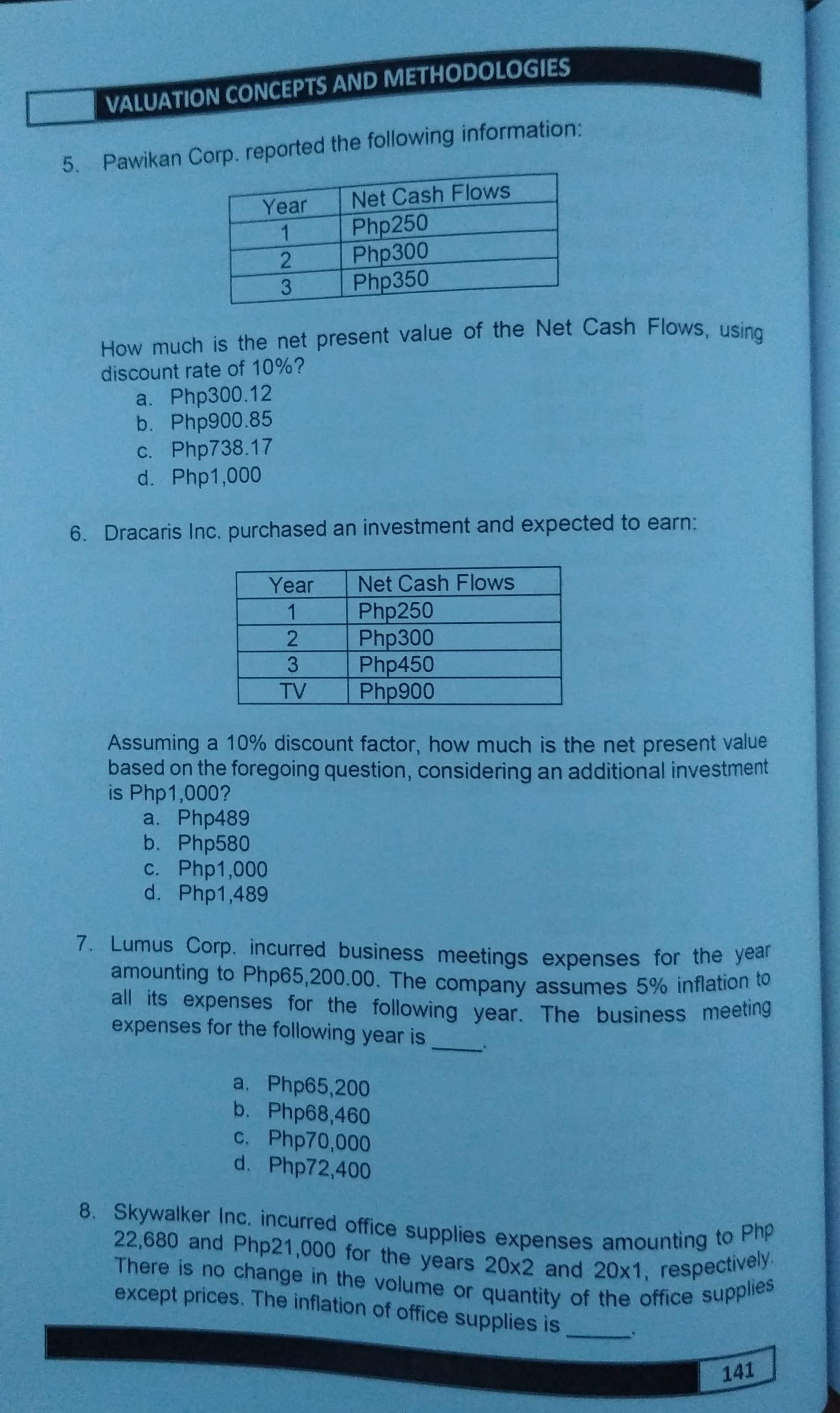

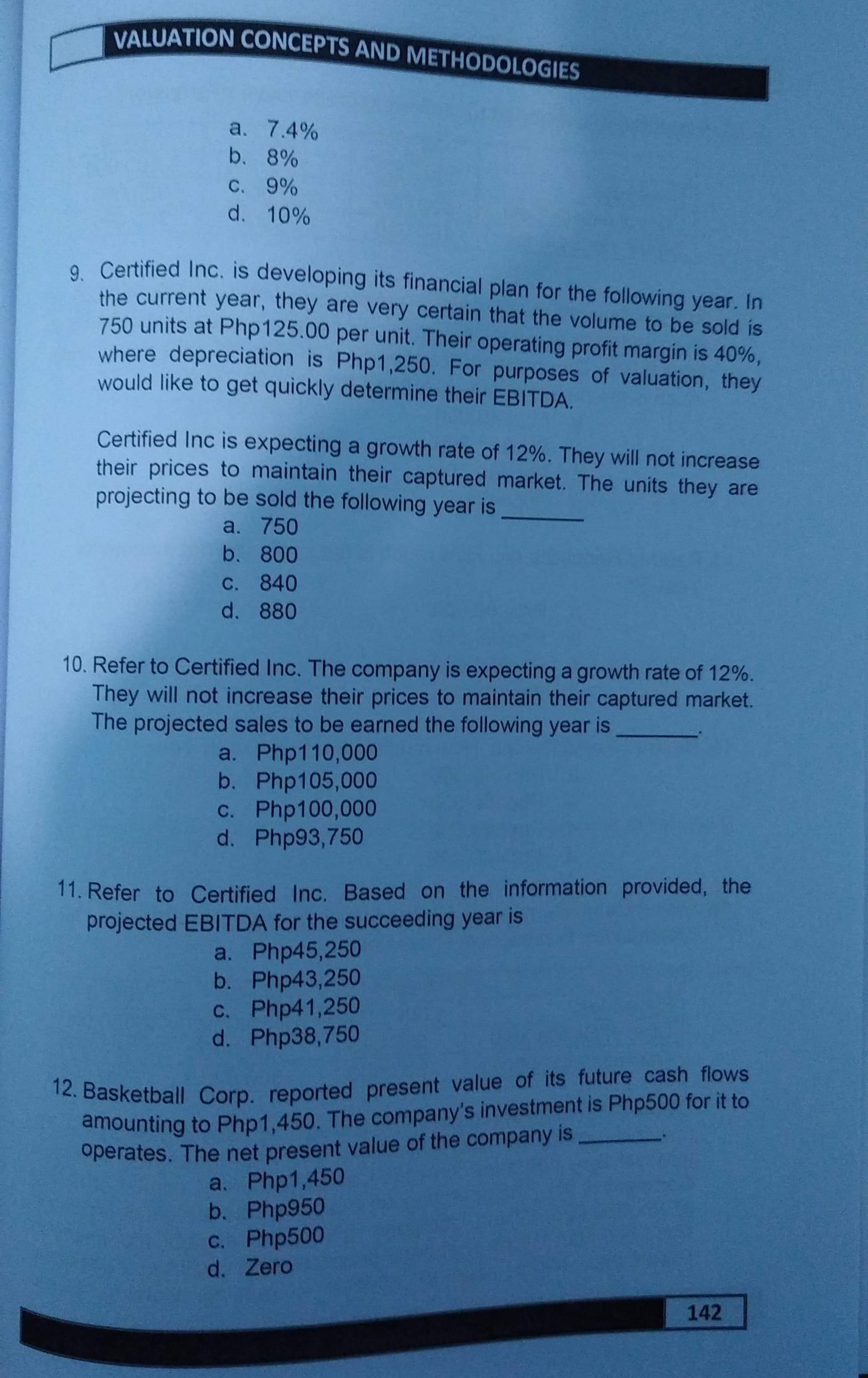

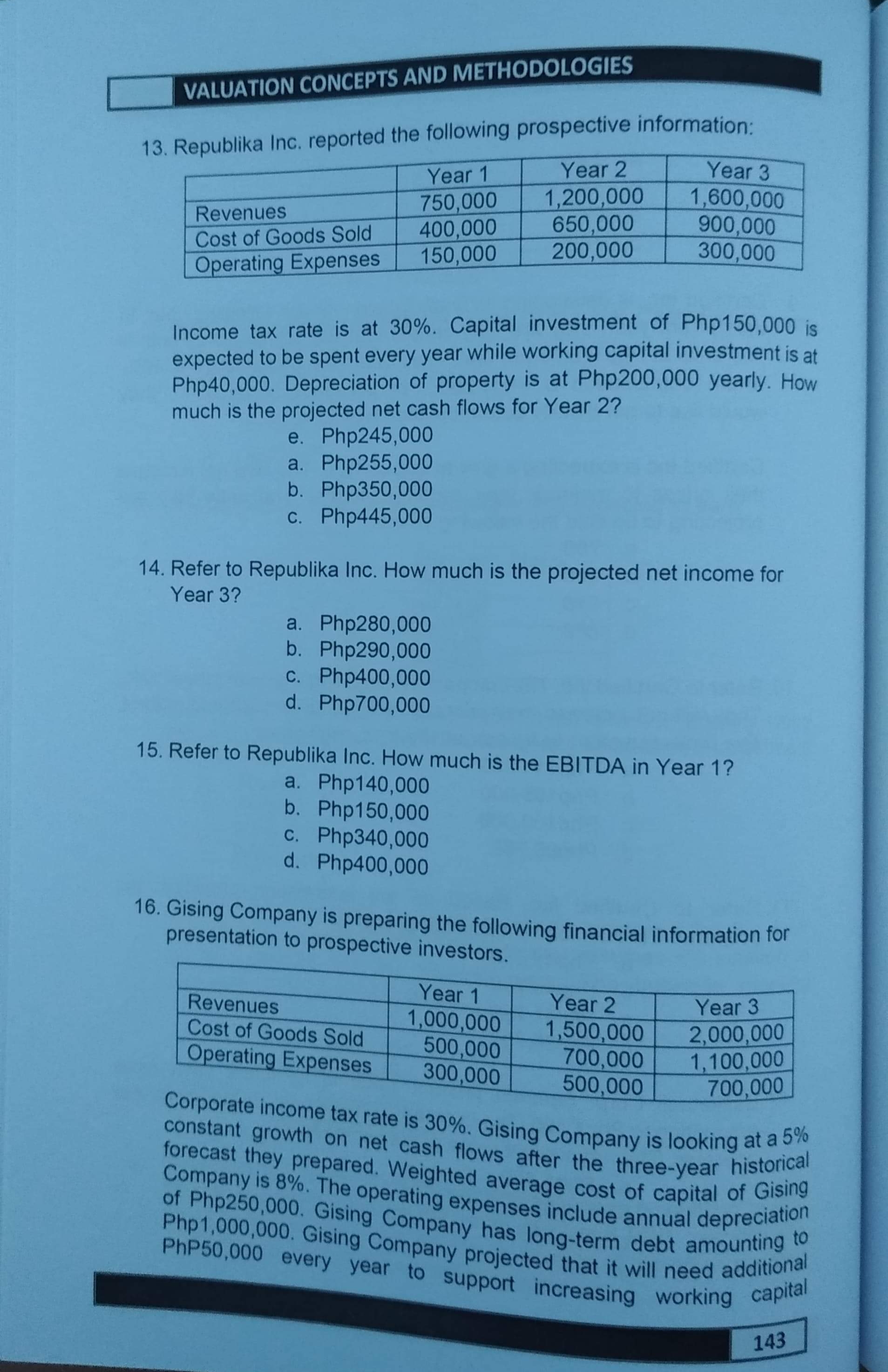

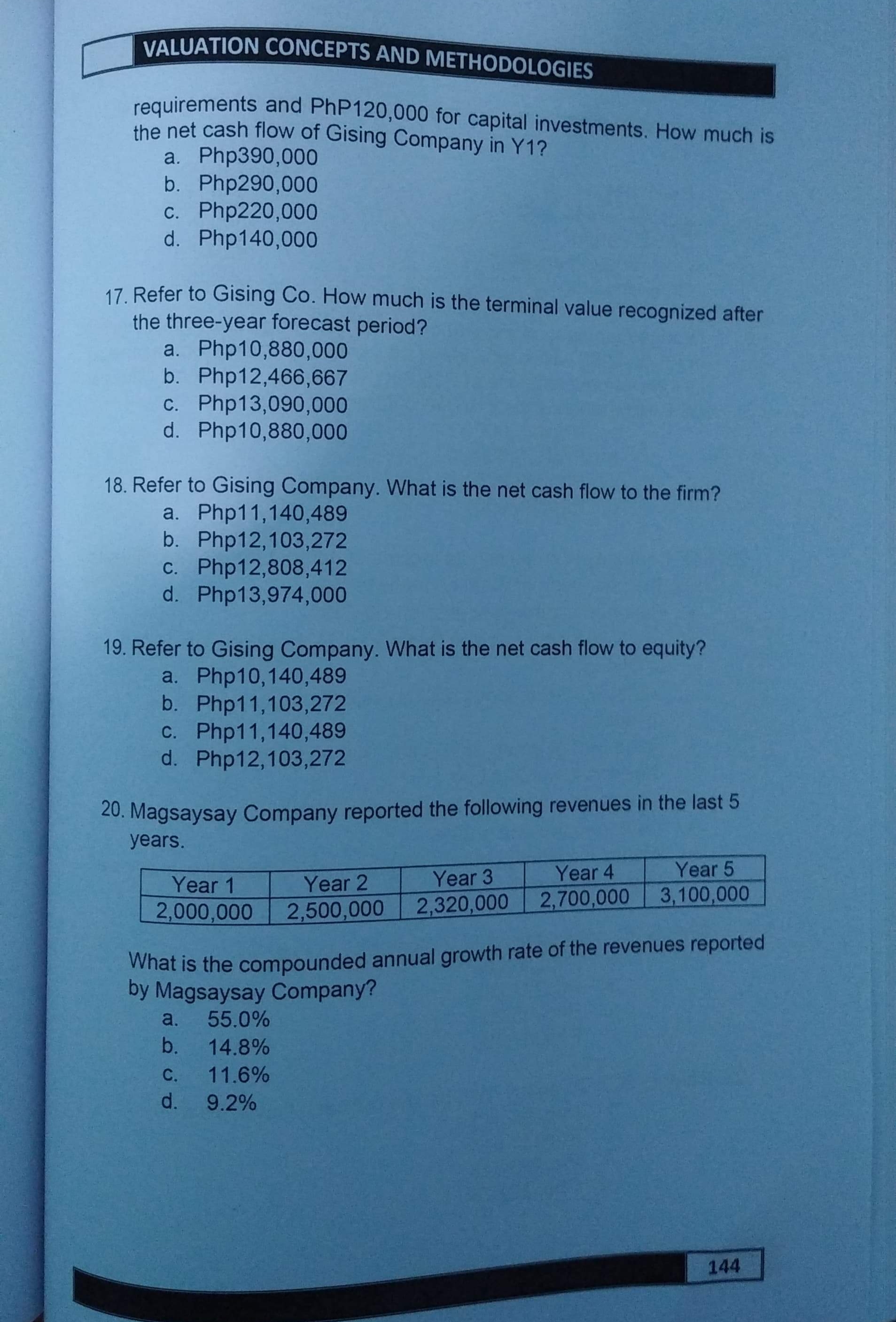

VALUATION CONCEPTS AND METHODOLOGIES 5. Pawikan Corp. reported the following information: Year Net Cash Flows 1 Php250 Php300 W / N Php350 How much is the net present value of the Net Cash Flows, using discount rate of 10%? a. Php300.12 b. Php900.85 c. Php738.17 d. Php1,000 6. Dracaris Inc. purchased an investment and expected to earn: Year Net Cash Flows 1 Php250 2 Php300 3 Php450 TV Php900 Assuming a 10% discount factor, how much is the net present value based on the foregoing question, considering an additional investment is Php1,000? a. Php489 b. Php580 c. Php1,000 d. Php1,489 7. Lumus Corp. incurred business meetings expenses for the year amounting to Php65,200.00. The company assumes 5% inflation to all its expenses for the following year. The business meeting expenses for the following year is a. Php65,200 b. Php68,460 c. Php70,000 d. Php72,400 8. Skywalker Inc. incurred office supplies expenses amounting to Php 22,680 and Php21,000 for the years 20x2 and 20x1, respectively. There is no change in the volume or quantity of the office supplies except prices. The inflation of office supplies is 141VALUATION CONCEPTS AND METHODOLOGIES a. 7.4% b. 8% C. 9% d. 10% 9. Certified Inc. is developing its financial plan for the following year. In the current year, they are very certain that the volume to be sold is 750 units at Php 125.00 per unit. Their operating profit margin is 40%, where depreciation is Php1,250. For purposes of valuation, they would like to get quickly determine their EBITDA. Certified Inc is expecting a growth rate of 12%. They will not increase their prices to maintain their captured market. The units they are projecting to be sold the following year is a. 750 b. 800 C. 840 d. 880 10. Refer to Certified Inc. The company is expecting a growth rate of 12%. They will not increase their prices to maintain their captured market. The projected sales to be earned the following year is a. Php1 10,000 b. Php105,000 c. Php100,000 d. Php93, 750 11. Refer to Certified Inc. Based on the information provided, the projected EBITDA for the succeeding year is a. Php45,250 b. Php43,250 c. Php41,250 d. Php38,750 12. Basketball Corp. reported present value of its future cash flows amounting to Php1,450. The company's investment is Php500 for it to operates. The net present value of the company is a. Php1,450 b. Php950 C. Php500 d. Zero 142VALUATION CONCEPTS AND METHODOLOGIES 13. Republika Inc. reported the following prospective information: Year 1 Year 2 Year 3 750,000 1,200,000 1,600,000 Revenues 400,000 650,000 900,000 Cost of Goods Sold 200,000 300,000 Operating Expenses 150,000 Income tax rate is at 30%. Capital investment of Php150,000 is expected to be spent every year while working capital investment is at Php40,000. Depreciation of property is at Php200,000 yearly. How much is the projected net cash flows for Year 2? e. Php245,000 a. Php255,000 b. Php350,000 c. Php445,000 14. Refer to Republika Inc. How much is the projected net income for Year 3? a. Php280,000 b. Php290,000 C. Php400,000 d. Php700,000 15. Refer to Republika Inc. How much is the EBITDA in Year 1? a. Php140,000 b. Php150,000 c. Php340,000 d. Php400,000 16. Gising Company is preparing the following financial information for presentation to prospective investors. Year 1 Revenues Year 2 Year 3 1,000,000 Cost of Goods Sold 1,500,000 2,000,000 500,000 Operating Expenses 700,000 1, 100,000 300,000 500,000 700,000 Corporate income tax rate is 30%. Gising Company is looking at a 5% constant growth on net cash flows after the three-year historical forecast they prepared. Weighted average cost of capital of Gising Company is 8%. The operating expenses include annual depreciation of Php250,000. Gising Company has long-term debt amounting to Php1,000,000. Gising Company projected that it will need additional PhP50,000 every year to support increasing working capital 143VALUATION CONCEPTS AND METHODOLOGIES requirements and PhP120,000 for capital investments. How much is the net cash flow of Gising Company in Y1? a. Php390,000 b. Php290,000 c. Php220,000 d. Php140,000 17. Refer to Gising Co. How much is the terminal value recognized after the three-year forecast period? a. Php10,880,000 b. Php12,466,667 c. Php13,090,000 d. Php10,880,000 18. Refer to Gising Company. What is the net cash flow to the firm? a. Php11, 140,489 b. Php12, 103, 272 c. Php12,808,412 d. Php13,974,000 19. Refer to Gising Company. What is the net cash flow to equity? a. Php10, 140,489 b. Php11, 103,272 c. Php11, 140,489 d. Php12, 103,272 20. Magsaysay Company reported the following revenues in the last 5 years. Year 1 Year 2 Year 3 Year 4 Year 5 2,000,000 2,500,000 2,320,000 2,700,000 3,100,000 What is the compounded annual growth rate of the revenues reported by Magsaysay Company? a. 55.0% b . 14.8% C . 11.6% d. 9.2% 144