Question

Valuation Models 1) Find the forecasted residual income for 2022 and beyond. 2) Compute the value of common equity as of December 31, 2021, using

Valuation Models

1) Find the forecasted residual income for 2022 and beyond.

2) Compute the value of common equity as of December 31, 2021, using the residual income model. Calculate the price per share.

3) Find the forecasted free cash flow to common equity for 2022 and beyond.

4) Compute the value of common equity as of December 31, 2021, using the free cash flow to common equity model. Calculate the price per share.

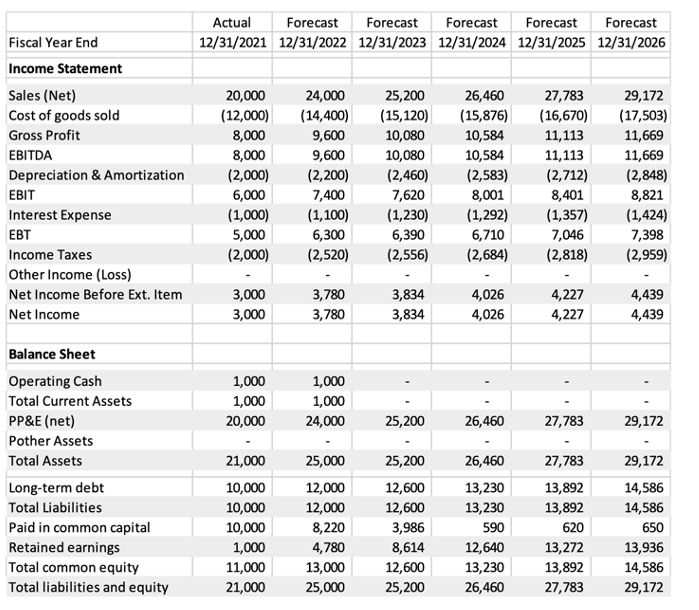

Table 1 presents the forecasted financial statements that extend into the infinite horizon (the Table only shows the first five years of forecasts). Note that year 2024 is the terminal period (growth rate in 2024 and all years after is a constant 5%). In addition, you should assume that the cost of equity capital is 10 percent. Also assume there are 1,000 shares outstanding and divide your valuation by 1,000 to get the price per share.

Actual Forecast Forecast Forecast Forecast Forecast 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 Fiscal Year End Income Statement Sales (Net) Cost of goods sold Gross Profit EBITDA Depreciation & Amortization EBIT Interest Expense EBT Income Taxes Other Income (Loss) Net Income Before Ext. Item Net Income 20,000 (12,000) 8,000 8,000 (2,000) 6,000 (1,000) 5,000 (2,000) 24,000 (14,400) 9,600 9,600 (2,200) 7,400 (1,100) 6,300 (2,520) 25,200 (15,120) 10,080 10,080 (2,460) 7,620 (1,230) 6,390 (2,556) 26,460 (15,876) 10,584 10,584 (2,583) 8,001 (1,292) 6,710 (2,684) 27,783 (16,670) 11,113 11,113 (2,712) 8,401 (1,357) 7,046 (2,818) 29,172 (17,503) 11,669 11,669 (2,848) 8,821 (1,424) 7,398 (2,959) - 3,000 3,000 3,780 3,780 3,834 3,834 4,026 4,026 4,227 4,227 4,439 4,439 1,000 1,000 20,000 1,000 1,000 24,000 25,200 26,460 27,783 29,172 Balance Sheet Operating Cash Total Current Assets PP&E (net) Pother Assets Total Assets Long-term debt Total Liabilities Paid in common capital Retained earnings Total common equity Total liabilities and equity 26,460 13,230 13,230 27,783 13,892 13,892 21,000 10,000 10,000 10,000 1,000 11,000 21,000 25,000 12,000 12,000 8,220 4,780 13,000 25,000 25,200 12,600 12,600 3,986 8,614 12,600 25,200 590 620 29,172 14,586 14,586 650 13,936 14,586 29,172 12,640 13,230 26,460 13,272 13,892 27,783 Actual Forecast Forecast Forecast Forecast Forecast 12/31/2021 12/31/2022 12/31/2023 12/31/2024 12/31/2025 12/31/2026 Fiscal Year End Income Statement Sales (Net) Cost of goods sold Gross Profit EBITDA Depreciation & Amortization EBIT Interest Expense EBT Income Taxes Other Income (Loss) Net Income Before Ext. Item Net Income 20,000 (12,000) 8,000 8,000 (2,000) 6,000 (1,000) 5,000 (2,000) 24,000 (14,400) 9,600 9,600 (2,200) 7,400 (1,100) 6,300 (2,520) 25,200 (15,120) 10,080 10,080 (2,460) 7,620 (1,230) 6,390 (2,556) 26,460 (15,876) 10,584 10,584 (2,583) 8,001 (1,292) 6,710 (2,684) 27,783 (16,670) 11,113 11,113 (2,712) 8,401 (1,357) 7,046 (2,818) 29,172 (17,503) 11,669 11,669 (2,848) 8,821 (1,424) 7,398 (2,959) - 3,000 3,000 3,780 3,780 3,834 3,834 4,026 4,026 4,227 4,227 4,439 4,439 1,000 1,000 20,000 1,000 1,000 24,000 25,200 26,460 27,783 29,172 Balance Sheet Operating Cash Total Current Assets PP&E (net) Pother Assets Total Assets Long-term debt Total Liabilities Paid in common capital Retained earnings Total common equity Total liabilities and equity 26,460 13,230 13,230 27,783 13,892 13,892 21,000 10,000 10,000 10,000 1,000 11,000 21,000 25,000 12,000 12,000 8,220 4,780 13,000 25,000 25,200 12,600 12,600 3,986 8,614 12,600 25,200 590 620 29,172 14,586 14,586 650 13,936 14,586 29,172 12,640 13,230 26,460 13,272 13,892 27,783Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started