Answered step by step

Verified Expert Solution

Question

1 Approved Answer

valuation of derivatives Consider a European call option on a non-dividend-paying stock when the current stock price is $45, the strike price is $40, the

valuation of derivatives

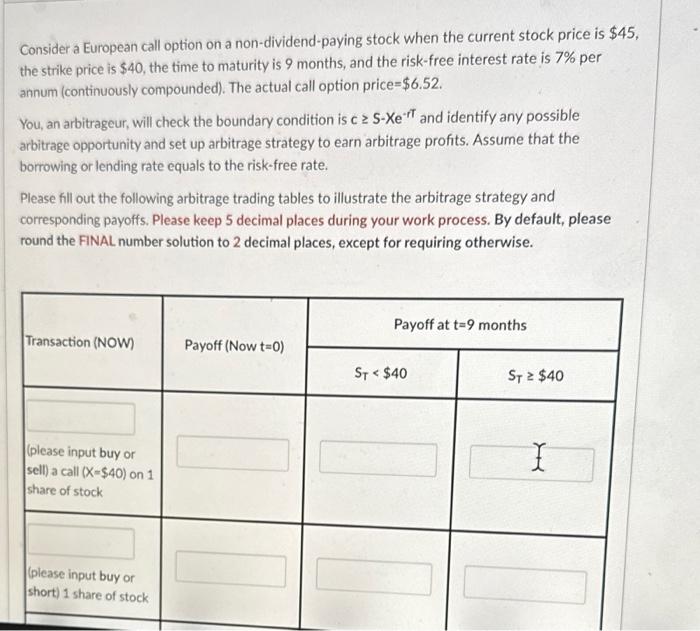

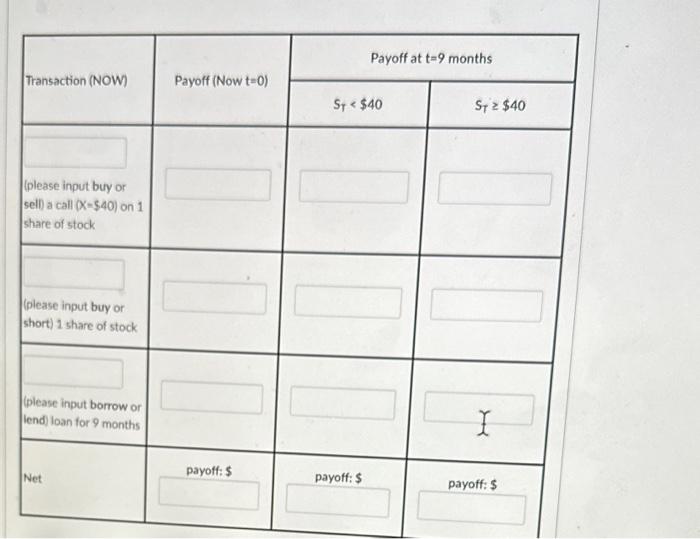

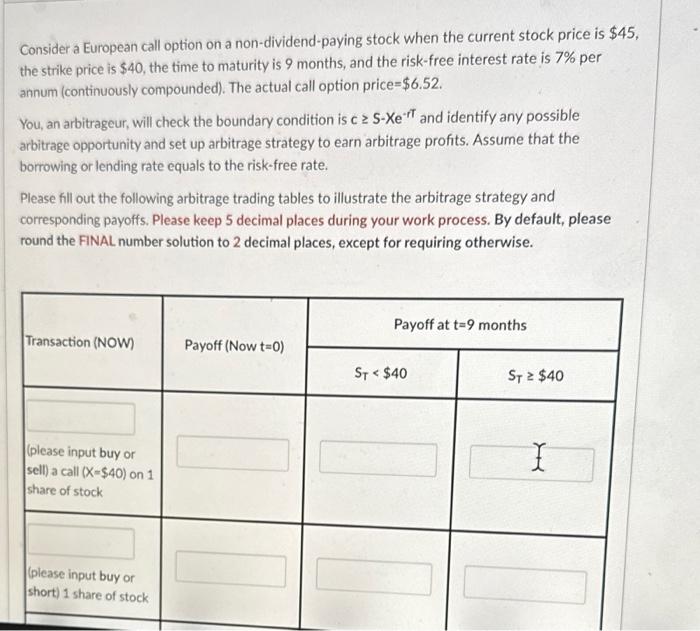

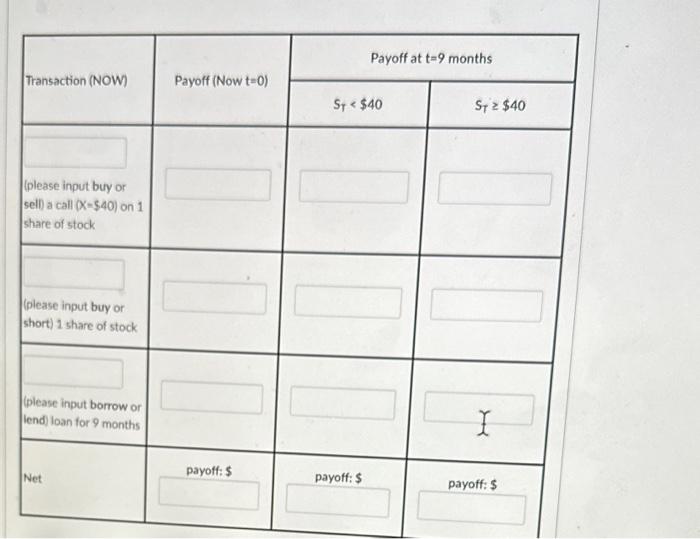

Consider a European call option on a non-dividend-paying stock when the current stock price is $45, the strike price is $40, the time to maturity is 9 months, and the risk-free interest rate is 7% per annum (continuously compounded). The actual call option price =$6.52. You, an arbitrageur, will check the boundary condition is cSXeT and identify any possible arbitrage opportunity and set up arbitrage strategy to earn arbitrage profits. Assume that the borrowing or lending rate equals to the risk-free rate. Please fill out the following arbitrage trading tables to illustrate the arbitrage strategy and corresponding payoffs. Please keep 5 decimal places during your work process. By default, please round the FINAL number solution to 2 decimal places, except for requiring otherwise. Consider a European call option on a non-dividend-paying stock when the current stock price is $45, the strike price is $40, the time to maturity is 9 months, and the risk-free interest rate is 7% per annum (continuously compounded). The actual call option price =$6.52. You, an arbitrageur, will check the boundary condition is cSXeT and identify any possible arbitrage opportunity and set up arbitrage strategy to earn arbitrage profits. Assume that the borrowing or lending rate equals to the risk-free rate. Please fill out the following arbitrage trading tables to illustrate the arbitrage strategy and corresponding payoffs. Please keep 5 decimal places during your work process. By default, please round the FINAL number solution to 2 decimal places, except for requiring otherwise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started