Question

Valuation Valuing REACH Health Inc. Simon Medcalfe, William Hamilton, and David Hess REACH Health, Inc. needed cash and David Hess (Chair of the Board and

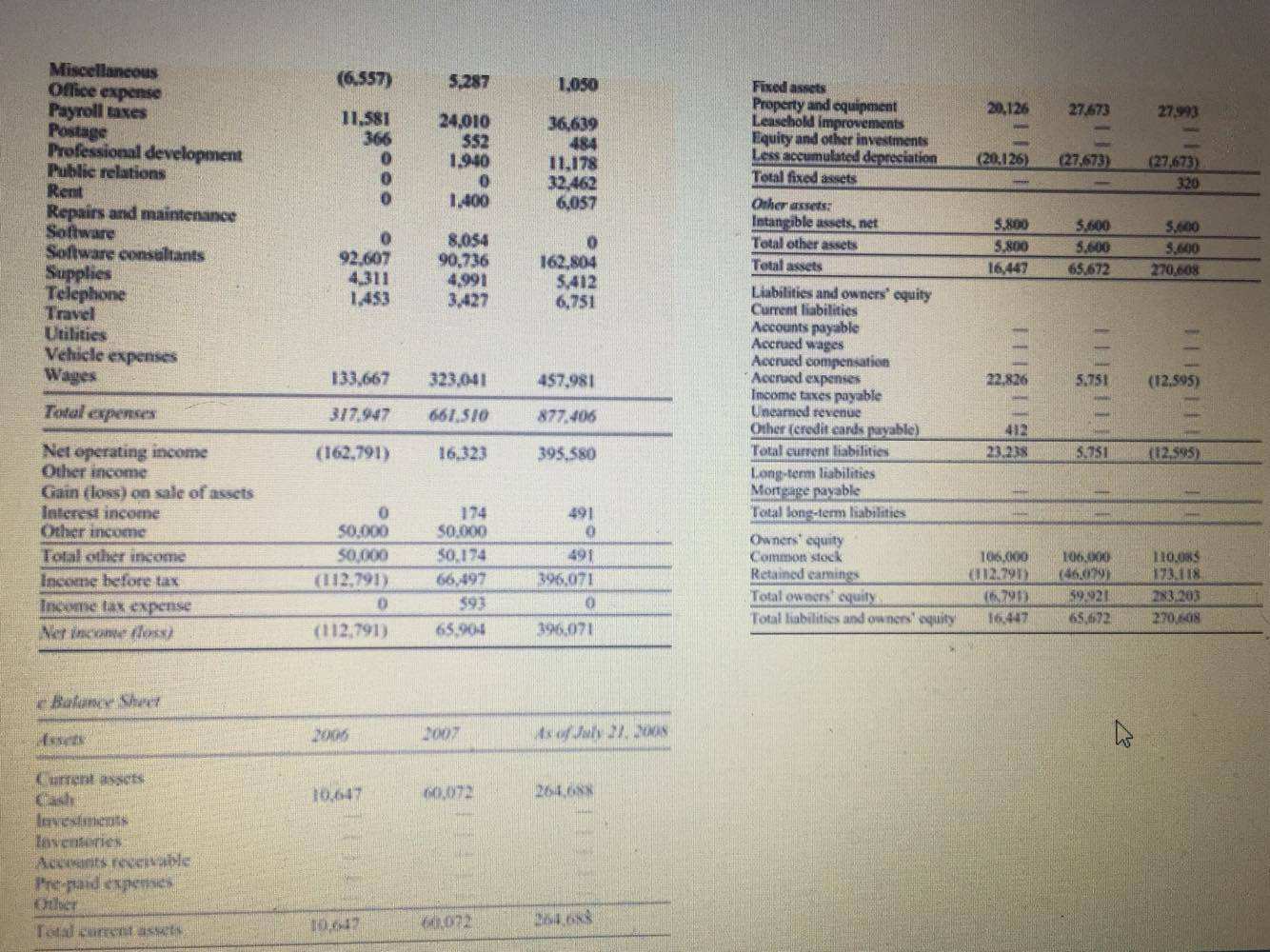

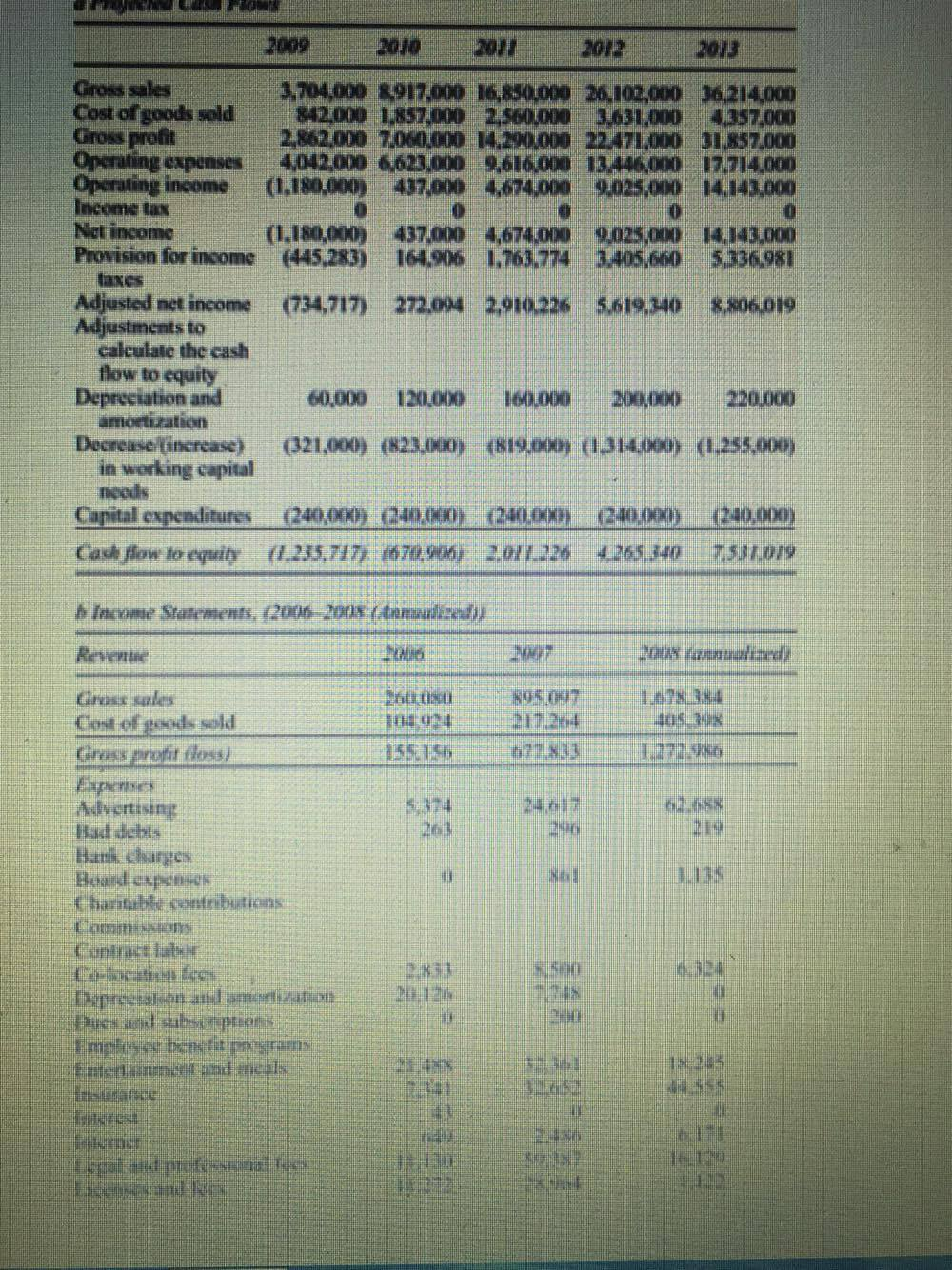

Valuation Valuing REACH Health Inc. Simon Medcalfe, William Hamilton, and David Hess REACH Health, Inc. needed cash and David Hess (Chair of the Board and Founder) and Bill Hamilton (Chief Operating Officer and Founder) were going to raise funds from a venture capital firm. But what was the value of the company? If they under-valued their company they would leave funds on the table, if they overvalued the company they might not find investors. Bill and David visited their accountant, Stephen Brown, in July 2008 to find out what REACH might be worth. There are many ways to value a company said Stephen. The two most popular are the discounted cash flow method and the multiples method. I will calculate both for you, but first I will need some information about REACH. Bill responded, Certainly Stephen. As you recall, REACH Health, Inc. was founded in early 2006 to provide telemedicine to rural Georgia. Telemedicine is the use of medical information exchanged from one site to another via electronic communications to improve a patients clinical health status. From 2006 to 2008, we were able to sustain the company from current revenues and the initial small investment. However, in the fall of 2007, in the face of financial difficulties, we made a major corporate decision not take an angel investment of $250,000 and grow the company organically. But, as we feared, the cash flows proved inadequate to sustain and grow the company. David continued, At this point, we feel that it is time to consider a private equity investment in the company. We have been approached by a group that is willing to make a $2 million investment in the company. Before we bring this before the board of directors, we would like to have a firm valuation of REACH. This will help us make the most informed decision on how much of the company we are willing to distribute to the new investors, while minimizing the dilution of the current shareholders. Do you have a copy of your projected cash flows? asked Stephen. Bill passed over a copy of the five-year projected cash flows (see attached.) Thanks, said Stephen. I will use these and your financial statements to work up a valuation. I will assume that cash flows after 2013 will grow at 2 percent, the long run rate of inflation. I will also have to calculate the discount rate using the BlackGreen build-up summation method. For the multiples method, I will need to find some companies that are similar to REACH that are publically traded and have financial statements available. Finally, I will also have to look into the marketability discount, since your firms shares are not going to be publically traded. Let me do some research and I will call you in a week or so with an update. One week later The phone in Bills office rang. Hi Bill, its Stephen Brown. I have an update on your valuation. For the discount rate, the current yield on 20 year Treasury bonds is 4.69 percent, so I will use that as the risk-free rate. Morningstar estimates that the current equity risk premium is 7.10 percent and the micro-capitalization equity size premium for capitalizations below $505 million is 3.65 percent. I think your company-specific risk premium is 12 percent, based on my subjective analysis of various internal and external factors affecting the company, such as management ability and industry conditions. Moreover, a summary of academic peer-reviewed journals suggests that the marketability discount is 30 percent. Finally, I have 2 also found two other firms that are in web-based telemedicine and have no other significant lines of business. I think they would be good comparable firms to REACH. I have sent you an email with some of their pertinent financials (see attached). Comparable Firms to REACH

Virtual Radiological NightHawk Radiology

Sales 93,280,000 166,752,000

EBITDA 17,576,000 24,824,000

Market value of invested capital (MVIC) 255,014,704 386,698,137

Why dont you and David come to my office tomorrow morning at 9am and I will tell you what your company is worth said Stephen. Bill and David were excited. What was the value of their company?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started