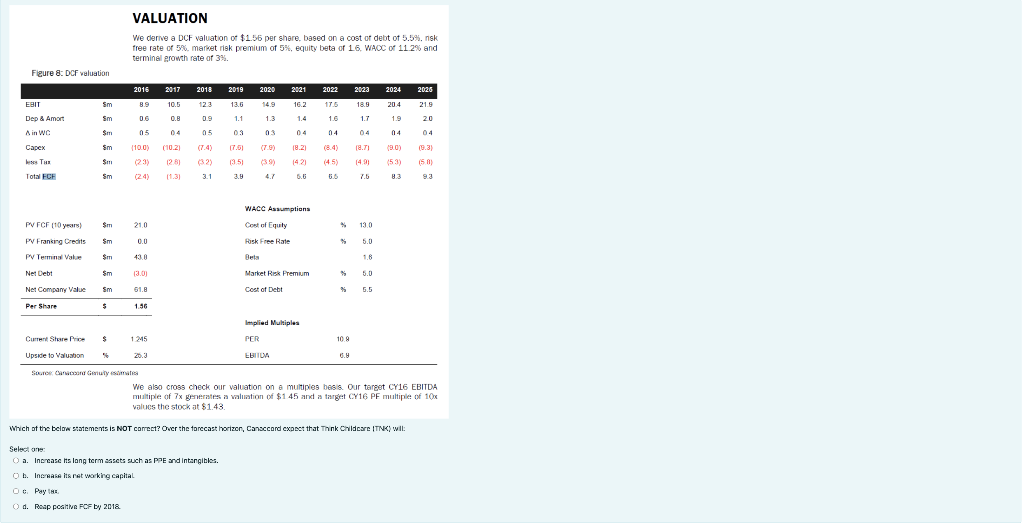

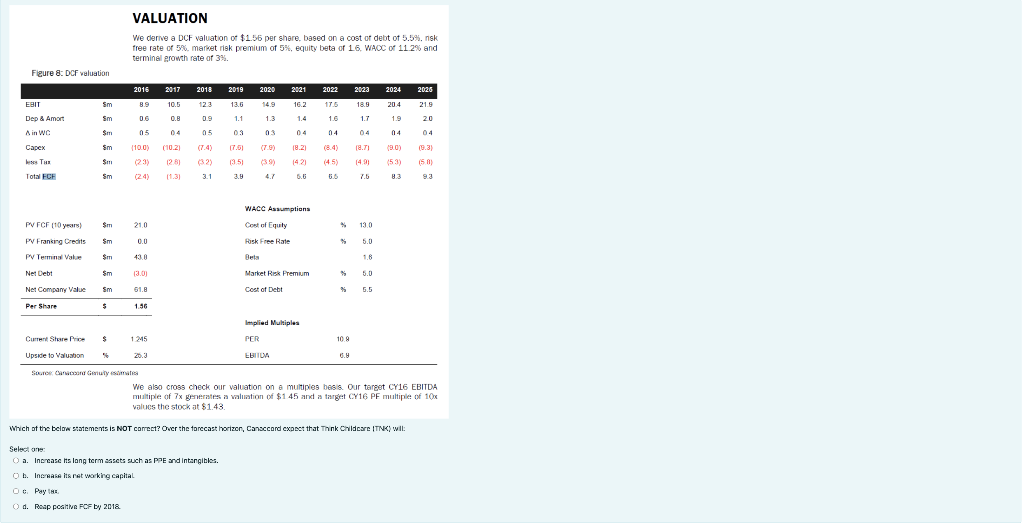

VALUATION We derive a DCF valuation of $1.56 per share, based on a cost of debt of 5.5%, nisk free rate of 5%, market risk premium of 5%, equity beta of 16. WAOC of 11.2% and terminal growth rate of 3%. Figure 8: Der valuation 2016 2017 2018 2019 2020 2021 2022 2023 2024 2026 21.5 EBIT Sm 123 13.5 14.9 16.2 116 20.4 18.9 1.7 Sm 10.5 0.B 04 1.1 1.3 16 1.9 Dep 4 Amort Ain wc 20 05 0 03 03 04 04 04 04 04 Capex $m Sm Sm 11003 (10.21 18.21 19.0) (9.3) 18. 149 (23) ) 13.51 (39) 1421 (45) (53) 12.81 11.31 (32) 3.1 Total FCF Sm 3.9 6.6 6.6 7.5 WACC Assumptions $m 21.0 Coat of Cquity 13.0 PV FCF 10 years) PV Franking Credits PV Te Value Sm 0.0 Fisk Free Rate 5.0 $m 438 Veta 1,8 Net Debt Sm 13.0) Market Risk Premium Cost of Debt Net Company Value Sm 61.8 % Per Share $ 136 Implied Multiples Current Stare Price $ 1 25 PER 108 Upside to Valuabon 20 EBIT 0.9 Sure wymi We also cross check our valuation on a multiples besis. Our target CY16 EBITDA multiple of 7x gets wilution of $1.45 and a target CY16 PF multiple of 10 values the stock at $1.43 Which of the below statements is NOT correct? Over the forecast horizon, Canaccord expect that Think Childcare ITNK) wil: Select one a. Increase its long term assets such as PPE and intangibles. Oh. Increase its networking capital OC Pays Od. Reap positive FCF by 2018 VALUATION We derive a DCF valuation of $1.56 per share, based on a cost of debt of 5.5%, nisk free rate of 5%, market risk premium of 5%, equity beta of 16. WAOC of 11.2% and terminal growth rate of 3%. Figure 8: Der valuation 2016 2017 2018 2019 2020 2021 2022 2023 2024 2026 21.5 EBIT Sm 123 13.5 14.9 16.2 116 20.4 18.9 1.7 Sm 10.5 0.B 04 1.1 1.3 16 1.9 Dep 4 Amort Ain wc 20 05 0 03 03 04 04 04 04 04 Capex $m Sm Sm 11003 (10.21 18.21 19.0) (9.3) 18. 149 (23) ) 13.51 (39) 1421 (45) (53) 12.81 11.31 (32) 3.1 Total FCF Sm 3.9 6.6 6.6 7.5 WACC Assumptions $m 21.0 Coat of Cquity 13.0 PV FCF 10 years) PV Franking Credits PV Te Value Sm 0.0 Fisk Free Rate 5.0 $m 438 Veta 1,8 Net Debt Sm 13.0) Market Risk Premium Cost of Debt Net Company Value Sm 61.8 % Per Share $ 136 Implied Multiples Current Stare Price $ 1 25 PER 108 Upside to Valuabon 20 EBIT 0.9 Sure wymi We also cross check our valuation on a multiples besis. Our target CY16 EBITDA multiple of 7x gets wilution of $1.45 and a target CY16 PF multiple of 10 values the stock at $1.43 Which of the below statements is NOT correct? Over the forecast horizon, Canaccord expect that Think Childcare ITNK) wil: Select one a. Increase its long term assets such as PPE and intangibles. Oh. Increase its networking capital OC Pays Od. Reap positive FCF by 2018