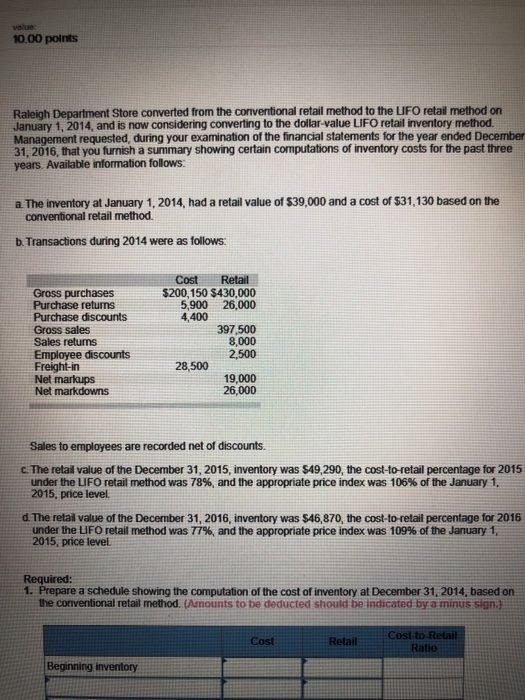

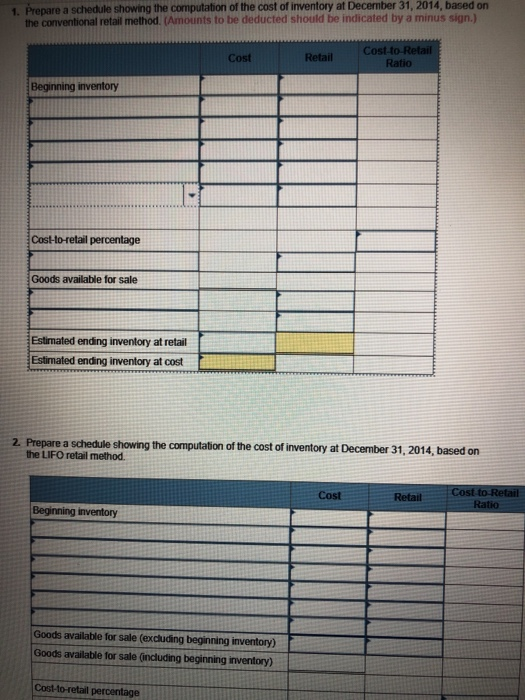

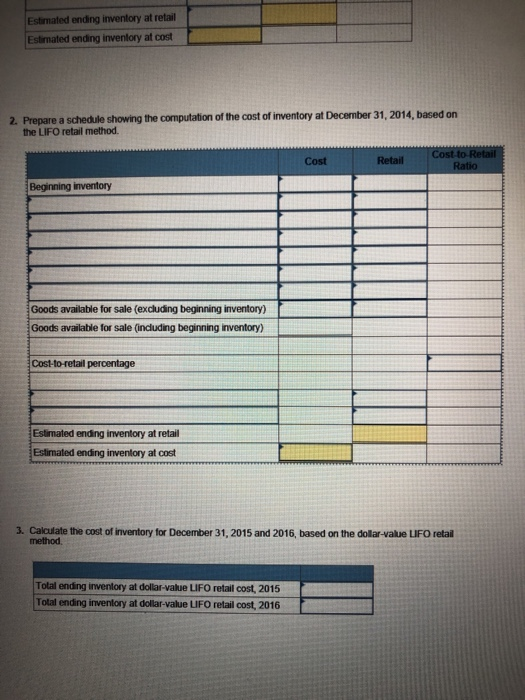

value: 10.00 points Raleigh Department Store converted from the conventional retail method to the LIFO retail method on January 1, 2014, and is now considering converting to the dollar-value LIFO retail inventory method Management requested, during your examination of the financial statements for the year ended December 31, 2016, that you furnish a summary showing certain computations of inventory costs for the past three years. Available information follows a The inventory at January 1, 2014, had a retail value of $39,000 and a cost of $31,130 based on the conventional retail method b. Transactions during 2014 were as follows Cost Retail $200,150 $430,000 5,900 26,000 Gross purchases Purchase returns Purchase discounts Gross sales Sales retums Employee discounts Freight-in Net markups Net markdowns 4,400 397,500 8,000 2,500 28,500 19,000 26,000 Sales to employees are recorded net of discounts. c. The retail value of the December 31, 2015, inventory was $49,290, the cost-to-retail percentage for 2015 under the LIFO retail method was 78%, and the appropriate price index was 106% ofthe January 1. 2015, price level. d. The retail value of the December 31, 2016, inventory was $46,870, the cost-to-retail percentage for 2016 under the uFo retail method was 77%, and the appropriate price index was 109% of the January 1, 2015, price level Required: 1. Prepare a schedule showing the computation of the cost of inventory at December 31, 2014, based on the conventional retail method. (Amounts to be deducted should be indicated by a minus siand Cost to Retail Ratio Cost Retail Beginning inventory 1. Prepare a schedule showing the computation of the cost of inventory at December 31, 2014, based on the conventional retail method. (Amounts to be deducted should be indicated by a minus sign.) Cost Retail Cost-t Beginning inventory Cost-to-retail percentage Goods available for sale Estimated ending inventory at retail Estimated ending inventory at cost 2 Prepare a schedule showing the computation of the cost of inventory at December 31, 2014, based on he LIFO retail method. Cost Retail Beginning inventory Goods available for sale (excluding beginning inventory) Goods available for sale (including beginning inventory) Cost-to-retail percentage Estimated ending inventory at retail Estimated ending invenlory at cost 2. Prepare a schedule showing the computation of the cost of inventory at December 31, 2014, based on the LIFO retail method. Cost to FR Cost Retail Beginning inventory Goods available for sale (excluding beginning inventory) Goods available for sale (incduding beginning inventory) Cost-to-retail percentage Estimated ending inventory at retail Estimated ending inventory at cost 3. Calculate the cost of inventory for December 31, 2015 and 2016, based on the dollar-value LIFO retail method Total ending inventory at dollar-value LIFO retail cost, 2015 Tolal ending inventory at dollar-value LIFO retail cost, 2016