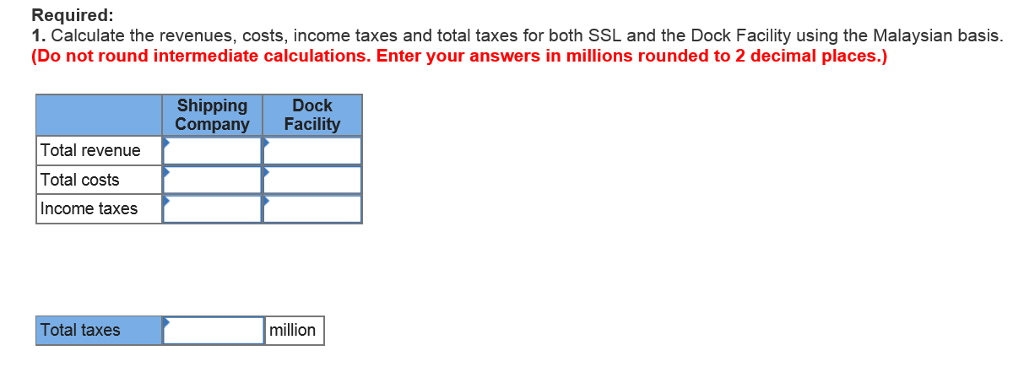

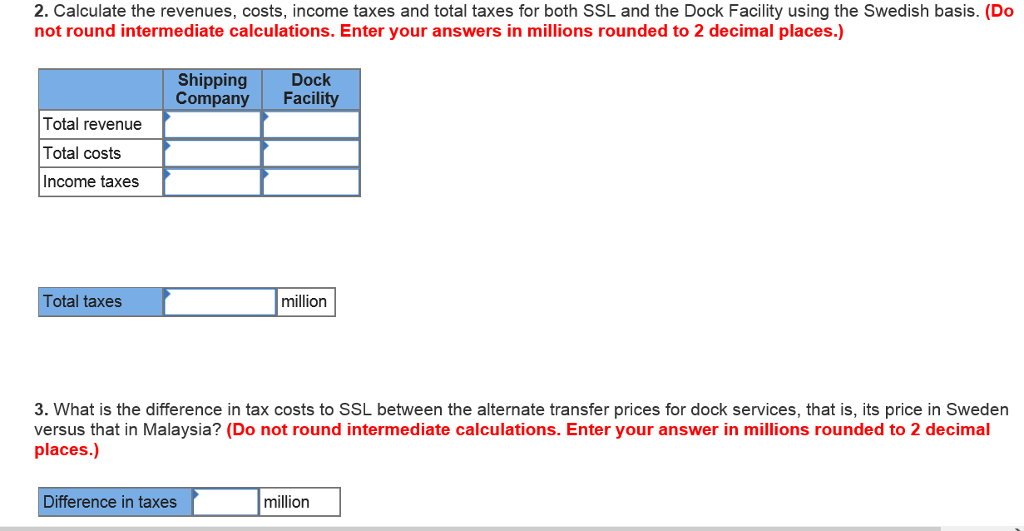

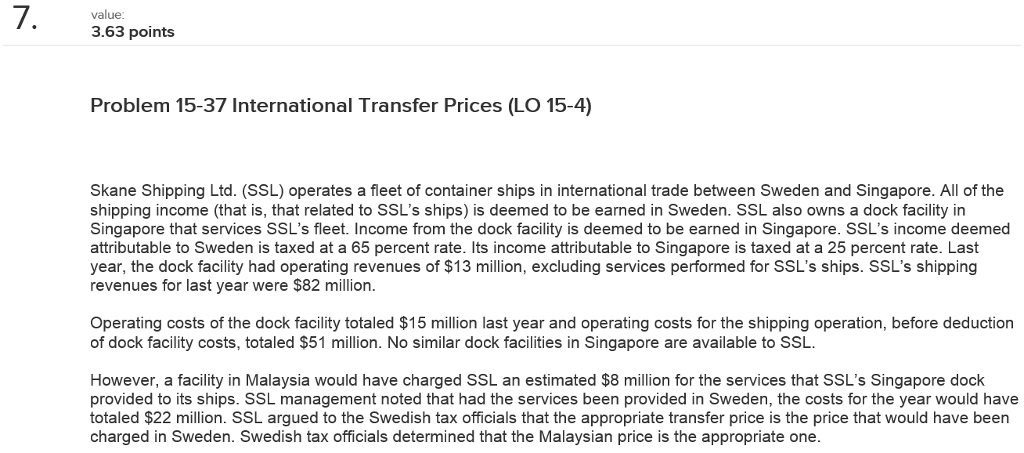

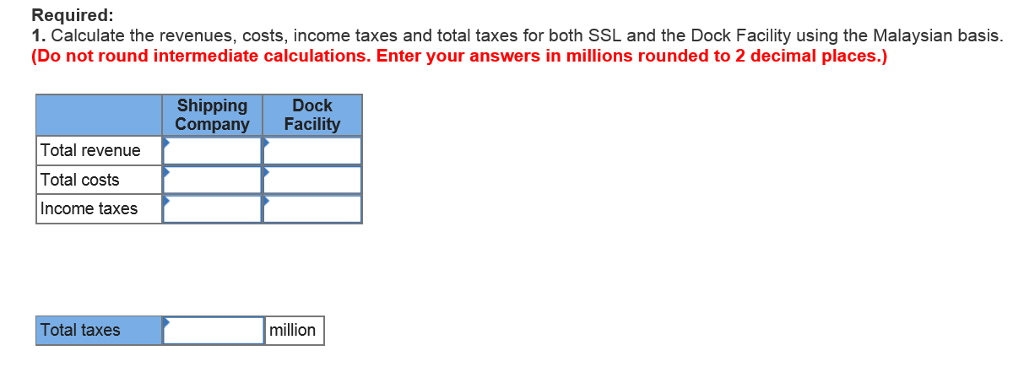

value 3.63 points Problem 15-37 International Transfer Prices (LO 15-4) Skane Shipping Ltd. (SSL) operates a fleet of container ships in international trade between Sweden and Singapore. All of the shipping income (that is, that related to SSL's ships) is deemed to be earned in Sweden. SSL also owns a dock facility in Singapore that services SSL's fleet. Income from the dock facility is deemed to be earned in Singapore. SSL's income deemed attributable to Sweden is taxed at a 65 percent rate. Its income attributable to Singapore is taxed at a 25 percent rate. Last year, the dock facility had operating revenues of $13 million, excluding services performed for SSL's ships. SSL's shipping revenues for last year were $82 million. Operating costs of the dock facility totaled $15 million last year and operating costs for the shipping operation, before deduction of dock facility costs, totaled $51 million. No similar dock facilities in Singapore are available to SSL However, a facility in Malaysia would have charged SSL an estimated $8 million for the services that SSL's Singapore dock provided to its ships. SSL management noted that had the services been provided in Sweden, the costs for the year would have totaled $22 million. SSL argued to the Swedish tax officials that the appropriate transfer price is the price that would have been charged in Sweden. Swedish tax officials determined that the Malaysian price is the appropriate one. value 3.63 points Problem 15-37 International Transfer Prices (LO 15-4) Skane Shipping Ltd. (SSL) operates a fleet of container ships in international trade between Sweden and Singapore. All of the shipping income (that is, that related to SSL's ships) is deemed to be earned in Sweden. SSL also owns a dock facility in Singapore that services SSL's fleet. Income from the dock facility is deemed to be earned in Singapore. SSL's income deemed attributable to Sweden is taxed at a 65 percent rate. Its income attributable to Singapore is taxed at a 25 percent rate. Last year, the dock facility had operating revenues of $13 million, excluding services performed for SSL's ships. SSL's shipping revenues for last year were $82 million. Operating costs of the dock facility totaled $15 million last year and operating costs for the shipping operation, before deduction of dock facility costs, totaled $51 million. No similar dock facilities in Singapore are available to SSL However, a facility in Malaysia would have charged SSL an estimated $8 million for the services that SSL's Singapore dock provided to its ships. SSL management noted that had the services been provided in Sweden, the costs for the year would have totaled $22 million. SSL argued to the Swedish tax officials that the appropriate transfer price is the price that would have been charged in Sweden. Swedish tax officials determined that the Malaysian price is the appropriate one