Question

Value Added Inc. buys $16 million of sow's ears at the beginning of January but doesn't pay immediately. Instead, it agrees to pay the bill

Value Added Inc. buys $16 million of sow's ears at the beginning of January but doesn't pay immediately. Instead, it agrees to pay the bill in March. It processes the ears into silk purses, which it sells for $17 million in February. However, it will not collect payment on the sales until April. (Leave no cells blank - be certain to enter "0" wherever required. Negative amounts should be indicated by a minus sign. Enter your answers in thousands of dollars not in millions.)

a. What is the firms net income in February?

b. What is its net income in March?

c. What is the firms net new investment in working capital in January?

d. What is its net new investment in working capital in April?

e. What is the firms cash flow in January?

f. What is the firms cash flow in February?

g. What is the cash flow in March?

h. What is the cash flow in April?

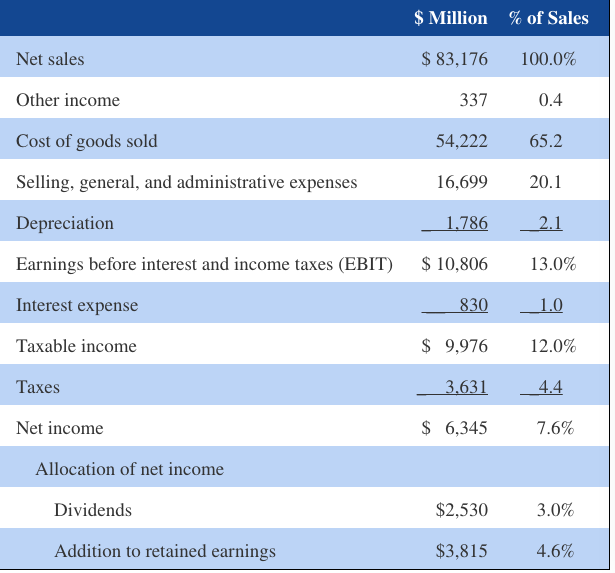

2014 BALANCE SHEET

|

CASH FLOW Cash Provided by Operations | |

| Net income | $6,345 |

| Depreciation | 1,786 |

| Changes in working capital items | |

| Decrease (increase) in accounts receivable | 86 |

| Decrease (increase) in inventories | 22 |

| Decrease (increase) in other current assets | 121 |

| Increase (decrease) in accounts payable | 94 |

| Increase (decrease) in other current liabilities | 131 |

| Total decrease (increase) in working capital | $ 4 |

| Cash provided by operations | $8,127 |

| Cash Flows from Investments | |

| Cash provided by (used for) disposal of (additions to) property, plant, and equipment | $1,289 |

| Sales (acquisitions) of other long-term assets | __ 31 |

| Cash provided by (used for) investments | $1,258 |

| Cash Provided by (Used for) Financing Activities | |

| Increase (decrease) in short-term debt | $ 295 |

| Increase (decrease) in long-term debt | 2,178 |

| Dividends | 2,530 |

| Repurchases of stock | 7,000 |

| Other | _ 18 |

| Cash provided by (used for) financing activities | $7,075 |

| Net increase (decrease) in cash and cash equivalents | $ 206 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started