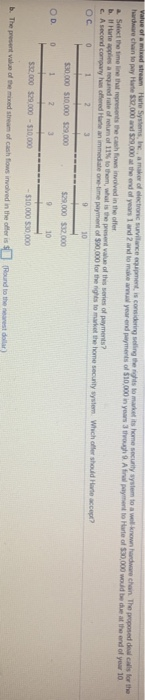

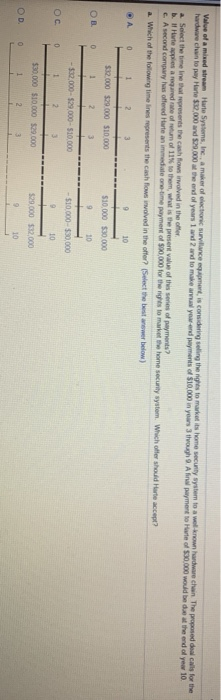

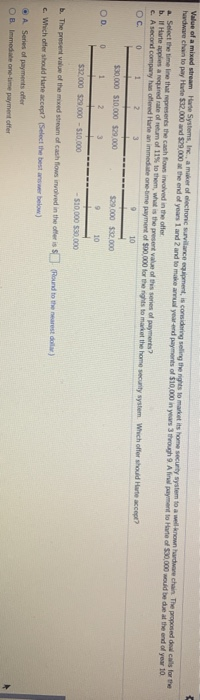

value of a mixed stream at Systems, Inc., a maker of electronic surviancement is considering selling the his to make it home security wystem to a well known aware chain. The proposed deal calls for the hardware chain to pay Hote$32,000 and 529.000 at the end of years 1 and 2 and to make a year and payments of $10,000 in your though. Afinal payment to Hate of $30,000 would be due at the end of year 10 Select the timeline that represents the cash flows involved in the offer b. ifte is a red rate ofretum of 11% to them, what is the present value of this series of payments? A second company has offered in an immediate one-time payment of $20,000 for the right to market the home security wystem. Which offer should Harte accept? 0 1 10 $30.000 $10000 129.000 $29.000 32.000 OD 0 1 2 3 9 10 $32.000 $29.000 - 510,000 $10,000 $30,000 . The present vase of the mixed stream of cash flows involved in the offer is Round to the newest color) Value of a mixed stream Hurte Systems, Inc., a maker of electronic survillance equipment is considering seling the nights to market its home security system to a wellknown hardware chain The proposed deal calls for the hardwe chain to pay Hote$2.000 and $29.000 the end of years and 2 and to make yow and payments of $10,000 in your though 9 Alin payment to Hart of $30.000 would be at the end of year 10 a Select the time in that represents the cash flows involved in the offer b. If Hute apples arredate of retum of 11% to them, what is the present value of this series of payments c. A second company has offered Hate an immediate one time payment of $20,000 for the rights to make the home security system. Which offer should Harte accept? a. Which of the following timelines represents the cash flows involved in the offer? (Select the best answer below) 0 10 $32.000 $29.000 $10000 $10.000 $30.000 OB 0 1 10 -$32,000-$29,000 - $10,000 $10,000-$30,000 0 1 9 10 $30.000 $10.000 $29.000 $29.000 12.000 OD 0 1 2 3 10 Value of a mixed stream Harte Systems, Inc., a maker of lectione surviance equipment is considering seling the right to market is home security system to a well known hardware chain. The propose de calls for the hardwwe chan to pay Hurte $12.000 and $29.000 the end of years 1 and 2 and to make a year-end payments of $10,000 in yours through 9. Ar payment to Hate of $30,000 would be due at the end of year 10 . Select the timeline that presents the cash flows involved in the offer b. If Harteles a quedate of retum of 115. to them, what is the present value of the series of payments c. A second company has offered Hartean immediate one-time payment of $90,000 for the rights to make the home security system which offer should Hare . 10 0 $30.000 510.000 $29.000 $20.000 $32,000 OD 0 1 10 $12.000 $29.000 - $10.000 $10.000 530.000 . The present value of the mixed stream of cash flows involved in the offer is Pound to the nearest data) c. Which offer should Harte scceptSelect the best below) A Series of payments offer OB Immediate one-time payment offer