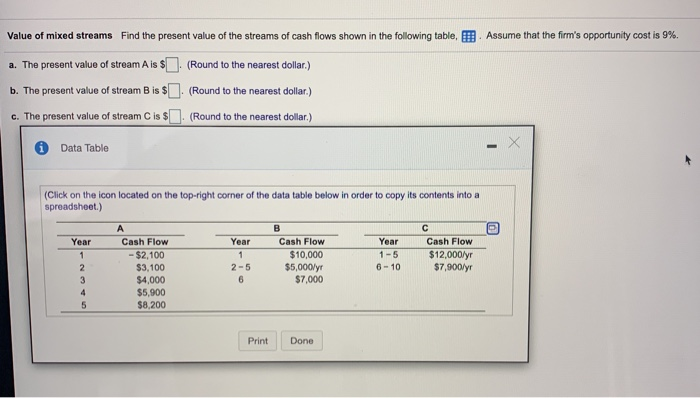

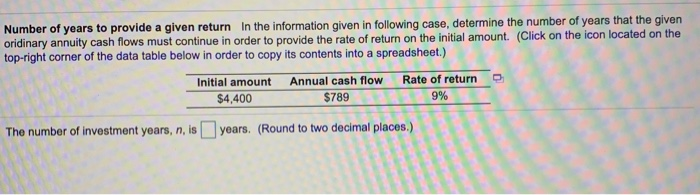

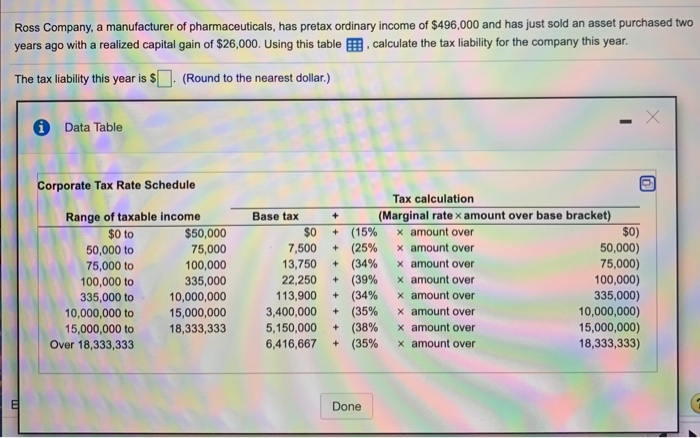

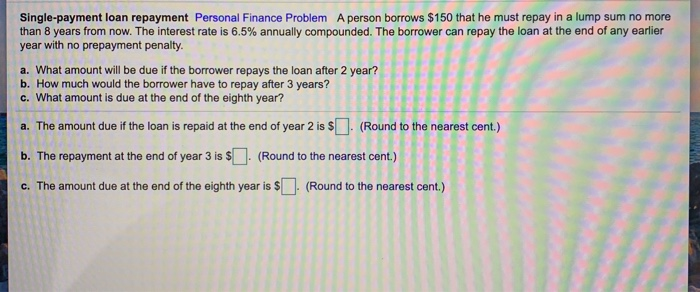

Value of mixed streams Find the present value of the streams of cash flows shown in the following table, Assume that the firm's opportunity cost is 9%. a. The present value of stream A is $ (Round to the nearest dollar) b. The present value of stream B is $ (Round to the nearest dollar.) c. The present value of stream C is $ 1. (Round to the nearest dollar.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) A B Year Cash Flow Year Cash Flow Year Cash Flow 1 - $2,100 $10,000 1-5 $12,000/yr $3,100 2-5 $5,000/yr 6-10 $7,900/yr 3 $4,000 6 $7,000 4 $5,900 5 $8,200 1 2 Print Done Number of years to provide a given return in the information given in following case, determine the number of years that the given oridinary annuity cash flows must continue in order to provide the rate of return on the initial amount. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Initial amount Annual cash flow Rate of return $4,400 $789 9% The number of investment years, n, is years. (Round to two decimal places.) Ross Company, a manufacturer of pharmaceuticals, has pretax ordinary income of $496,000 and has just sold an asset purchased two years ago with a realized capital gain of $26,000. Using this table calculate the tax liability for the company this year. The tax liability this year is $1. (Round to the nearest dollar.) * Data Table 0 Corporate Tax Rate Schedule + Range of taxable income $0 to $50,000 50,000 to 75,000 75,000 to 100,000 100,000 to 335,000 335,000 to 10,000,000 10,000,000 to 15,000,000 15,000,000 to 18,333,333 Over 18,333,333 Base tax $0 7,500 13,750 22,250 113,900 3,400,000 5,150,000 6,416,667 Tax calculation (Marginal rate x amount over base bracket) + (15% x amount over $0) + (25% x amount over 50,000) + (34% x amount over 75,000) + (39% x amount over 100,000) + (34% x amount over 335,000) + (35% x amount over 10,000,000) + (38% x amount over 15,000,000) + (35% x amount over 18,333,333) Done Value of an annuity versus a single amount Personal Finance Problem Assume that you just won the state lottery. Your prize can be taken either in the form of $62,000 at the end of each of the next 30 years (that is, $1,860,000 over 30 years) or as a single amount of $1,248,000 paid immediately. a. If you expect to earn 5% annually on your investments over the next 30 years, ignoring taxes and other considerations, which alternative should you take? Why? b. Would your decision in part a change if you could earn 7% rather than 5% on your investments over the next 30 years? Why? c. At approximately what interest rate would you be indifferent between the two options? a. To decide which alternative to tako, you need to compare the values of these alternatives. Although the total nominal dollar amount of the annuity is much larger than the single payment, the former is not necessarily a better choice due to the different timing of cash flows. A way to make a meaningful comparison of the two alternatives is to compare their present values. you take the prize an an annuity, the prosont value of the 30-year ordinary annulty in $. (Round to the nearest cont.) If you take the prize as a single amount, the present value of the lump sum is $. (Round to the nearest dollar.) Which alternative should be chosen? (Select the best answer below.) O Annual payments, because the present value is greater O Lump sum, because the present value is greater b. If you earned 7% rather than 5% on your investments, the present value of the 30-year ordinary annuity is $ ]. (Round to the nearest cont.) Which alternative should be chosen? (Select the best answer below.) O lump sum, because the present value is greater O Annual payments, because the present value is greater c. On a strictly economic basis, the rate at which you would be indifferent between the two plans is % (Round to two decimal places.) Click to select your answer(s). Single-payment loan repayment Personal Finance Problem A person borrows $150 that he must repay in a lump sum no more than 8 years from now. The interest rate is 6.5% annually compounded. The borrower can repay the loan at the end of any earlier year with no prepayment penalty. a. What amount will be due if the borrower repays the loan after 2 year? b. How much would the borrower have to repay after 3 years? c. What amount is due at the end of the eighth year? a. The amount due if the loan is repaid at the end of year 2 is $. (Round to the nearest cent.) b. The repayment at the end of year 3 is $(). (Round to the nearest cent.) c. The amount due at the end of the eighth year is $]. (Round to the nearest cent.)