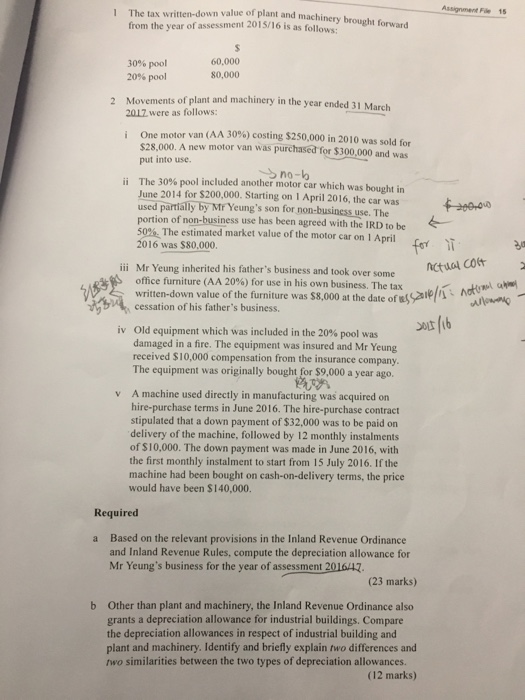

value of plant and machinery brought forward Assignment File 15 1 The tax written-down from the year of assessment 2015/16 is as follows: 30% pool 20% pool 60,000 80,000 Movements of plant and machinery in the year ended 31 Ma 2012 were as follows: 2 One motor van (AA 30%) costing $250,000 in 2010 was sold for s28,000. A new motor van was purchased for $300,000 and was put into use. no The 30% pool included another motor car which was bought in June 2014 for S200,000. Starting on 1 April 2016, the car was use partially by MrYeung's son for non-businessuse. The portion of non-business use 5020, The estimated market value of the motor car on 1 April 2016 was $80,000 ii has been agreed with the IRD to be ii Mr Yeung inherited his father's business and took over so his father's business and took over some office furniture (AA 20%) for use in his own business. The tax written-down value of the furniture was S8,000 at the date of assalp" cessation of his father's business. old equipment which was included in the 20% pool was damaged in a fire. The equipment was insured and Mr Yeung received $10,000 compensation from the insurance company. iv The A machine used directly in manufacturing was acquired on hire-purchase terms in June 2016. The hire-purchase contract stipulated that a down payment of $32,000 was to be paid on delivery of the machine, followed by 12 monthly instalments of $10,000. The down payment was made in June 2016, with the first monthly instalment to start from 15 July 2016. If the machine had been bought on cash-on-delivery terms, the price would have been $140,000 equipment was originally bought for $9,000 a year ago. v Required Based on the relevant provisions in the Inland Revenue Ordinance and Inland Revenue Rules, compute the depreciation allowance for Mr Yeung's business for the year of assessment 201642. a (23 marks) Other than plant and machinery, the Inland Revenue Ordinance also grants a depreciation allowance for industrial buildings. Compare the depreciation allowances in respect of industrial building and plant and machinery. Identify and briefly explain two differences and two similarities between the two types of depreciation allowances. b (12 marks) value of plant and machinery brought forward Assignment File 15 1 The tax written-down from the year of assessment 2015/16 is as follows: 30% pool 20% pool 60,000 80,000 Movements of plant and machinery in the year ended 31 Ma 2012 were as follows: 2 One motor van (AA 30%) costing $250,000 in 2010 was sold for s28,000. A new motor van was purchased for $300,000 and was put into use. no The 30% pool included another motor car which was bought in June 2014 for S200,000. Starting on 1 April 2016, the car was use partially by MrYeung's son for non-businessuse. The portion of non-business use 5020, The estimated market value of the motor car on 1 April 2016 was $80,000 ii has been agreed with the IRD to be ii Mr Yeung inherited his father's business and took over so his father's business and took over some office furniture (AA 20%) for use in his own business. The tax written-down value of the furniture was S8,000 at the date of assalp" cessation of his father's business. old equipment which was included in the 20% pool was damaged in a fire. The equipment was insured and Mr Yeung received $10,000 compensation from the insurance company. iv The A machine used directly in manufacturing was acquired on hire-purchase terms in June 2016. The hire-purchase contract stipulated that a down payment of $32,000 was to be paid on delivery of the machine, followed by 12 monthly instalments of $10,000. The down payment was made in June 2016, with the first monthly instalment to start from 15 July 2016. If the machine had been bought on cash-on-delivery terms, the price would have been $140,000 equipment was originally bought for $9,000 a year ago. v Required Based on the relevant provisions in the Inland Revenue Ordinance and Inland Revenue Rules, compute the depreciation allowance for Mr Yeung's business for the year of assessment 201642. a (23 marks) Other than plant and machinery, the Inland Revenue Ordinance also grants a depreciation allowance for industrial buildings. Compare the depreciation allowances in respect of industrial building and plant and machinery. Identify and briefly explain two differences and two similarities between the two types of depreciation allowances. b (12 marks)