Answered step by step

Verified Expert Solution

Question

1 Approved Answer

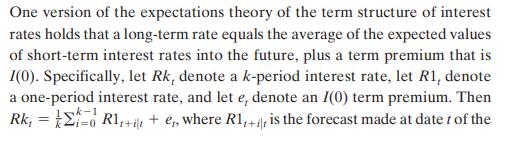

One version of the expectations theory of the term structure of interest rates holds that a long-term rate equals the average of the expected

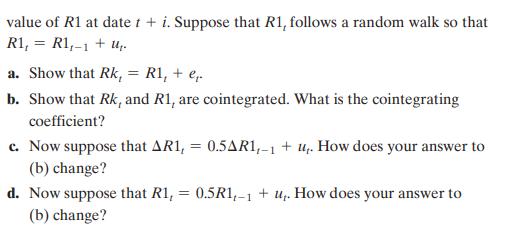

One version of the expectations theory of the term structure of interest rates holds that a long-term rate equals the average of the expected values of short-term interest rates into the future, plus a term premium that is I(0). Specifically, let Rk, denote a k-period interest rate, let R1, denote a one-period interest rate, and let e, denote an I(0) term premium. Then Rk, = }E-0 R1,+it + e, where R1,+ik is the forecast made at date t of the value of R1 at date t + i. Suppose that R1, follows a random walk so that R1, = R1,-1 + u,. a. Show that Rk, = R1, + e. b. Show that Rk, and R1, are cointegrated. What is the cointegrating coefficient? c. Now suppose that AR1, = 0.5AR1,-1 + up. How does your answer to (b) change? d. Now suppose that R1, = 0.5R1,-1 + u,. How does your answer to (b) change? -1

Step by Step Solution

★★★★★

3.49 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

Required ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started