Answered step by step

Verified Expert Solution

Question

1 Approved Answer

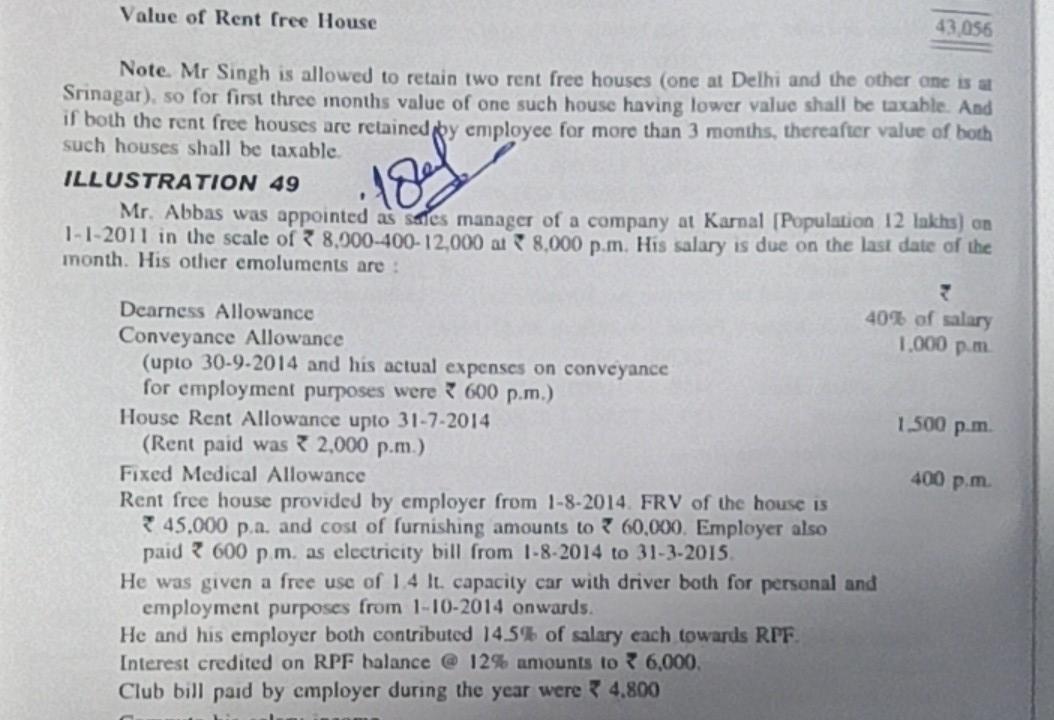

Value of Rent Cree House 43,056 Note. Mr Singh is allowed to retain two rent free houses (one at Delhi and the other one is

Value of Rent Cree House 43,056 Note. Mr Singh is allowed to retain two rent free houses (one at Delhi and the other one is a Srinagar), so for first three months value of one such house having lower value shall be taxable. And if both the rent free houses are retained by employee for more than 3 months, thereafter value of both such houses shall be taxable. ILLUSTRATION 49 Mr. Abbas was appointed as sales manager of a company at Karnal (Population 12 lakhs) on 1-1-2011 in the scale of 8,000-400-12,000 at 8,000 p.m. His salary is due on the last date of the month. His other emoluments are: 1891 . 1.000 pm 1.500 p.mn 400 pm Dearness Allowance 40% of salary Conveyance Allowance (upto 30-9-2014 and his actual expenses on conveyance for employment purposes were 600 p.m.) House Rent Allowance upto 31-7-2014 (Rent paid was 2.000 p.m.) Fixed Medical Allowance Rent free house provided by employer from 1-8-2014. FRV of the house is 345.000 p.a. and cost of furnishing amounts to 60,000. Employer also paid 600 pm, as electricity bill from 1-8-2014 to 31-3-2015 He was given a free use of 1.4 Il capacity car with driver both for personal and employment purposes from 1-10-2014 onwards. He and his employer both contributed 14.5% of salary each towards RPF. Interest credited on RPF balance @ 12% amounts to 6.000. Club bill paid by employer during the year were 4.800 Value of Rent Cree House 43,056 Note. Mr Singh is allowed to retain two rent free houses (one at Delhi and the other one is a Srinagar), so for first three months value of one such house having lower value shall be taxable. And if both the rent free houses are retained by employee for more than 3 months, thereafter value of both such houses shall be taxable. ILLUSTRATION 49 Mr. Abbas was appointed as sales manager of a company at Karnal (Population 12 lakhs) on 1-1-2011 in the scale of 8,000-400-12,000 at 8,000 p.m. His salary is due on the last date of the month. His other emoluments are: 1891 . 1.000 pm 1.500 p.mn 400 pm Dearness Allowance 40% of salary Conveyance Allowance (upto 30-9-2014 and his actual expenses on conveyance for employment purposes were 600 p.m.) House Rent Allowance upto 31-7-2014 (Rent paid was 2.000 p.m.) Fixed Medical Allowance Rent free house provided by employer from 1-8-2014. FRV of the house is 345.000 p.a. and cost of furnishing amounts to 60,000. Employer also paid 600 pm, as electricity bill from 1-8-2014 to 31-3-2015 He was given a free use of 1.4 Il capacity car with driver both for personal and employment purposes from 1-10-2014 onwards. He and his employer both contributed 14.5% of salary each towards RPF. Interest credited on RPF balance @ 12% amounts to 6.000. Club bill paid by employer during the year were 4.800

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started