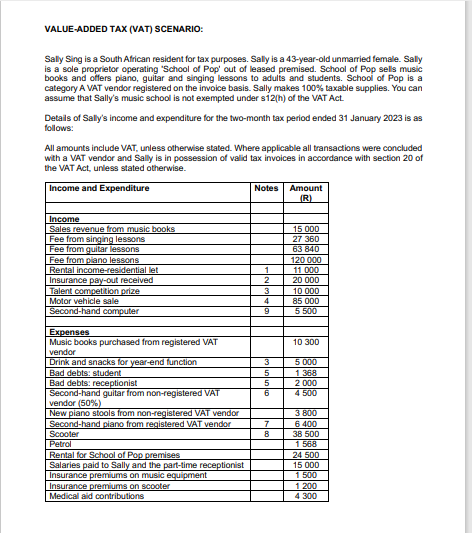

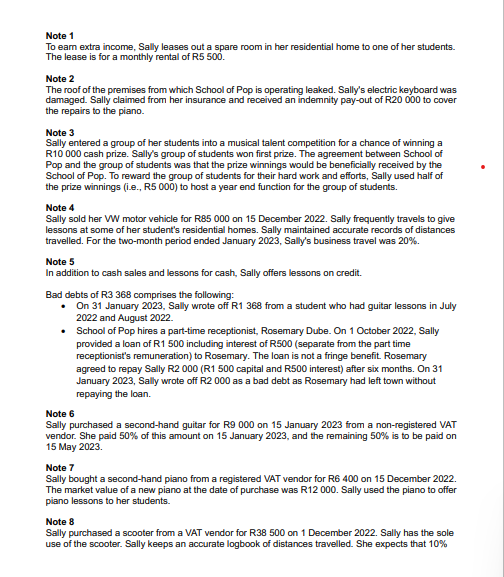

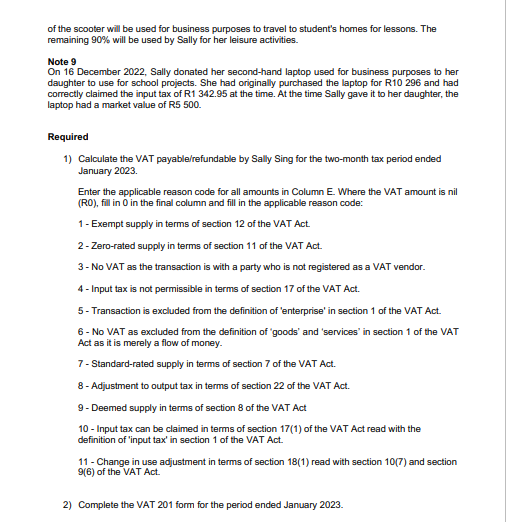

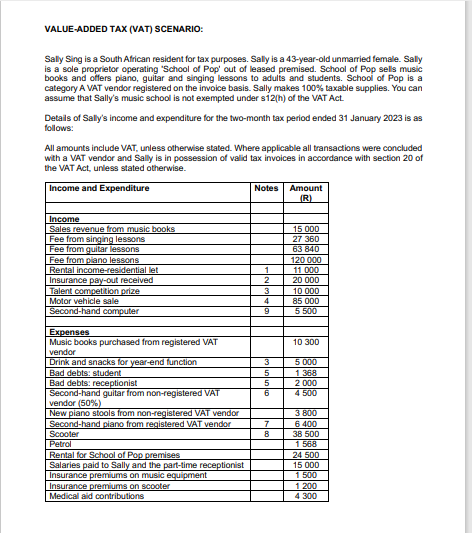

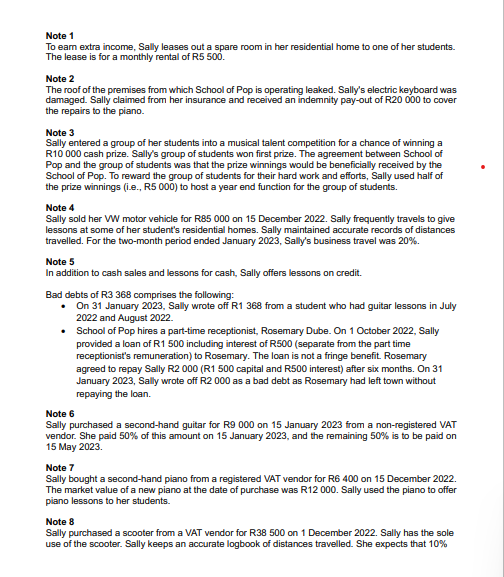

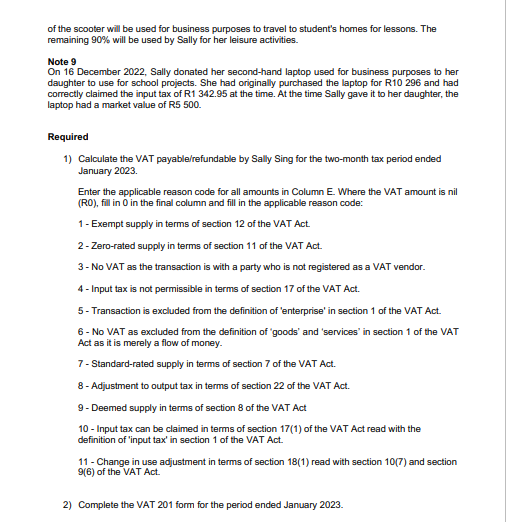

VALUE-ADDED TAX (VAT) SCENARIO: Sally Sing is a South African resident for tax purposes. Saly is a 43-year-old unmarried female. Saly is a sole proprietor operating 'School of Pop' out of leased premised. School of Pop sells music books and oflers piano, guitar and singing lessons to adults and students. School of Pop is a category A VAT vendor registered on the imvoice basis. Sally makes 100% taxable supplies. You can assume that Sally's music school is not exempted under s12(h) of the VAT Act. Detals of Saly's income and expenditure for the two-month tax period ended 31 January 2023 is as follows: All amounts include VAT, unless otherwise stated. Where applicable all transactions were concluded with a VAT vendor and Sally is in possession of valid tax invoices in accordance with section 20 of the VAT Act, unless stated otherwise. of the scooter will be used for business purposes to travel to student's homes for lessons. The remaining 90% will be used by Sally for her leisure activities. Note 9 On 16 December 2022, Sally donated her second-hand laptop used for business purposes to her daughter to use for school projects. She had originally purchased the laptop for R10 296 and had correctly claimed the input tax of R1 342.95 at the time. At the time Sally gave it to her daughter, the laptop had a market value of R5 500 . Required 1) Calculate the VAT payable/refundable by Sally Sing for the two-month tax period ended January 2023. Enter the applicable reason code for all amounts in Column E. Where the VAT amount is nil (R0), fill in 0 in the final column and fill in the applicable reason code: 1 - Exempt supply in terms of section 12 of the VAT Act. 2 - Zero-rated supply in terms of section 11 of the VAT Act. 3 - No VAT as the transaction is with a party who is not registered as a VAT vendor. 4 - Input tax is not permissible in terms of section 17 of the VAT Act. 5 - Transaction is excluded from the definition of 'enterprise' in section 1 of the VAT Act. 6 - No VAT as excluded from the definition of 'goods' and 'services' in section 1 of the VAT Act as it is merely a flow of money. 7 - Standard-rated supply in terms of section 7 of the VAT Act. 8 - Adjustment to output tax in terms of section 22 of the VAT Act. 9 - Deemed supply in terms of section 8 of the VAT Act 10 - Input tax can be claimed in terms of section 17(1) of the VAT Act read with the definition of 'input tax' in section 1 of the VAT Act. 11 - Change in use adjustment in terms of section 18(1) read with section 10(7) and section 9(6) of the VAT Act. 2) Complete the VAT 201 form for the period ended January 2023. Note 1 To eam extra income, Sally leases out a spare room in her residential home to one of her students. The lease is for a monthly rental of R5 500 . Note 2 The roof of the premises from which School of Pop is operating leaked. Sally's electric keyboard was damaged. Sally claimed from her insurance and received an indemnity pay-out of R20 000 to cover the repairs to the piano. Note 3 Sally entered a group of her students into a musical talent competition for a chance of winning a R10 000 cash prize. Sally's group of students won first prize. The agreement between School of Pop and the group of students was that the prize winnings would be beneficially received by the School of Pop. To reward the group of students for their hard work and efforts, Sally used half of the prize winnings (i.e., R5 000) to host a year end function for the group of students. Note 4 Sally sold her WW motor vehicle for R85 000 on 15 December 2022 . Sally frequently travels to give lessons at some of her student's residential homes. Sally maintained accurate records of distances travelled. For the two-month period ended January 2023, Sally's business travel was 20%. Note 5 In addition to cash sales and lessons for cash, Sally offers lessons on credit. Bad debts of R3 368 comprises the following: - On 31 January 2023, Sally wrote off R1 368 from a student who had guitar lessons in July 2022 and August 2022. - School of Pop hires a part-time receptionist, Rosemary Dube. On 1 October 2022, Sally provided a loan of R1 500 including interest of R500 (separate from the part time receptionist's remuneration) to Rosemary. The loan is not a fringe benefit. Rosemary agreed to repay Sally R2 000 (R1 500 capital and R500 interest) after six months. On 31 January 2023 , Sally wrote off R2 000 as a bad debt as Rosemary had left town without repaying the loan. Note 6 Sally purchased a second-hand guitar for R9 000 on 15 January 2023 from a non-registered VAT vendor. She paid 50% of this amount on 15 January 2023 , and the remaining 50% is to be paid on 15 May 2023. Note 7 Sally bought a second-hand piano from a registered VAT vendor for R6 400 on 15 December 2022. The market value of a new piano at the date of purchase was R12 000. Sally used the piano to offer piano lessons to her students. Note 8 Sally purchased a scooter from a VAT vendor for R38 500 on 1 December 2022. Sally has the sole use of the scooter. Sally keeps an accurate logbook of distances travelled. She expects that 10%