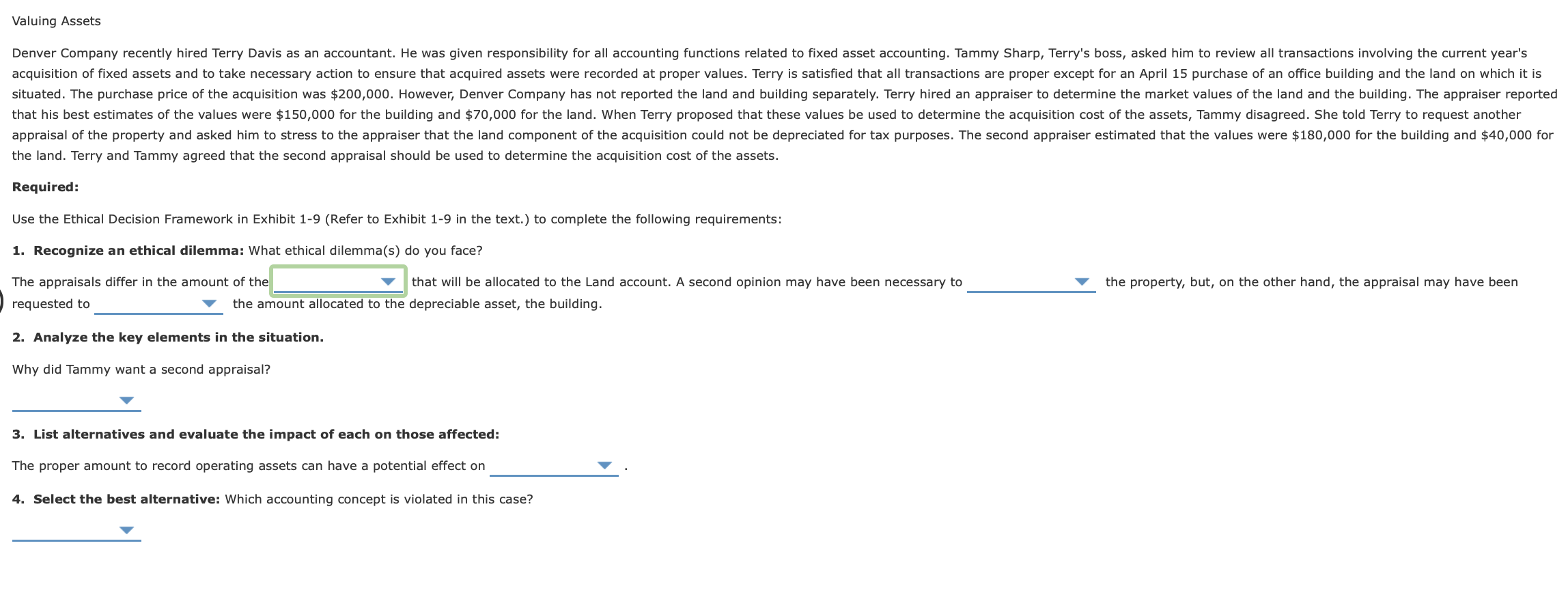

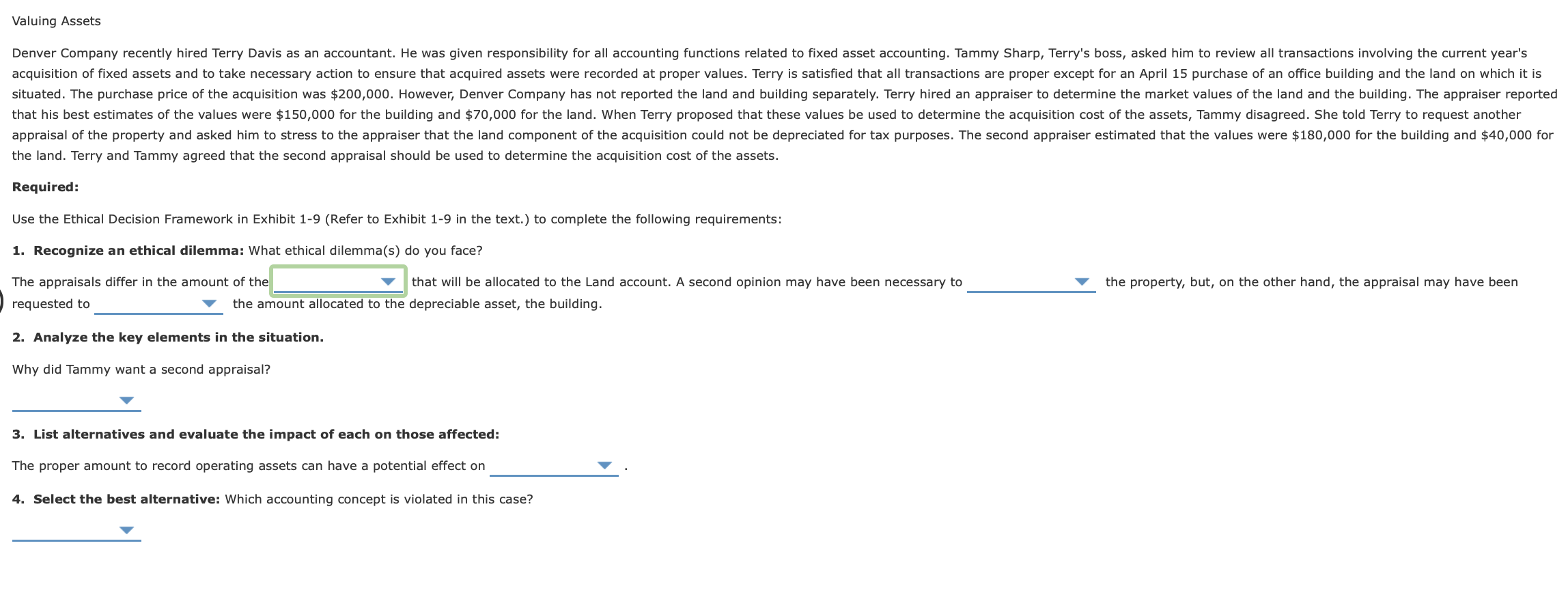

Valuing Assets Denver Company recently hired Terry Davis as an accountant. He was given responsibility for all accounting functions related to fixed asset accounting. Tammy Sharp, Terry's boss, asked him to review all transactions involving the current year's acquisition of fixed assets and to take necessary action to ensure that acquired assets were recorded at proper values. Terry is satisfied that all transactions are proper except for an April 15 purchase of an office building and the land on which it is situated. The purchase price of the acquisition was $200,000. However, Denver Company has not reported the land and building separately. Terry hired an appraiser to determine the market values of the land and the building. The appraiser reported that his best estimates of the values were $150,000 for the building and $70,000 for the land. When Terry proposed that these values be used to determine the acquisition cost of the assets, Tammy disagreed. She told Terry to request another appraisal of the property and asked him to stress to the appraiser that the land component of the acquisition could not be depreciated for tax purposes. The second appraiser estimated that the values were $180,000 for the building and $40,000 for the land. Terry and Tammy agreed that the second appraisal should be used to determine the acquisition cost of the assets. Required: Use the Ethical Decision Framework in Exhibit 1-9 (Refer to Exhibit 1-9 in the text.) to complete the following requirements: 1. Recognize an ethical dilemma: What ethical dilemma(s) do you face? the property, but, on the other hand, the appraisal may have been The appraisals differ in the amount of the that will be allocated to the Land account. A second opinion may have been necessary to requested to the amount allocated to the depreciable asset, the building. 2. Analyze the key elements in the situation. Why did Tammy want a second appraisal? 3. List alternatives and evaluate the impact of each on those affected: The proper amount to record operating assets can have a potential effect on 4. Select the best alternative: Which accounting concept is violated in this case? Valuing Assets Denver Company recently hired Terry Davis as an accountant. He was given responsibility for all accounting functions related to fixed asset accounting. Tammy Sharp, Terry's boss, asked him to review all transactions involving the current year's acquisition of fixed assets and to take necessary action to ensure that acquired assets were recorded at proper values. Terry is satisfied that all transactions are proper except for an April 15 purchase of an office building and the land on which it is situated. The purchase price of the acquisition was $200,000. However, Denver Company has not reported the land and building separately. Terry hired an appraiser to determine the market values of the land and the building. The appraiser reported that his best estimates of the values were $150,000 for the building and $70,000 for the land. When Terry proposed that these values be used to determine the acquisition cost of the assets, Tammy disagreed. She told Terry to request another appraisal of the property and asked him to stress to the appraiser that the land component of the acquisition could not be depreciated for tax purposes. The second appraiser estimated that the values were $180,000 for the building and $40,000 for the land. Terry and Tammy agreed that the second appraisal should be used to determine the acquisition cost of the assets. Required: Use the Ethical Decision Framework in Exhibit 1-9 (Refer to Exhibit 1-9 in the text.) to complete the following requirements: 1. Recognize an ethical dilemma: What ethical dilemma(s) do you face? the property, but, on the other hand, the appraisal may have been The appraisals differ in the amount of the that will be allocated to the Land account. A second opinion may have been necessary to requested to the amount allocated to the depreciable asset, the building. 2. Analyze the key elements in the situation. Why did Tammy want a second appraisal? 3. List alternatives and evaluate the impact of each on those affected: The proper amount to record operating assets can have a potential effect on 4. Select the best alternative: Which accounting concept is violated in this case