Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valuing Corporate Acquisitions Made for Each Other It was late Sunday night, and Jassir Amor was getting weary. The big presentation was set for 8

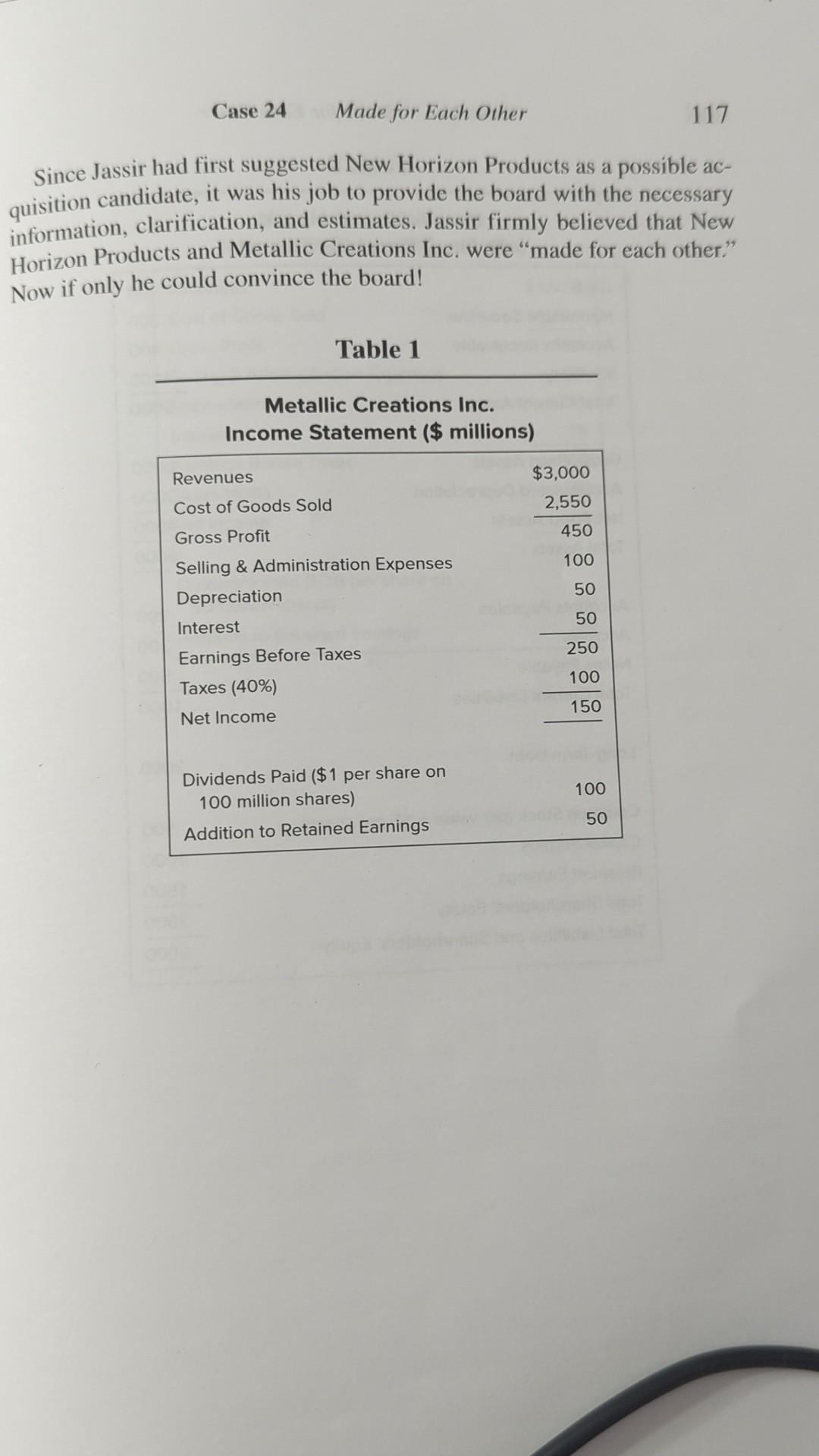

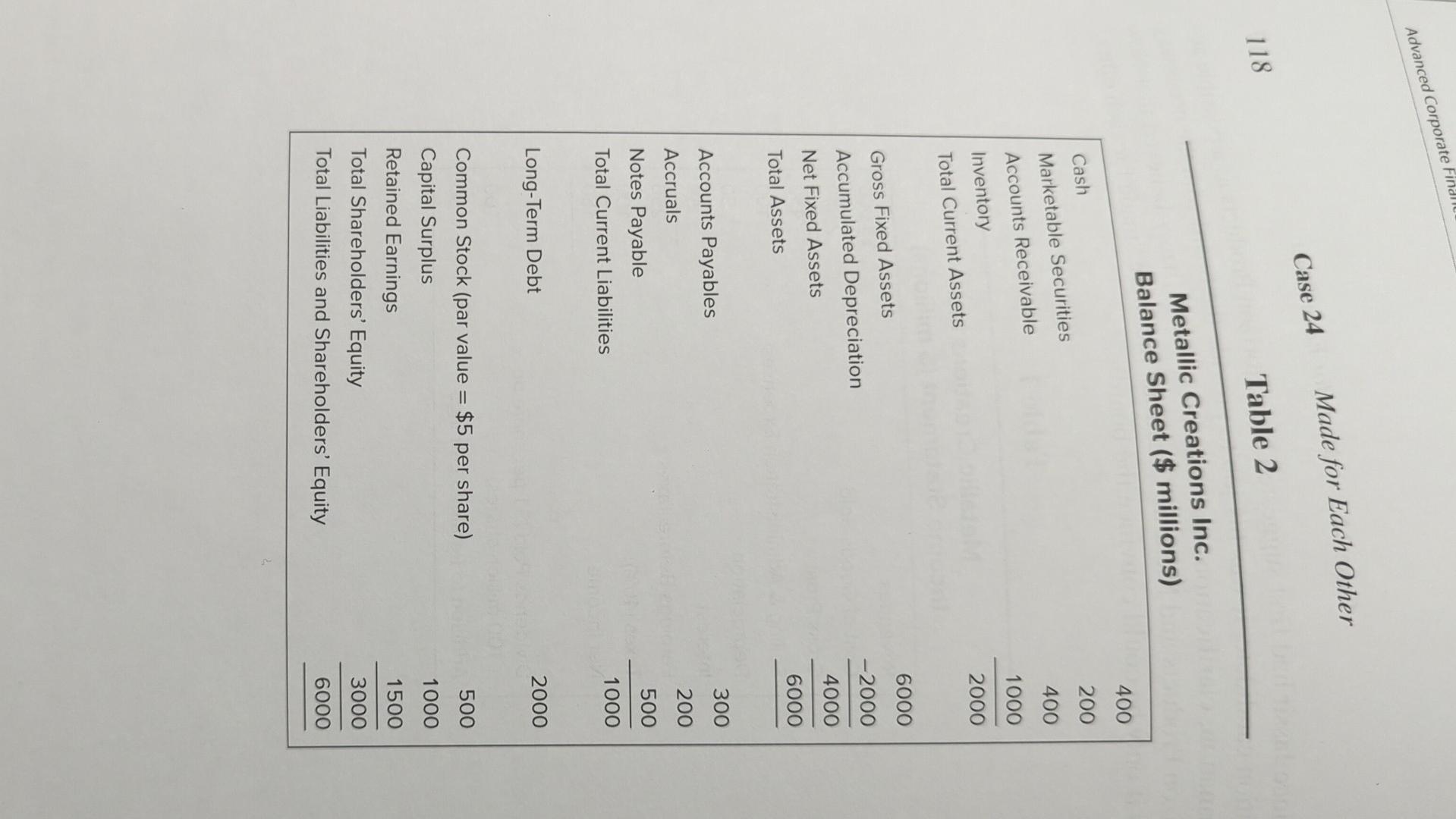

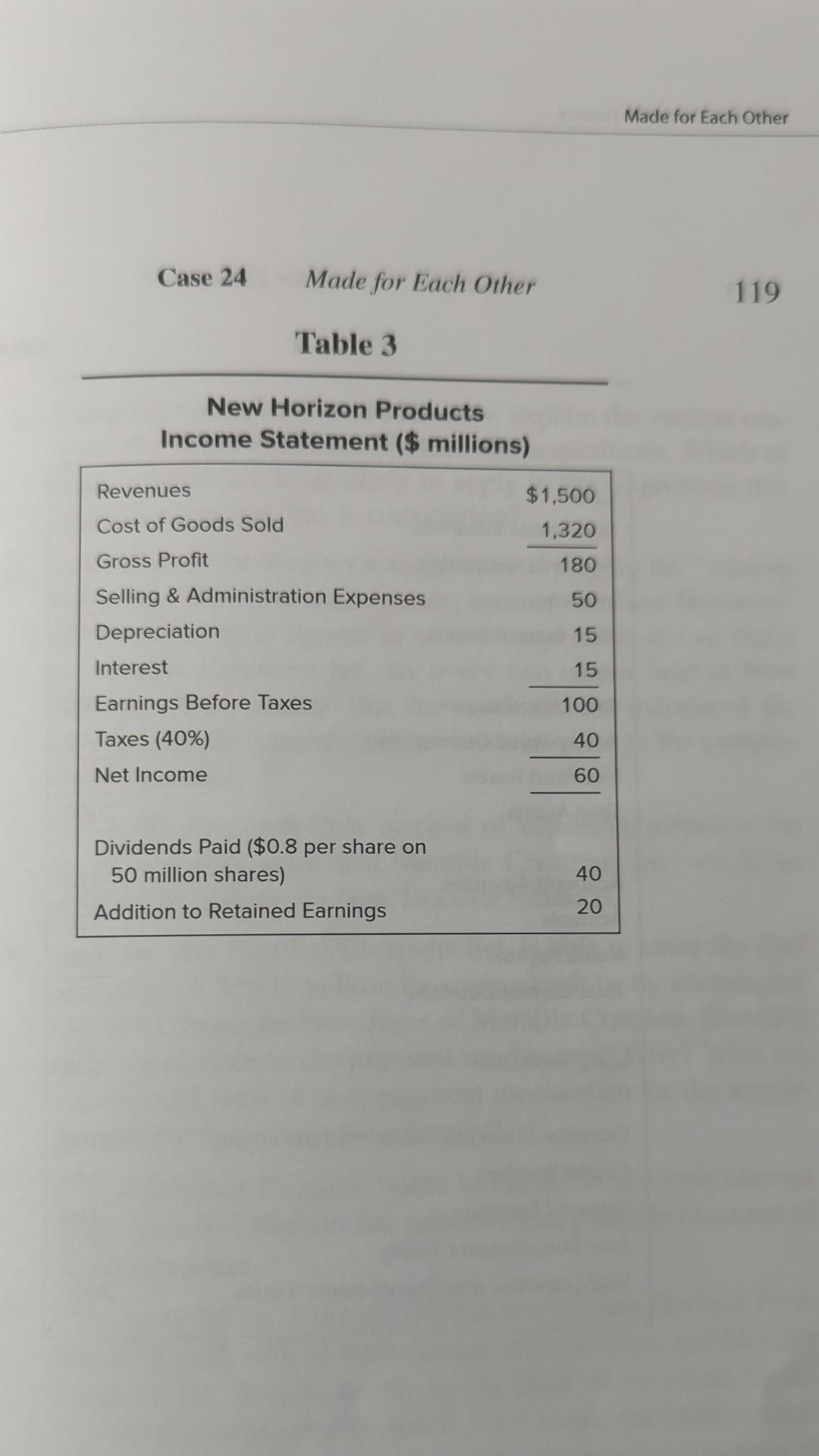

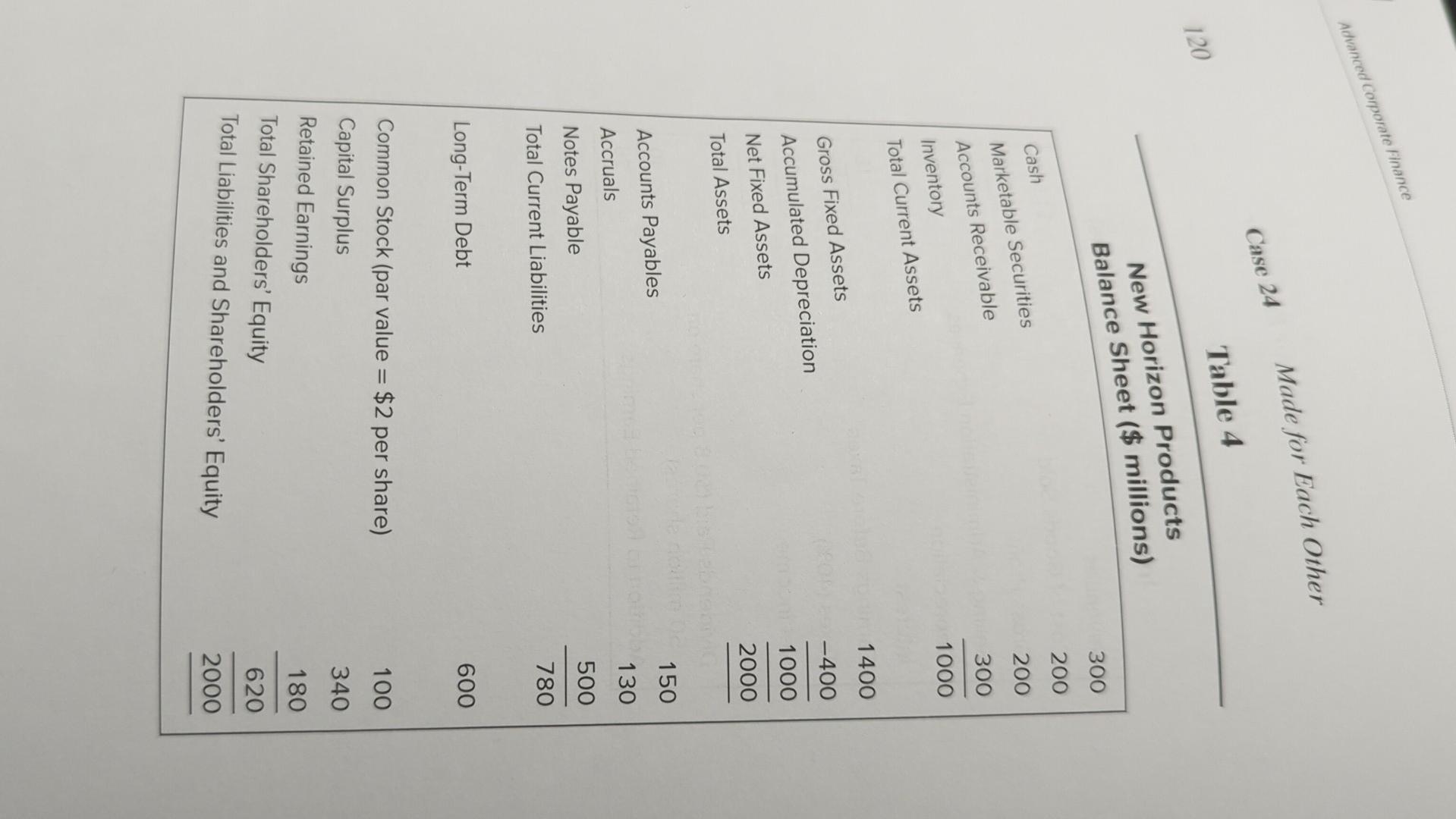

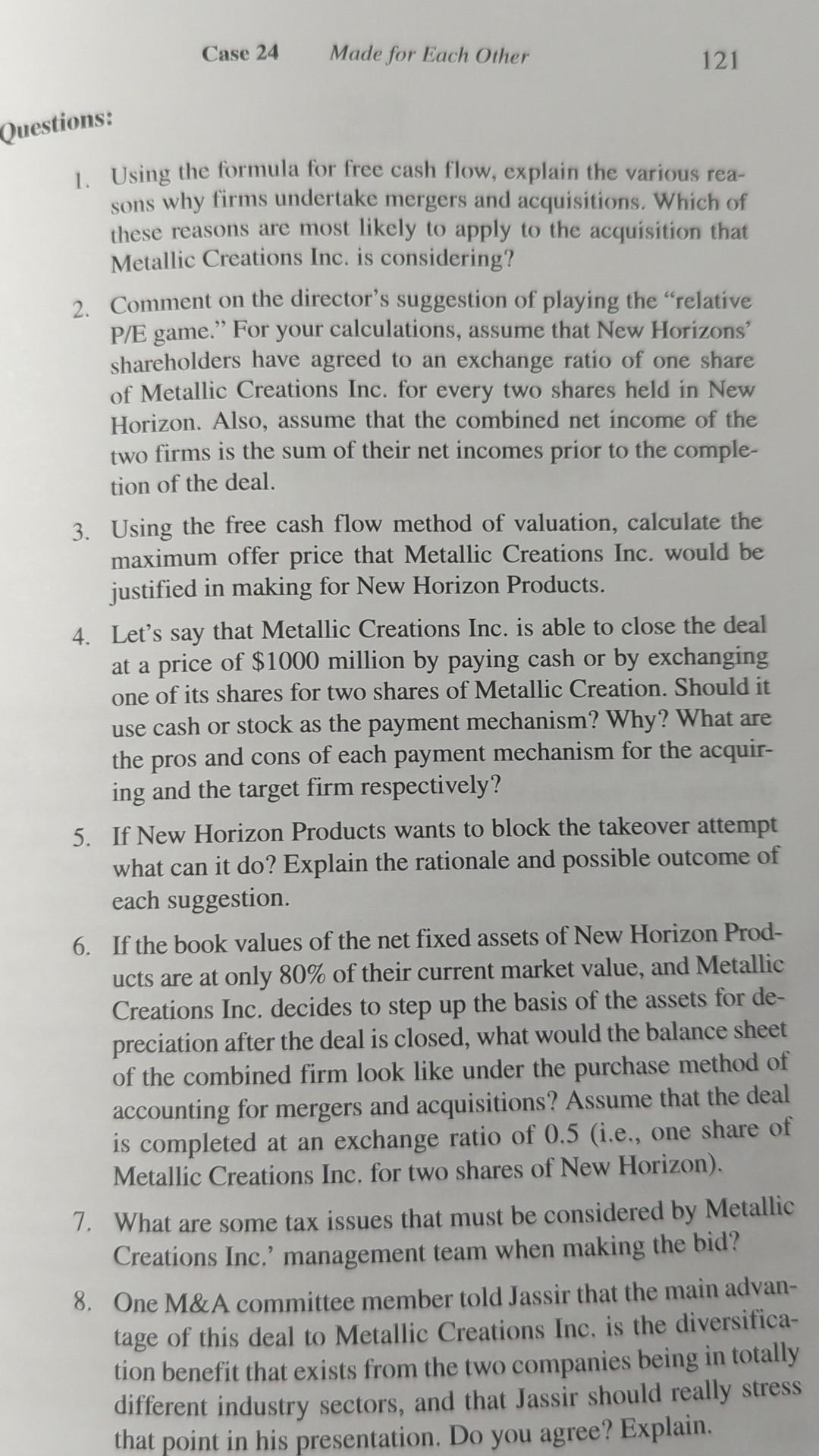

Valuing Corporate Acquisitions Made for Each Other It was late Sunday night, and Jassir Amor was getting weary. The big presentation was set for 8 am the next day, and Jassir kept remembering what Greg LeBlanc, the chairman of the mergers and acquisitions (M\&A) committee had said to him: "The board members are going to ask several tough questions at the meeting, so we better prepare ourselves thoroughly. Make sure that we can substantiate all our numbers and justify all our assumptions." Jassir and Greg were serving on the M\&A committee, which had been formed by their chairman and CEO, Nelson Jones, to "look into" possible candidates for acquisition. The three of them were employed by Metallic Creations Inc., a fairly large-sized manufacturing firm headquartered in Pittsburgh, Pennsylvania, which produced unique metal products for household and commercial use. Formed in 1980, the company had seen better days. At the time of its inception, its industry sector was still in its infancy stage and competition was almost nonexistent. As a result, the company enjoyed significant growth over the years and was able to recruit excellent personnel, many of whom stayed with the company right from the start. The firm had accumulated a significant amount of cash and built a good credit history. Over the past couple of years, however, due to fierce competition and a lackluster economy, the firm's scope of expansion had all but dried up, and the managers were hard pressed to search for alternative avenues for simonides no shameful act; but against necessity Case 24 Made for Each Other 116 The company's stock price had recently dropped to $45 per share. growth. The company's steck price had recenty dropped to $45 per share. The orerwhiciming consensus in the boardrom to better utilize its resources and diversify its risk. About three months ago, Jones had set up the M\&A committee to research possible acquisition candidates and present its findings at the quarterly board meeting. He asked the committee members to consider firms in related as well as unrelated industries and explain the rationale for their recommendations. After considerable research, data gathering, and analysis, the committee had narrowed their choices down to three possible candidates. After the presentation at the quarterly meeting in March, the board of directors had ruled out two of the three candidates and asked the committee to conduct further valuation and analysis on the third candidate-New Horizon Products. The board members were particularly curious about the low P/E ratio at which the firm was trading. In fact, one board member had heard Horizon Products the firm could boost its P/E ratio and possibly its earnings per share. New Horizon Products, headquartered in Denver, Colorado, was a midsized company with assets of $2 billion. The firm's earnings per share had been steadily increasing each year and were currently $1.2 per share. Surprisingly, however, the committee found that although the firm had a fairly well-diversified customer base, its P/E ratio was rather low at 12.5X-much below the average P/E ratio for the industry. The committee felt that one reason for the low P/E ratio might have been the recent retirement of their CEO, who had managed the company in a very centralized manner. All managers reported directly to him, and he made most of the strategic decisions. His experience and vision had been well rewarded in the market. The members of the M\&A committee felt that if New Horizon Products were to be acquired by Metallic Creations Inc., production and marketing costs could be significantly reduced due to Metallic Creations' technical and marketing expertise. The incremental net cash flows of the combined company were estimated to be at least $45 million per year for the foreseeable future. Moreover, since New Horizon Products was involved in a totally different industrial sector there were some significant diversification benefits to be had. Tables 1-4 present the financial statements of Metallic Creations Inc. and New Horizon Products respectively. The finance department of Metallic Creations Inc, had recently estimated the firm's weighted average cost of capital to be 16% and the required rate of return on equity to be 20%. Since Jassir had first suggested New Horizon Products as a possible acquisition candidate, it was his job to provide the board with the necessary information, clarification, and estimates. Jassir firmly believed that New Horizon Products and Metallic Creations Inc. were "made for each other." Now if only he could convince the board! Table 2 Case 24 Made for Each Other Table 3 New Horizon Products Income Statement ( $ millions) Advanced corporate finance Case 24 Made for Each Other Table 4 120 2. Comment on the director's suggestion of playing the "relative P/E game." For your calculations, assume that New Horizons" shareholders have agreed to an exchange ratio of one share of Metallic Creations Inc. for every two shares held in New Horizon. Also, assume that the combined net income of the two firms is the sum of their net incomes prior to the completion of the deal. 3. Using the free cash flow method of valuation, calculate the maximum offer price that Metallic Creations Inc. would be justified in making for New Horizon Products. 4. Let's say that Metallic Creations Inc. is able to close the deal at a price of $1000 million by paying cash or by exchanging one of its shares for two shares of Metallic Creation. Should it use cash or stock as the payment mechanism? Why? What are the pros and cons of each payment mechanism for the acquiring and the target firm respectively? 5. If New Horizon Products wants to block the takeover attempt what can it do? Explain the rationale and possible outcome of each suggestion. 6. If the book values of the net fixed assets of New Horizon Products are at only 80% of their current market value, and Metallic Creations Inc. decides to step up the basis of the assets for depreciation after the deal is closed, what would the balance sheet of the combined firm look like under the purchase method of accounting for mergers and acquisitions? Assume that the deal is completed at an exchange ratio of 0.5 (i.e., one share of Metallic Creations Inc. for two shares of New Horizon). 7. What are some tax issues that must be considered by Metallic Creations Inc.' management team when making the bid? 8. One M\&A committee member told Jassir that the main advantage of this deal to Metallic Creations Inc, is the diversification benefit that exists from the two companies being in totally different industry sectors, and that Jassir should really stress that point in his presentation. Do you agree? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started