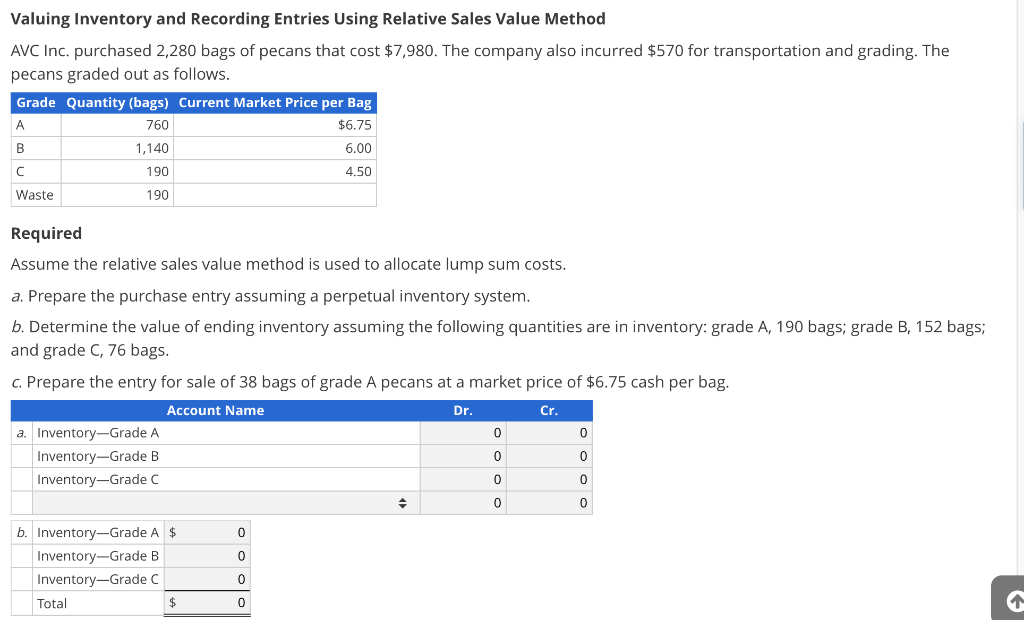

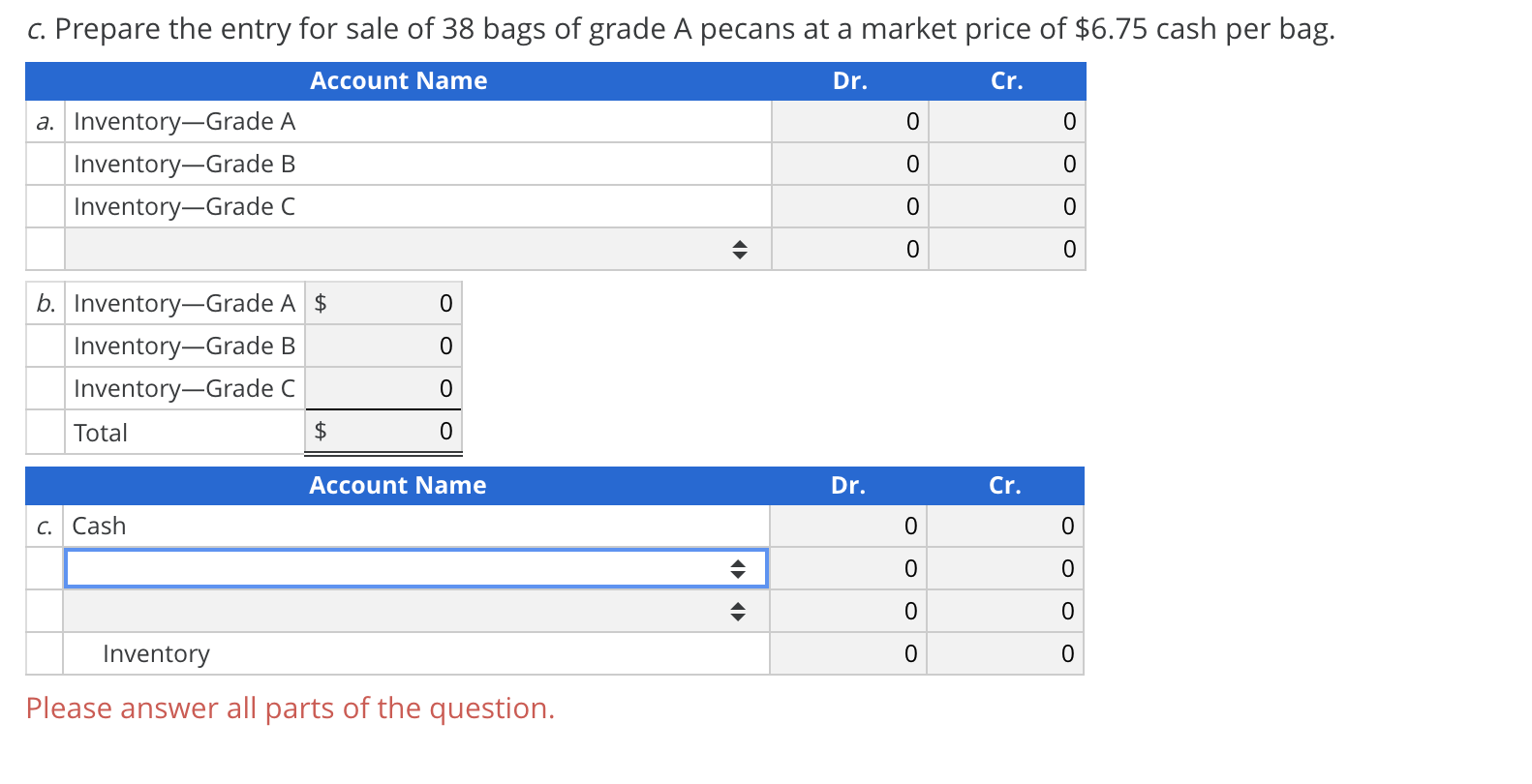

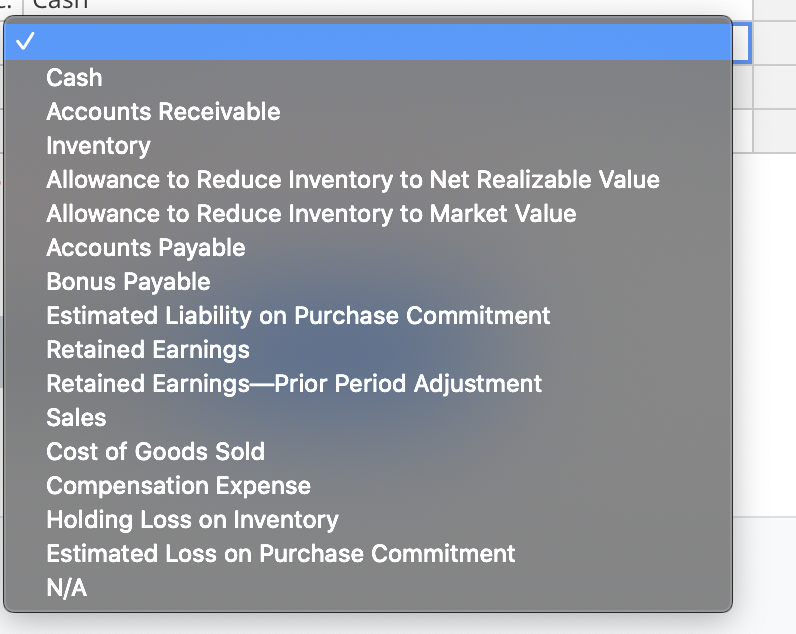

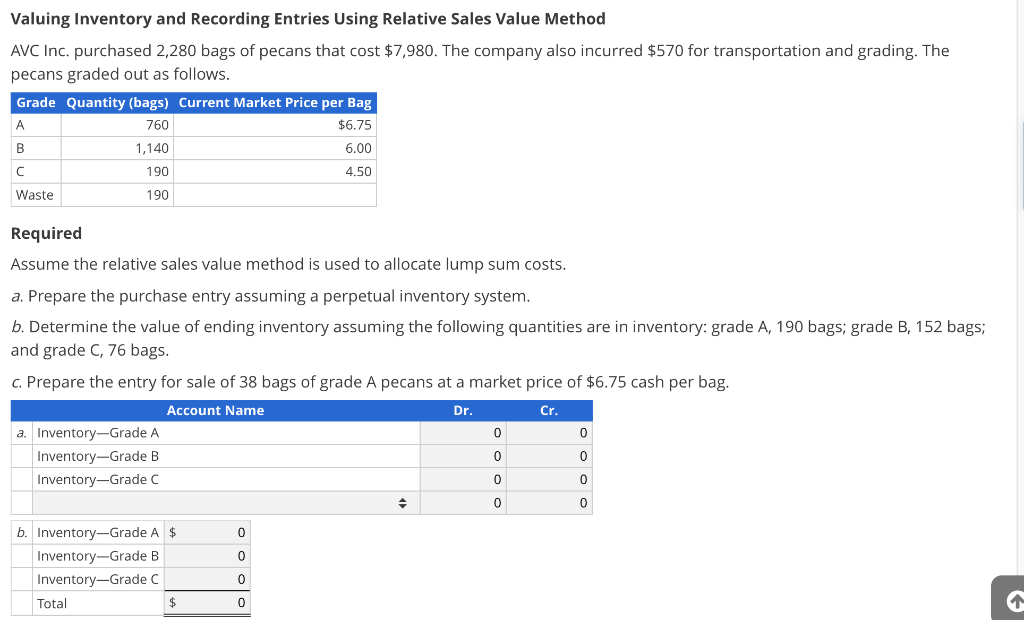

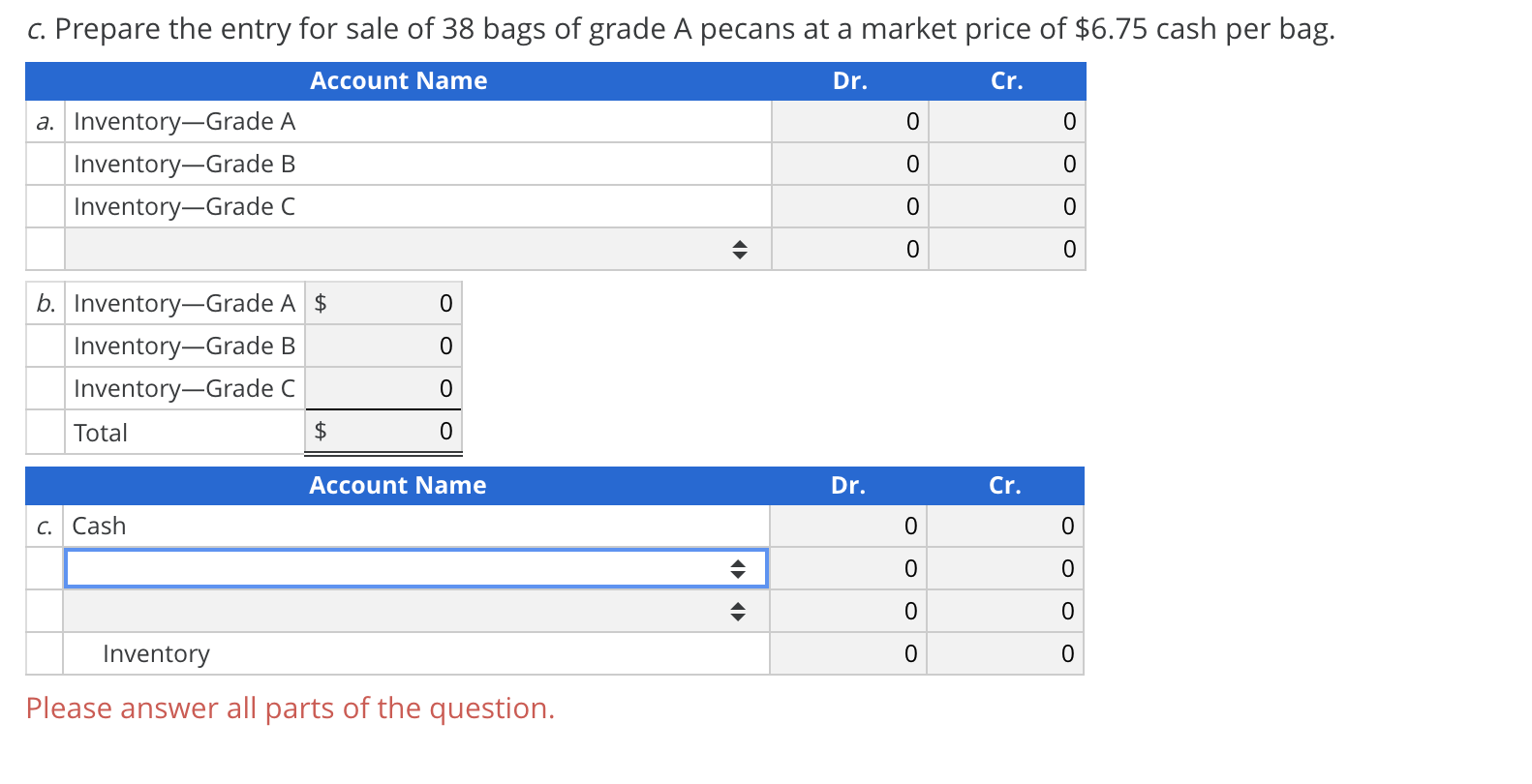

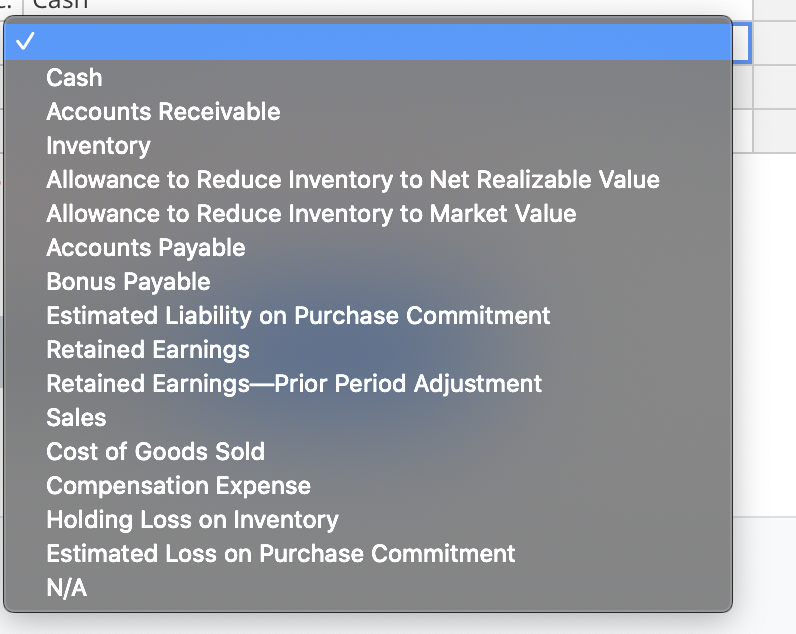

Valuing Inventory and Recording Entries Using Relative Sales Value Method AVC Inc. purchased 2,280 bags of pecans that cost $7,980. The company also incurred $570 for transportation and grading. The pecans graded out as follows. Grade Quantity (bags) Current Market Price per Bag 760 $6.75 B 1,140 6.00 190 4.50 Waste 190 A Required Assume the relative sales value method is used to allocate lump sum costs. a. Prepare the purchase entry assuming a perpetual inventory system. b. Determine the value of ending inventory assuming the following quantities are in inventory: grade A, 190 bags, grade B, 152 bags; and grade C, 76 bags. c. Prepare the entry for sale of 38 bags of grade A pecans at a market price of $6.75 cash per bag. Account Name Dr. a. Inventory-Grade A 0 0 Inventory-Grade B 0 Inventory-Gradec Cr. 0 0 0 0 0 0 0 b. Inventory-Grade A $ Inventory-Grade B Inventory-Gradec Total 0 $ 0 c. Prepare the entry for sale of 38 bags of grade A pecans at a market price of $6.75 cash per bag. Account Name Dr. Cr. 0 0 a. Inventory-Grade A Inventory-Grade B Inventory-Gradec 0 0 0 0 0 0 0 b. Inventory-Grade A $ Inventory-Grade B Inventory-Gradec 0 0 Total $ 0 Account Name Dr. Cr. C. Cash 0 0 0 0 0 0 Inventory 0 0 Please answer all parts of the question. Cash Accounts Receivable Inventory Allowance to Reduce Inventory to Net Realizable Value Allowance to Reduce Inventory to Market Value Accounts Payable Bonus Payable Estimated Liability on Purchase Commitment Retained Earnings Retained EarningsPrior Period Adjustment Sales Cost of Goods Sold Compensation Expense Holding Loss on Inventory Estimated Loss on Purchase Commitment N/A Valuing Inventory and Recording Entries Using Relative Sales Value Method AVC Inc. purchased 2,280 bags of pecans that cost $7,980. The company also incurred $570 for transportation and grading. The pecans graded out as follows. Grade Quantity (bags) Current Market Price per Bag 760 $6.75 B 1,140 6.00 190 4.50 Waste 190 A Required Assume the relative sales value method is used to allocate lump sum costs. a. Prepare the purchase entry assuming a perpetual inventory system. b. Determine the value of ending inventory assuming the following quantities are in inventory: grade A, 190 bags, grade B, 152 bags; and grade C, 76 bags. c. Prepare the entry for sale of 38 bags of grade A pecans at a market price of $6.75 cash per bag. Account Name Dr. a. Inventory-Grade A 0 0 Inventory-Grade B 0 Inventory-Gradec Cr. 0 0 0 0 0 0 0 b. Inventory-Grade A $ Inventory-Grade B Inventory-Gradec Total 0 $ 0 c. Prepare the entry for sale of 38 bags of grade A pecans at a market price of $6.75 cash per bag. Account Name Dr. Cr. 0 0 a. Inventory-Grade A Inventory-Grade B Inventory-Gradec 0 0 0 0 0 0 0 b. Inventory-Grade A $ Inventory-Grade B Inventory-Gradec 0 0 Total $ 0 Account Name Dr. Cr. C. Cash 0 0 0 0 0 0 Inventory 0 0 Please answer all parts of the question. Cash Accounts Receivable Inventory Allowance to Reduce Inventory to Net Realizable Value Allowance to Reduce Inventory to Market Value Accounts Payable Bonus Payable Estimated Liability on Purchase Commitment Retained Earnings Retained EarningsPrior Period Adjustment Sales Cost of Goods Sold Compensation Expense Holding Loss on Inventory Estimated Loss on Purchase Commitment N/A