Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part 1 of the following table sets forth the analyst's assumptions for specific operating variables. These values are then used, in Part 2, to project

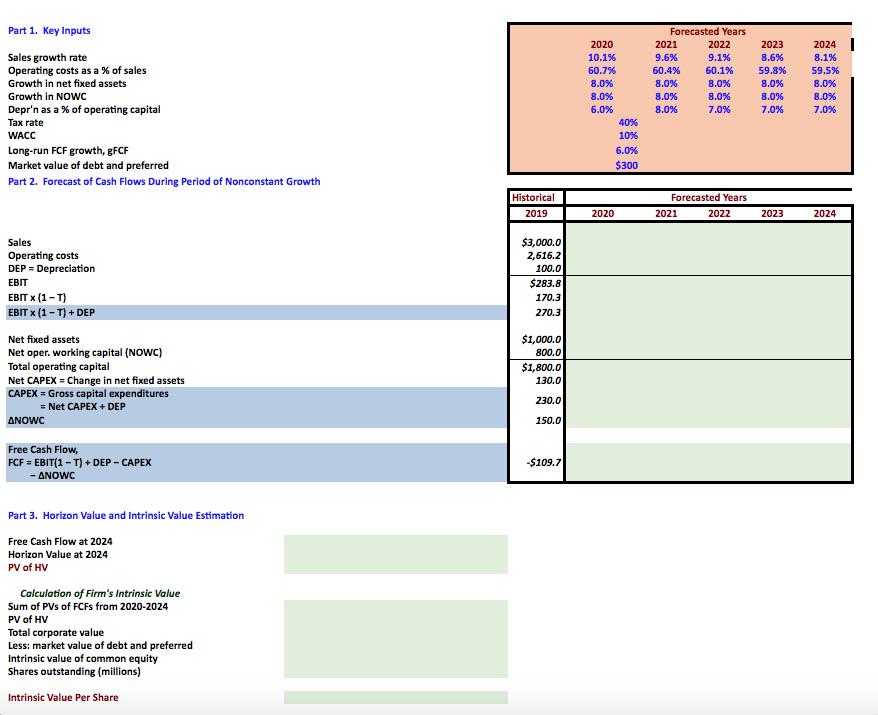

Part 1 of the following table sets forth the analyst's assumptions for specific operating variables. These values are then used, in Part 2, to project free cash flows from 2020 out to the "horizon year," after which it is assumed that the 2024 FCF will grow at the constant rate gLR. The PV of the FCFs during the nonconstant growth period are then discounted at the WACC. Finally, in Part 3, we find the sum of the nonconstant FCF PVs, then use the constant growth model to find the value of the firm at the horizon year, add these two components to find the value of the firm today, subtract the market value of the debt and preferred stock to find the value of the equity, and then divide by shares outstanding to find the estimated intrinsic value per share today.

Part 1. Key Inputs Forecasted Years 2020 2021 2022 2023 2024 Sales growth rate Operating costs as a % of sales Growth in net fixed assets 9.6% 10.1% 60.7% 9.1% 8.6% 8.1% 60.4% 60.1% 59.8% 59.5% 8.0% 8.0% 8.0% 8.0% 8.0% Growth in NOWC 8.0% 8.0% 8.0% 8.0% 8.0% Depr'n as a % of operating capital 6.0% 8.0% 7.0% 7.0% 7.0% x rate 40% WACC 10% Long-run FCF growth, BFCF Market value of debt and preferred 6.0% $300 Part 2. Forecast of Cash Flows During Period of Nonconstant Growth Historical Forecasted Years 2019 2020 2021 2022 2023 2024 Sales $3,000.0 2,616.2 Operating costs DEP = Depreciation 100.0 EBIT $283.8 T x (1- ) 170.3 EBIT x (1 - T) + DEP 270.3 Net fixed assets $1,000.0 Net oper. working capital (NOWC) Total operating capital 800.0 $1,800.0 130.0 Net CAPEX = Change in net fixed assets CAPEX = Gross capital expenditures 230.0 = Net CAPEX + DEP ANOWC 150.0 Free Cash Flow, FCF = EBIT(1 - T) + DEP - CAPEX - OWC -$109.7 Part 3. Horizon Value and Intrinsic Value Estimation Free Cash Flow at 2024 Horizon Value at 2024 PV of HV Calculation of Firm's Intrinsic Value Sum of PVs of FCFS from 2020-2024 PV of HV Total corporate value Less: market value of debt and preferred Intrinsic value of common equity Shares outstanding (millions) Intrinsic Value Per Share

Step by Step Solution

★★★★★

3.57 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Answer Free cash flow is the cash a company generates after taking into consideration cash outflows ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started