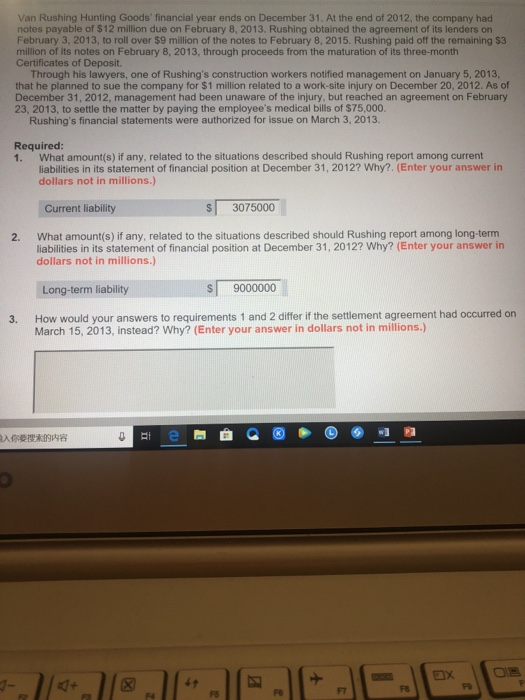

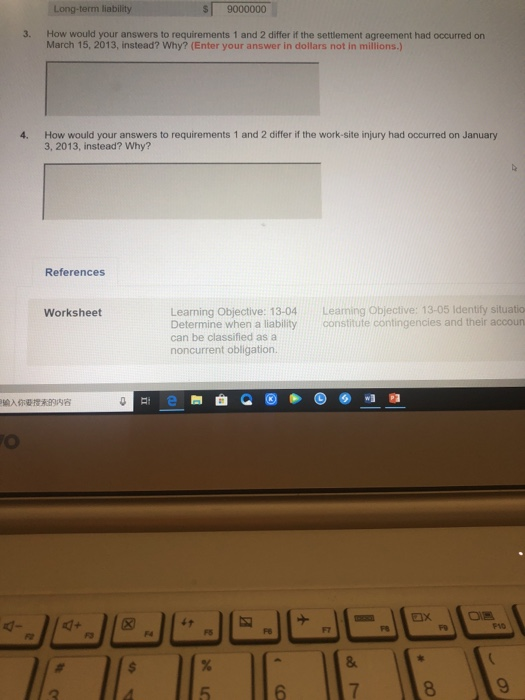

Van Rushing Hunting Goods' financial year ends on December 31. At the end of 2012, the company had notes payable of $12 million due on February 8, 2013. Rushing obtained the agreement of its lenders on February 3, 2013, to roll over $9 million of the notes to February 8, 2015. Rushing paid off the remaining $3 million of its notes on February 8, 2013, through proceeds from the maturation of its three-month Certificates of Deposit. Through his lawyers, one of Rushing's construction workers notified management on January 5, 2013, that he planned to sue the company for $1 million related to a work-site injury on December 20, 2012. As of December 31, 2012, management had been unaware of the injury, but reached an agreement on February 23, 2013, to settle the matter by paying the employee's medical bills of $75,000. Rushing's financial statements were authorized for issue on March 3, 2013. Required: 1. What amount(s) if any, related to the situations described should Rushing report among current liabilities in its statement of financial position at December 31, 2012? Why?. (Enter your answer in dollars not in millions.) Current liability S 3075000 What amount(s) if any, related to the situations described should Rushing report among long-term liabilities in its statement of financial position at December 31, 2012? Why? (Enter your answer in dollars not in millions.) 2. Long-term liability s 9000000 How would your answers to requirements 1 and 2 differ if the settlement agreement had occurred on March 15, 2013, instead? Why? (Enter your answer in dollars not in millions.) 3. ax Long-term liability S 9000000 3. How would your answers to requirements 1 and 2 differ if the settlement agreement had occurred on March 15, 2013, instead? Why? (Enter your answer in dollars not in millions.) How would your answers to requirements 1 and 2 differ if the work-site injury had occurred on January 3, 2013, instead? Why? 4. References Leaning Objective: 13-05 Identify situatio constitute contingencies and their accoun Learning Objective: 13-04 Determine when a liability can be classified as a noncurrent obligation. Worksheet d- FT F4