Question

Vanessa went to Florida and purchased a laptop for US$920.00 by converting his Canadian money at an exchange rate of C$1 = US$0.9254. After

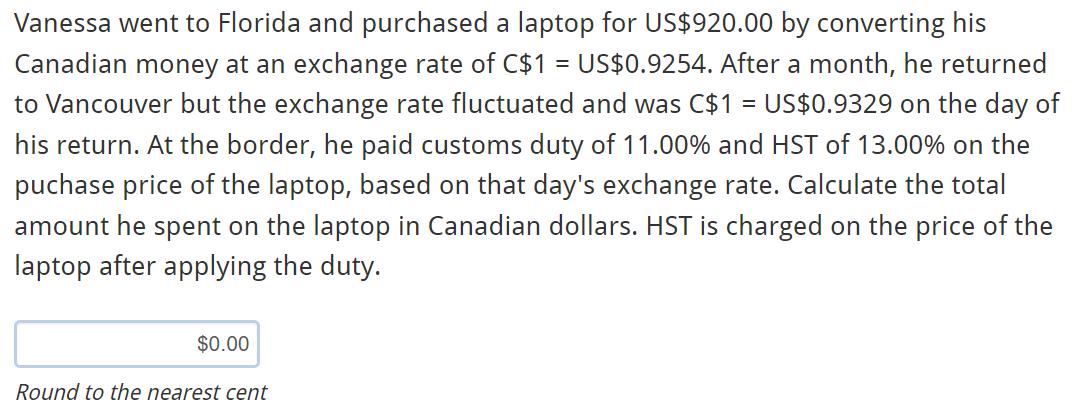

Vanessa went to Florida and purchased a laptop for US$920.00 by converting his Canadian money at an exchange rate of C$1 = US$0.9254. After a month, he returned to Vancouver but the exchange rate fluctuated and was C$1 = US$0.9329 on the day of his return. At the border, he paid customs duty of 11.00% and HST of 13.00% on the puchase price of the laptop, based on that day's exchange rate. Calculate the total amount he spent on the laptop in Canadian dollars. HST is charged on the price of the laptop after applying the duty. $0.00 Round to the nearest cent

Step by Step Solution

3.34 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

A delightful problem involving currency conversion exchange rates and taxes Lets break it down step ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Business Mathematics In Canada

Authors: F. Ernest Jerome, Jackie Shemko

3rd Edition

1259370151, 978-1259370151

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App