Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vanguard Corporation issued $7,000,000 of 10% bonds on November 1, 2023, due on November 1, 2029. The interest is to be paid twice a

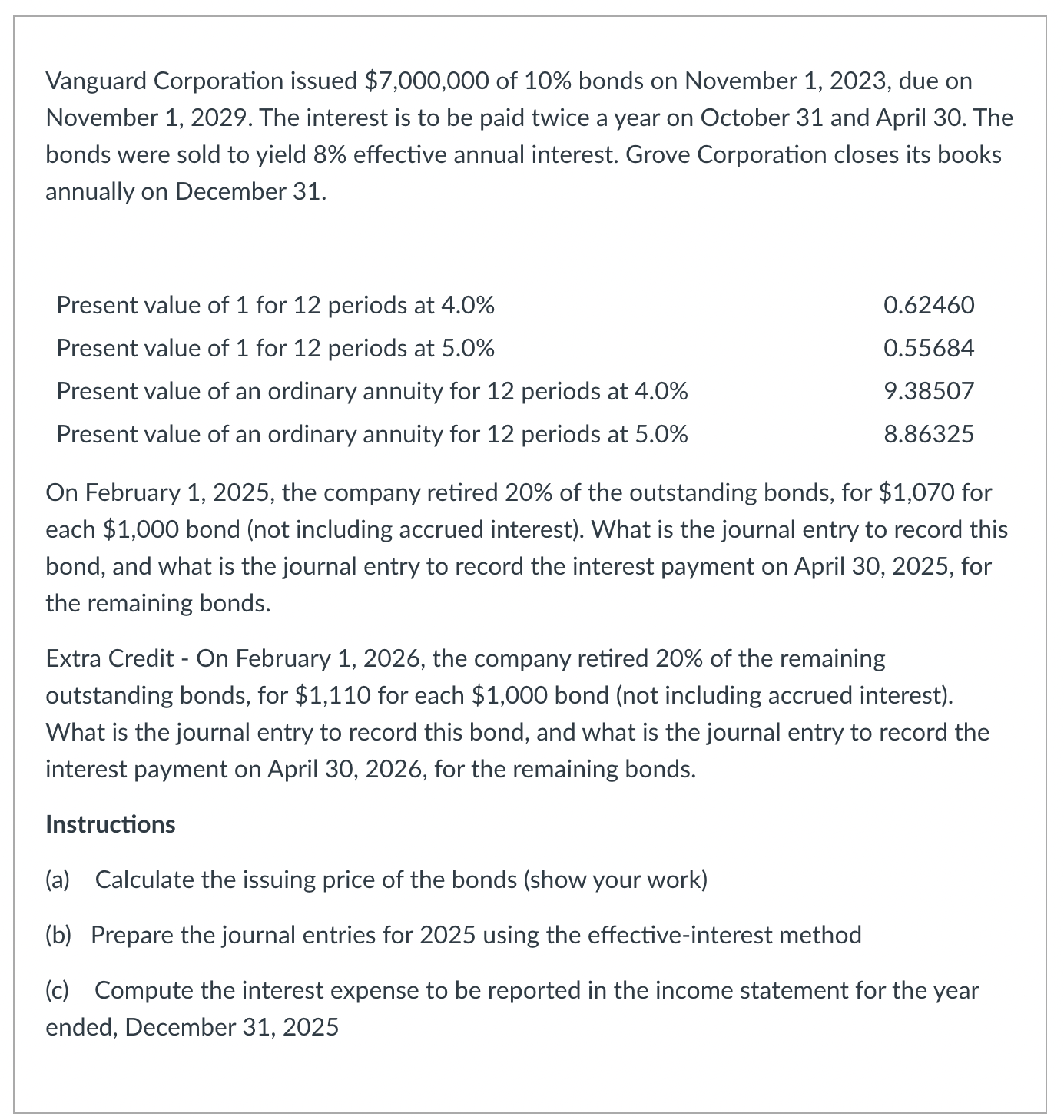

Vanguard Corporation issued $7,000,000 of 10% bonds on November 1, 2023, due on November 1, 2029. The interest is to be paid twice a year on October 31 and April 30. The bonds were sold to yield 8% effective annual interest. Grove Corporation closes its books annually on December 31. Present value of 1 for 12 periods at 4.0% Present value of 1 for 12 periods at 5.0% Present value of an ordinary annuity for 12 periods at 4.0% Present value of an ordinary annuity for 12 periods at 5.0% 0.62460 0.55684 9.38507 8.86325 On February 1, 2025, the company retired 20% of the outstanding bonds, for $1,070 for each $1,000 bond (not including accrued interest). What is the journal entry to record this bond, and what is the journal entry to record the interest payment on April 30, 2025, for the remaining bonds. Extra Credit - On February 1, 2026, the company retired 20% of the remaining outstanding bonds, for $1,110 for each $1,000 bond (not including accrued interest). What is the journal entry to record this bond, and what is the journal entry to record the interest payment on April 30, 2026, for the remaining bonds. Instructions (a) Calculate the issuing price of the bonds (show your work) (b) Prepare the journal entries for 2025 using the effective-interest method (c) Compute the interest expense to be reported in the income statement for the year ended, December 31, 2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculating the Issuing Price of the Bonds We can use the present value PV of an annuity formula to find the issuing price because the bond makes semiannual coupon payments at an effective annual in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started