Answered step by step

Verified Expert Solution

Question

1 Approved Answer

VaR Questions VaR0.98 1-year R 1. Interpret the notation above. 3. 2. In a portfolio of loans, the outcomes are equally likely between a loss

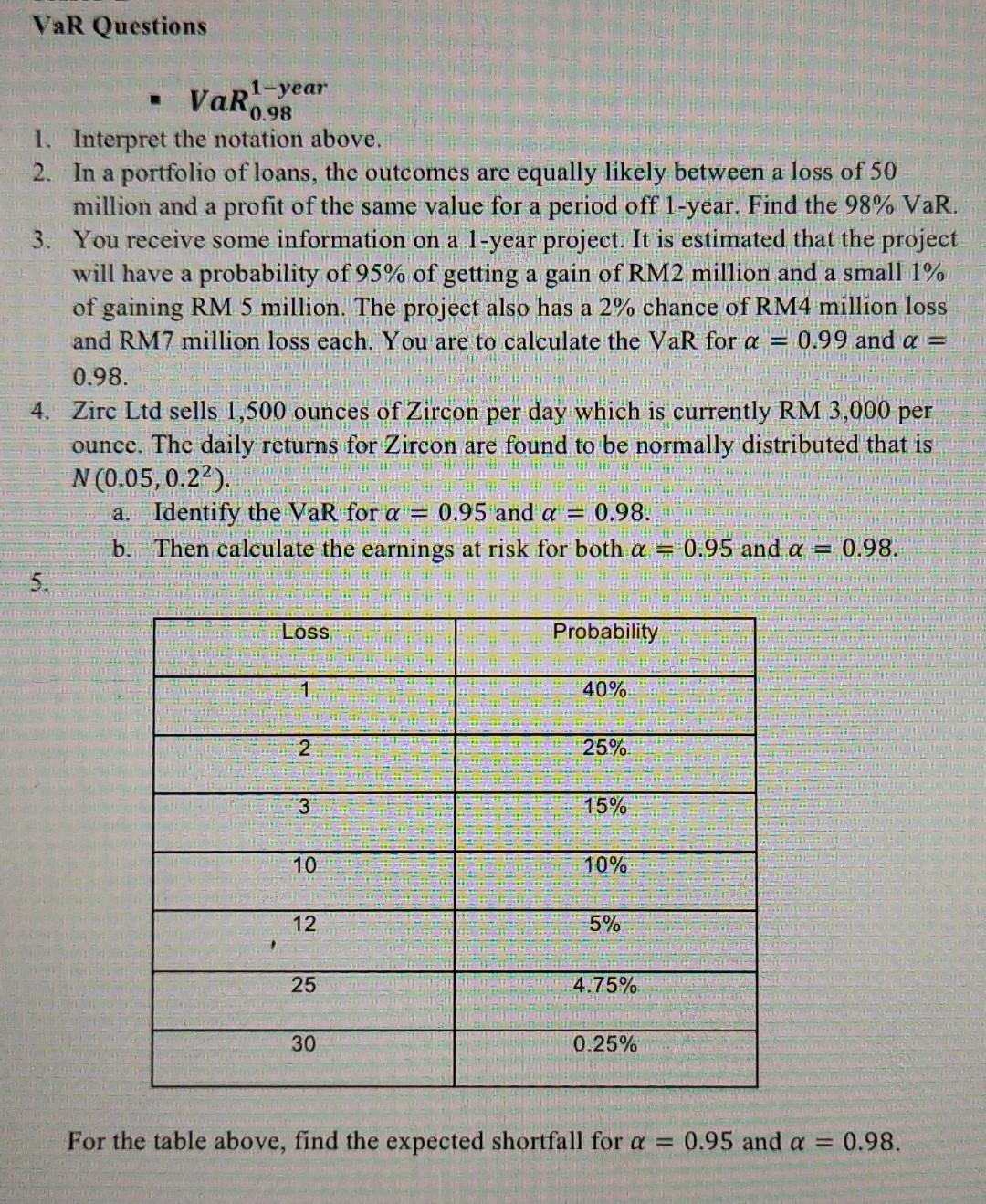

VaR Questions VaR0.98 1-year R 1. Interpret the notation above. 3. 2. In a portfolio of loans, the outcomes are equally likely between a loss of 50 million and a profit of the same value for a period off 1-year. Find the 98% VaR. You receive some information on a 1-year project. It is estimated that the project will have a probability of 95% of getting a gain of RM2 million and a small 1% of gaining RM 5 million. The project also has a 2% chance of RM4 million loss and RM7 million loss each. You are to calculate the VaR for a = 0.99 and a = 0.98. 4. Zirc Ltd sells 1,500 ounces of Zircon per day which is currently RM 3,000 per ounce. The daily returns for Zircon are found to be normally distributed that is N (0.05, 0.2). a. Identify the VaR for a = 0.95 and a = 0.98. b. Then calculate the earnings at risk for both a = 0.95 and a = 0.98. 5. Loss Probability 1 40% 2 25% 3 15% 10 10% 12 5% 25 4.75% 30 0.25% For the table above, find the expected shortfall for a = 0.95 and a = 0.98. VaR Questions VaR0.98 1-year R 1. Interpret the notation above. 3. 2. In a portfolio of loans, the outcomes are equally likely between a loss of 50 million and a profit of the same value for a period off 1-year. Find the 98% VaR. You receive some information on a 1-year project. It is estimated that the project will have a probability of 95% of getting a gain of RM2 million and a small 1% of gaining RM 5 million. The project also has a 2% chance of RM4 million loss and RM7 million loss each. You are to calculate the VaR for a = 0.99 and a = 0.98. 4. Zirc Ltd sells 1,500 ounces of Zircon per day which is currently RM 3,000 per ounce. The daily returns for Zircon are found to be normally distributed that is N (0.05, 0.2). a. Identify the VaR for a = 0.95 and a = 0.98. b. Then calculate the earnings at risk for both a = 0.95 and a = 0.98. 5. Loss Probability 1 40% 2 25% 3 15% 10 10% 12 5% 25 4.75% 30 0.25% For the table above, find the expected shortfall for a = 0.95 and a = 0.98

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started