Answered step by step

Verified Expert Solution

Question

1 Approved Answer

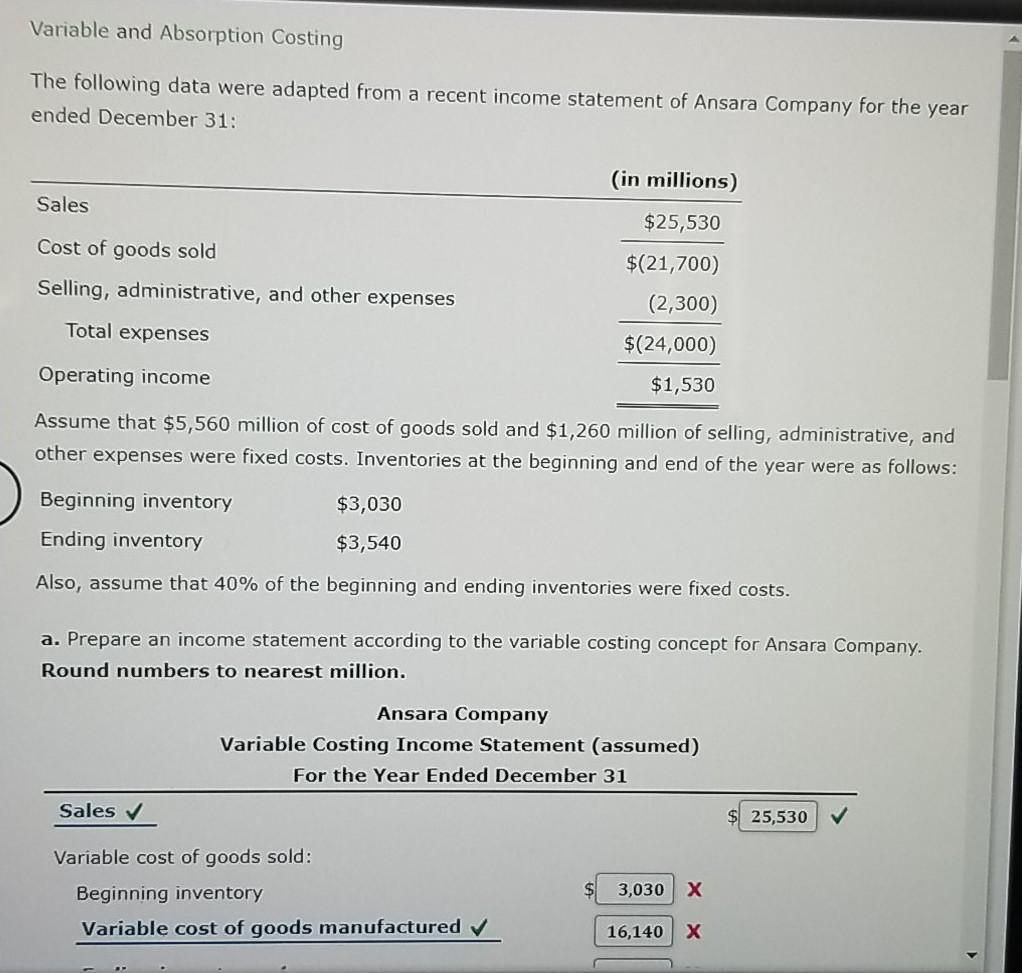

Variable and Absorption Costing The following data were adapted from a recent income statement of Ansara Company for the year ended December 31: (in millions)

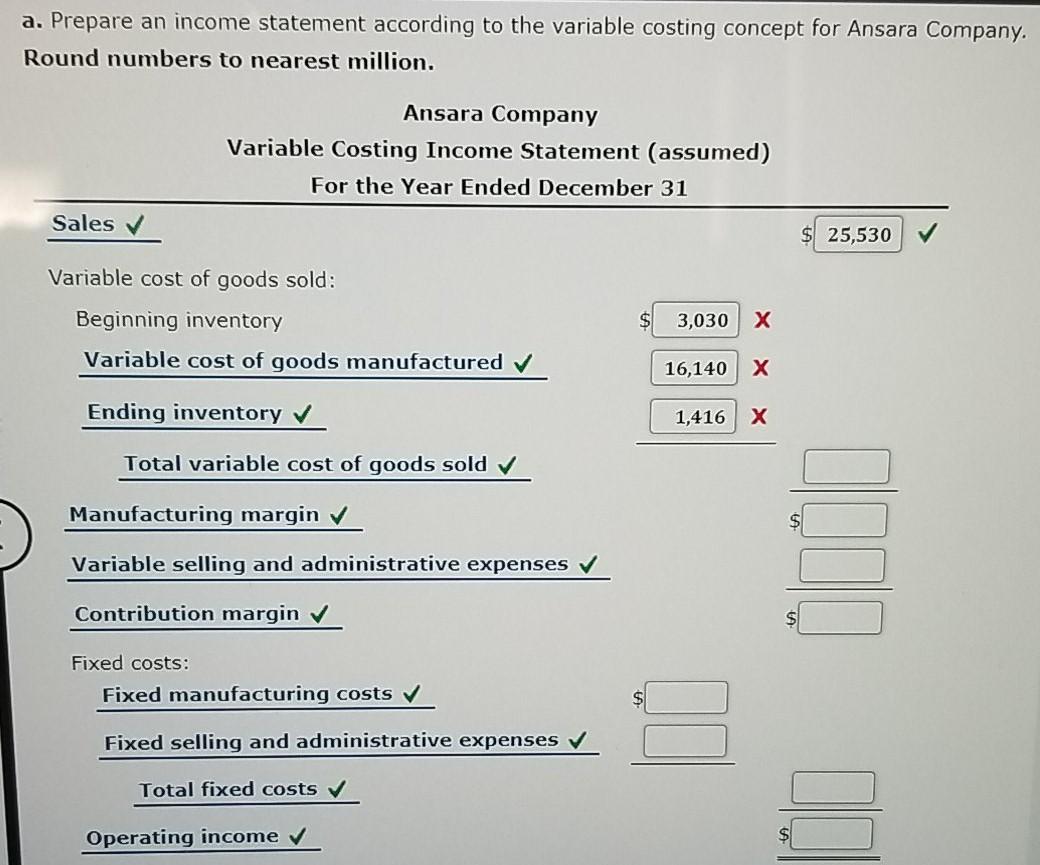

Variable and Absorption Costing The following data were adapted from a recent income statement of Ansara Company for the year ended December 31: (in millions) Sales $25,530 Cost of goods sold Selling, administrative, and other expenses Total expenses $(21,700) (2,300) $(24,000) $1,530 Operating income Assume that $5,560 million of cost of goods sold and $1,260 million of selling, administrative, and other expenses were fixed costs. Inventories at the beginning and end of the year were as follows: $3,030 Beginning inventory Ending inventory $3,540 Also, assume that 40% of the beginning and ending inventories were fixed costs. a. Prepare an income statement according to the variable costing concept for Ansara Company. Round numbers to nearest million. Ansara Company Variable Costing Income Statement (assumed) For the Year Ended December 31 Sales 25,530 Variable cost of goods sold: Beginning inventory Variable cost of goods manufactured 3,030 X 16,140 X a. Prepare an income statement according to the variable costing concept for Ansara Company. Round numbers to nearest million. Ansara Company Variable Costing Income Statement (assumed) For the Year Ended December 31 Sales $ 25,530 Variable cost of goods sold: Beginning inventory Variable cost of goods manufactured 3,030 16,140 X Ending inventory 1,416 Total variable cost of goods sold Manufacturing margin Variable selling and administrative expenses Contribution margin Fixed costs: Fixed manufacturing costs Fixed selling and administrative expenses Total fixed costs Operating income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started