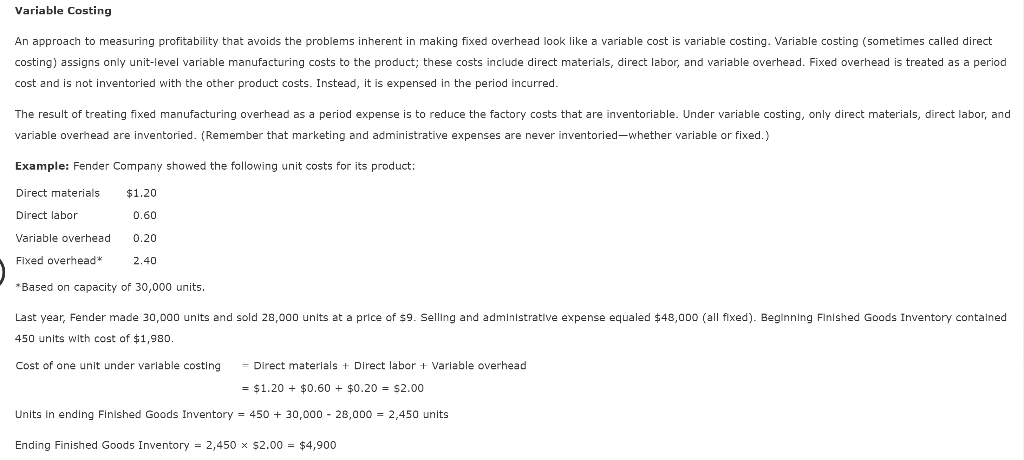

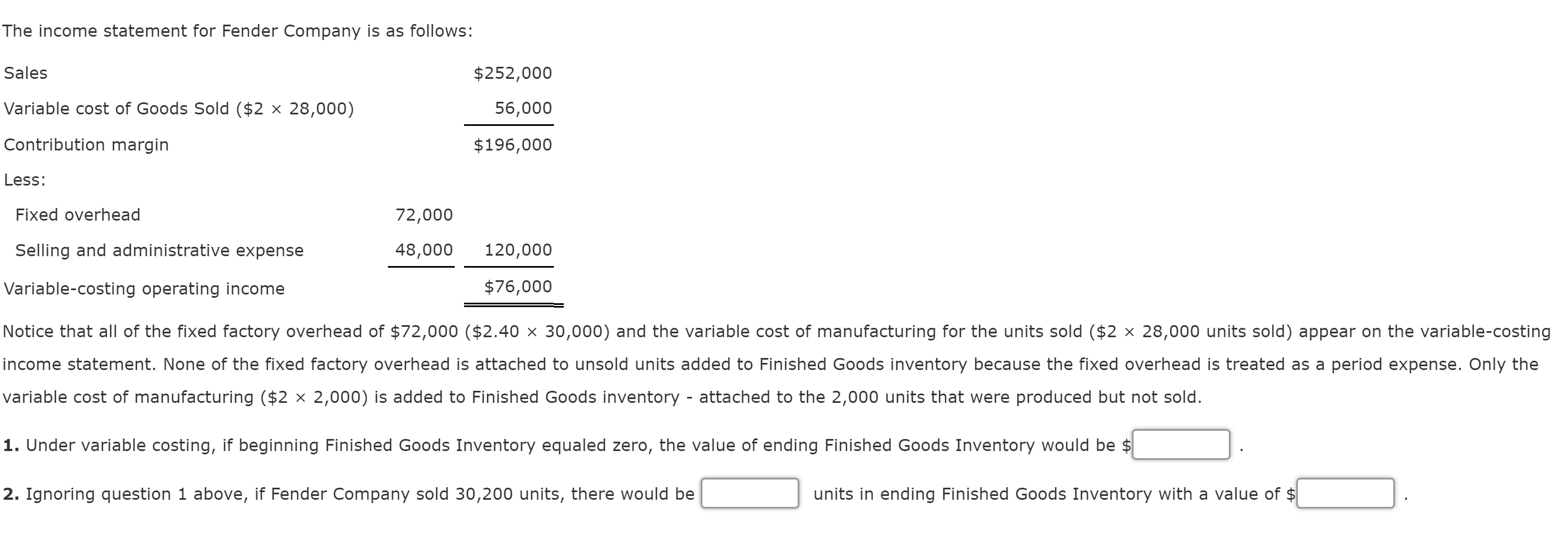

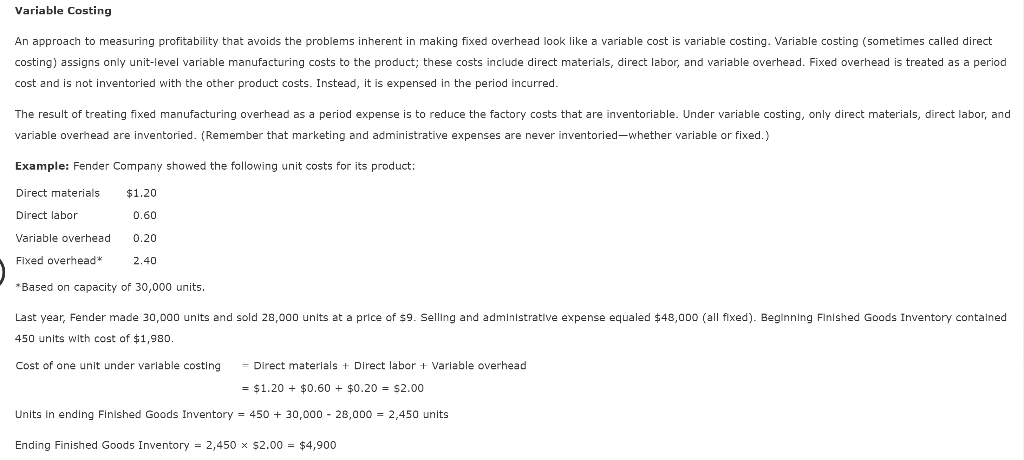

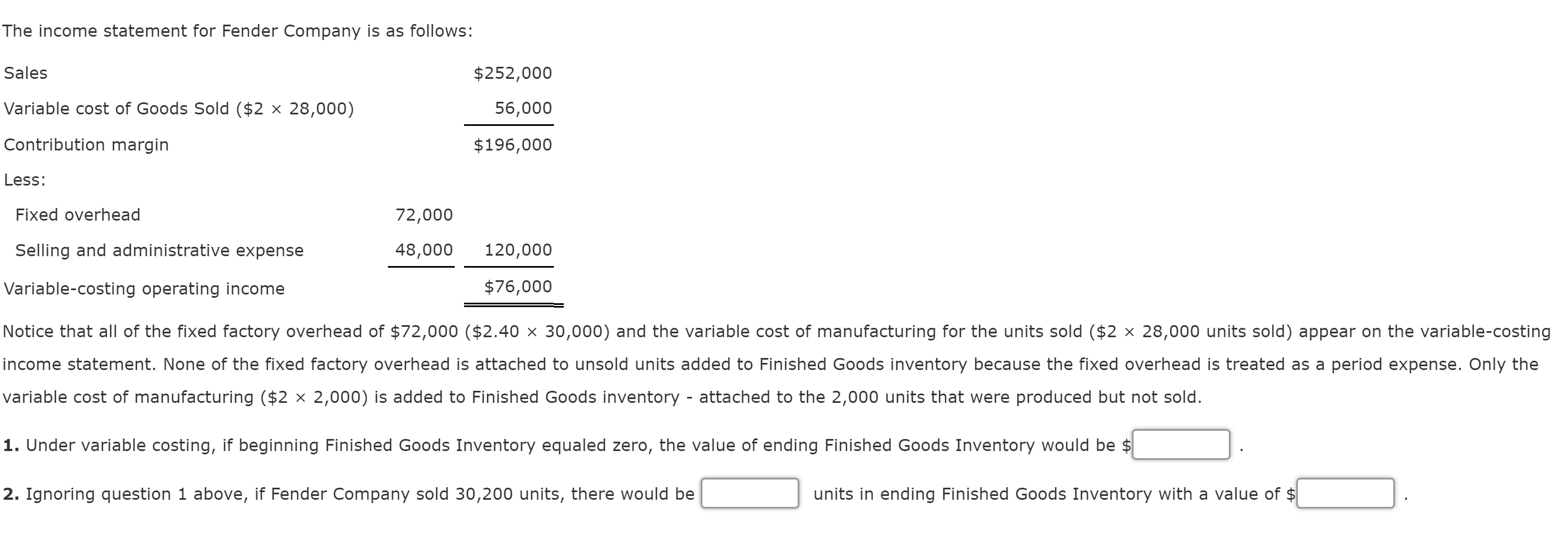

Variable Costing An approach to measuring profitability that avoids the problems inherent in making fixed overhead look like a variable cost is variable costing, Variable costing (sometimes called direct costing) assigns only unit-level variable manufacturing costs to the product; these costs include direct materials, direct labor, and variable overhead. Fixed overhead is treated as a period cost and is not inventoried with the other product costs. Instead, it is expensed in the period incurred. The result of treating fixed manufacturing overhead as a period expense is to reduce the factory costs that are inventoriable. Under variable costing, only direct materials, direct labor, and variable overhead are inventoried. (Remember that marketing and administrative expenses are never inventoried-whether variable or fixed.) Example: Fender Company showed the following unit costs for its product: Direct materials Direct labor Variable overhead Fixed overhead* $1.20 0.60 0.20 2.40 *Based on capacity of 30,000 units. Last year, Fender made 30,000 units and sold 28,000 units at a price of $9. Selling and administrative expense equaled $48,000 (all fixed). Beginning Finished Goods Inventory contained 450 units with cost of $1,980. Cost of one unit under variable costing = Direct materials + Direct labor + Variable overhead = $1.20 + $0.60 + $0.20 = 52.00 Units in ending Finished Goods Inventory = 450 + 30,000 - 28,000 = 2,450 units Ending Finished Goods Inventory = 2,450 $2.00 = $4,900 The income statement for Fender Company is as follows: Sales $252,000 Variable cost of Goods Sold ($2 x 28,000) 56,000 Contribution margin $196,000 Less: Fixed overhead 72,000 48,000 Selling and administrative expense 120,000 Variable-costing operating income $76,000 Notice that all of the fixed factory overhead of $72,000 ($2.40 x 30,000) and the variable cost of manufacturing for the units sold ($2 x 28,000 units sold) appear on the variable-costing income statement. None of the fixed factory overhead is attached to unsold units added to Finished Goods inventory because the fixed overhead is treated as a period expense. Only the variable cost of manufacturing ($2 x 2,000) is added to Finished Goods inventory - attached to the 2,000 units that were produced but not sold. 1. Under variable costing, if beginning Finished Goods Inventory equaled zero, the value of ending Finished Goods Inventory would be $ 2. Ignoring question 1 above, if Fender Company sold 30,200 units, there would be units in ending Finished Goods Inventory with a value of $