Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Variable overhead Total hours of housekeeping services per year Total fixed overhead $40,000 a) Determine whether Vanes College should outsource housekeeping, assuming that 75% offixed

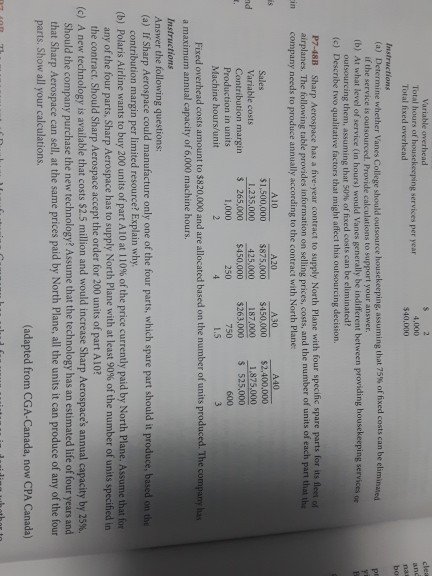

Variable overhead Total hours of housekeeping services per year Total fixed overhead $40,000 a) Determine whether Vanes College should outsource housekeeping, assuming that 75% offixed costs can be eliminated if the service is outsourced. Provide calculations to support your answer (b) At what level of service (in hours) would Vanes generally be indifferent between providing housekeeping services or outsourcing them, assuming that 50% of fixed costs can be eliminated? (c) Describe two qualitative factors that might affect this outsourcing decision P7-48B Sharp Aerospace has a five-year contract to supply North Plane with four specific spare airplanes. The following table provides information on selling prices, costs, and the number of units of each part that the company needs to produce annually according to the contract with North Plane: in A40 A10 $1,500,000 1,235,000 A20 $875,000 $450,000 A30 Sales Variable costs $2.400,0D0 1.875,000 425,000 187,000 Contribution margin 265,000 $450,000 $263,000 525,000 600 Production in units 1,000 Machine hours/unit 1.5 Fixed overhead costs amount to $820,000 and are allocated based on the number of units produced. The company has a maximum annual capacity of 6,000 machine hours Instructions Answer the following questions: (a) If Sharp Aerospace could manufacture only one of the four parts, which spare part should it produce, based on the contribution margin per limited resource? Explain why. (b) Polaris Airline wants to buy 200 units of part A 10 at 110% of the price currently paid by North Plane. Assume that for any of the four parts, Sharp Aerospace has to supply North Plane with at least 90% of the number of units specified in the contract. Should Sharp Aerospace accept the order for 200 units of part A10? (c) A new technology is available that costs $2.5 million and would increase Sharp Aerospace's annual capacity by 25% Should the company purchase the new technology? Assume that the technology has an estimated life of four years and that Sharp Aerospace can sell, at the same prices paid by North Plane, all the units it can produce of any of the four parts. Show all your calculations (adapted from CGA-Canada, now CPA Canada)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started