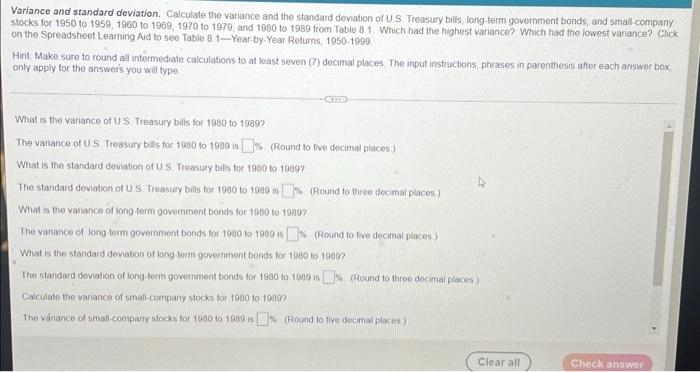

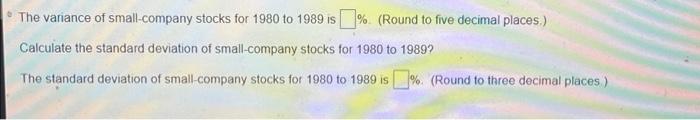

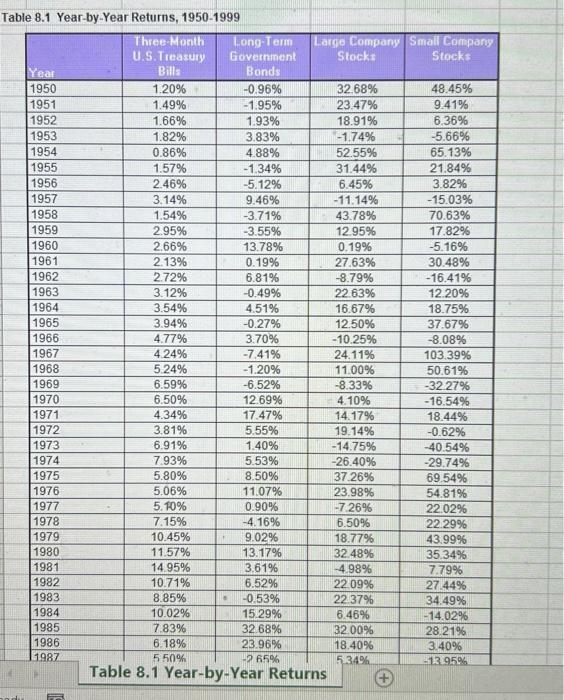

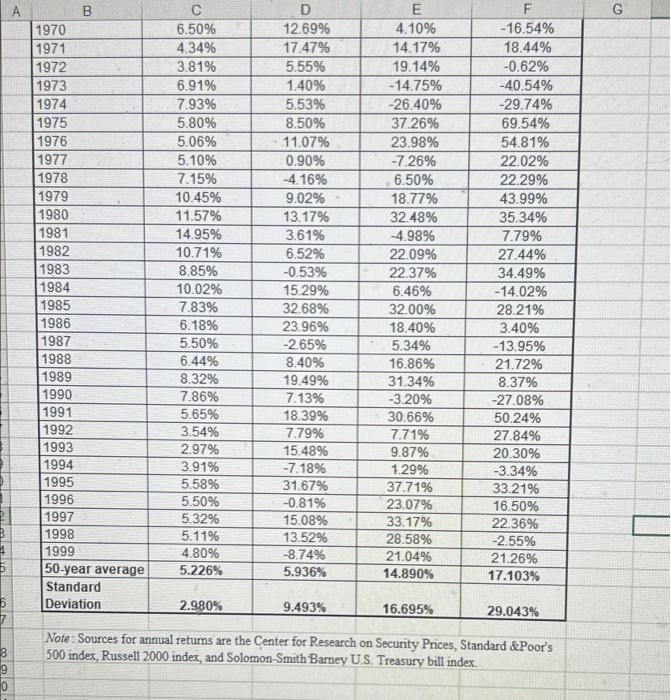

Variance and standard deviation. Calculate the variance and the standard deviation of US Treasury bills long term government bonds, and small company stocks for 1950 to 1959 1960 to 1969 1970 to 1979 and 1980 to 1989 from Table 81 Which had the highest variance? Which had the lowest variance? Click on the Spreadshoot Learning Aid to see Table 8.1-Year-by-Year Returns, 1950-1999 Hint Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instructions, phrases in parenthesis after each answer box only apply for the answers you will type What is the variance of US Treasury bills for 1980 to 1984? The varianco of US Treasury bills for 1980 to 1989 s % (Round to live decimal places :) What is the standard deviation of US Treasury bills for 1980 to 10407 The standard deviation of US Treasury bills for 1980 to 1989 is % (Round to three decimal places) What is the variance of long term government bonds for 1980 to 19002 The variance of tong tot government bonds for 1980 to 1000 W (Round to five decimal places) What is the standard deviation of long term government bonds for 1080 10 10007 The standard deviation of long term government bonds for 1080 to 100913(Round to three decimal places) Calculate tho vanance of small company stocks for 1980 to 1980 The variance of small company stocks for 1900 to 1980 15 Round to hive decima puces Clear all Check answer The variance of small-company stocks for 1980 to 1989 is % (Round to five decimal places) Calculate the standard deviation of small company stocks for 1980 to 1989 The standard deviation of small company stocks for 1980 to 1989 is % (Round to three decimal places) Table 8.1 Year-by-Year Returns, 1950-1999 Three Month Long-Term Large Company Small Company U.S.Treasury Government Stock: Stocks Year Bills Bonds 1950 1.20% -0.96% 32.68% 48.45% 1951 1.49% -1.95% 23.47% 9.41% 1952 1.66% 1.93% 18.91% 6.36% 1953 1.82% 3.83% -1.74% -5.66% 1954 0.86% 4.88% 52.55% 65.13% 1955 1.57% -1.34% 31.44% 21.84% 1956 2.46% -5.12% 6.45% 3.82% 1957 3.14% 9.46% -11.14% -15.03% 1958 1.54% -3.71% 43.78% 70.63% 1959 2.95% -3.55% 12.95% 17.82% 1960 2.66% 13.78% 0.19% -5.16% 1961 2.13% 0.19% 27.63% 30.48% 1962 2.72% 6.81% -8.79% -16.41% 1963 3.12% -0.49% 22.63% 12.20% 1964 3.54% 4.51% 16.67% 18.75% 1965 3.94% -0.27% 12.50% 37.67% 1966 4.77% 3.70% -10.25% -8.08% 1967 4.24% -7.41% 24.11% 103.39% 1968 5.24% -1.20% 11.00% 50.61% 1969 6.59% -6.52% -8.3396 -32.27% 1970 6.50% 12.69% 4.10% -16.54% 1971 4.34% 17.47% 14.17% 18.44% 1972 3.81% 5.55% 19.14% -0.62% 1973 6.91% 1.40% - 14.75% -40.54% 1974 7.93% 5.53% -26.40% -29.74% 1975 5.80% 8.50% 37.26% 69.54% 1976 5.06% 11.07% 23.98% 54.81% 1977 5. 70% 0.90% -7 26% 22.02% 1978 7.15% -4.16% 6.50% 22.29% 1979 10.45% 9.02% 18.77% 43.99% 1980 11.57% 13.17% 32.48% 35.34% 1981 14 95% 3.61% -4.98% 7.79% 1982 10.71% 6.52% 22.09% 27.44% 1983 8.85% -0.53% 22.37% 34.49% 1984 10.02% 15 29% 6.46% -14.02% 1985 7.83% 32.68% 32.00% 28.21% 1986 6.18% 23.96% 18.40% 3.40% 1987 550% -25% 5.3496 -12.95% Table 8.1 Year-by-Year Returns G B 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 50-year average Standard Deviation 6.50% 4.34% 3.81% 6.91% 7.93% 5.80% 5.06% 5.10% 7.15% 10.45% 11.57% 14.95% 10.71% 8.85% 10.02% 7.83% 6.18% 5.50% 6.44% 8.32% 7.86% 5.65% 3.54% 2.97% 3.91% 5.58% 5.50% 5.32% 5.11% 4.80% 5.226% D 12.69% 17.47% 5.55% 1.40% 5.53% 8.50% 11.07% 0.90% -4.16% 9.02% 13.17% 3.61% 6.52% -0.53% 15.29% 32.68% 23.96% -2.65% 8.40% 19.49% 7.13% 18.39% 7.79% 15.48% -7.18% 31.67% -0.81% 15.08% 13.52% -8.74% 5.936% E 4.10% 14.17% 19.14% - 14.75% -26.40% 37 26% 23.98% -7.26% 6.50% 18.77% 32.48% -4.98% 22.09% 22.37% 6.46% 32.00% 18.40% 5.34% 16.86% 31.34% -3.20% 30.66% 7.71% 9.87% 1.29% 37.71% 23.07% 33.17% 28.58% 21.04% 14.890% F -16.54% 18.44% -0.62% -40.54% -29.74% 69.54% 54.81% 22.02% 22.29% 43.99% 35.34% 7.79% 27.44% 34.49% -14.02% 28.21% 3.40% -13.95% 21.72% 8.37% -27.08% 50.24% 27.84% 20.30% -3.34% 33.21% 16.50% 22.36% -2.55% 21.26% 17.103% B 6 6 7 2.980% 9.493% 16.695% 29.043% Note: Sources for annual returns are the Center for Research on Security Prices, Standard & Poor's 500 index, Russell 2000 index, and Solomon-Smith Barney U.S. Treasury bill index 3 9 0