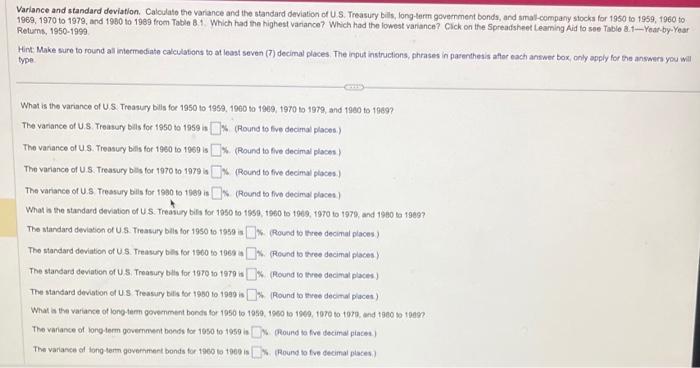

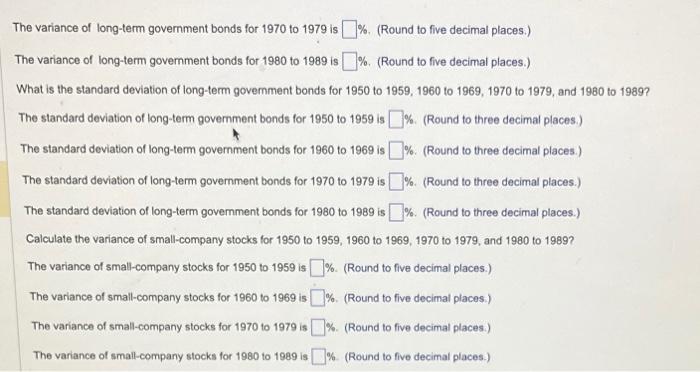

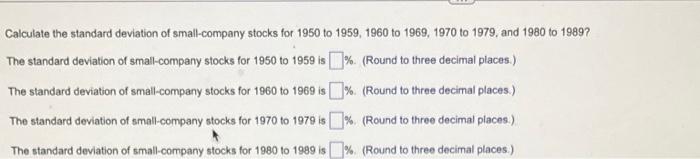

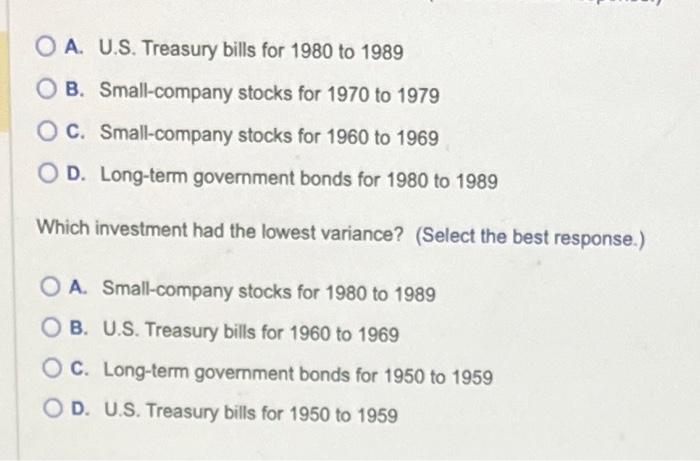

Variance and standard deviation. Calculato the variance and the standard deviation of U S. Treasury bills, long-term goverrment bonds, and smat-company stocks for 1950 to 1959,1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table B.1. Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Leaming Aid to soe Table a. - Year-by-Year Returns, 1950-1999 Hint Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instruclions, phrases in parenthesis affor each answer box, only apply for the answers you will type. What is the variance of US. Treasury bils foe 1950 to 1959,1900 to 1969 , t970 to 1979 , and 1960 to 1969? The variance of U.S. Treasury bals for 1950 to 1959 is (Round to fre decimal places) The variance of U.s. Treasucy bals for 1960 to 1969 is 5. (Round to five decimal placos) The variance of U.S. Treasury bills for 1970101979 is W. (Round to five decimal places.) The variance of U.S. Treasury bills for 1990 to 1969 is (Round to five decimal places) What is the standard deviation of US. Treanuy bils for 1050 to 1959,1960 to 1909,1970 to 1979 , and 1980 ta 1969? The standard deviation of U.S. Treasury bals for 1950 to 1959 is (4. (Round to three decimal places) The standard deviation of U.S. Treasey bils for 1960 to 1969 it S. (Round to tree decimal placesy The standard deviation of US. Treasury bils for 1970 io 1979 is \%. (Round to three decimal places) The standard deviation of US. Treasury bilis for 1900 to 1999 is is. (Round to evee decmal places) What i the variance of long-term government bonds for 1950 to 1059,1960 to 1909,1070 to torg, and t1000 so toes? The variance of long-term govemment bonss toe 1950 to 1959 is ( P Pound to five decimal piacet.) The variavee of longterm govemmert bonds for 1969 to 1009 is 6. (Round to fve decimal places) The variance of long-term government bonds for 1970 to 1979 is \%. (Round to five decimal places.) The variance of long-term govemment bonds for 1980 to 1989 is \%. (Round to five decimal places.) What is the standard deviation of long-term govemment bonds for 1950 to 1959,1960 to 1969,1970 to 1979 , and 1980 to 1989 ? The standard deviation of long-term govemment bonds for 1950 to 1959 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1960 to 1969 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1970 to 1979 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1980 to 1989 is \%. (Round to three decimal places.) Calculate the variance of small-company stocks for 1950 to 1959,1960 to 1969,1970 to 1979 , and 1980 to 1989? The variance of small-company stocks for 1950 to 1959 is \%. (Round to five decimal places.) The variance of small-company stocks for 1960 to 1969 is \% \%. (Round to five decimal places.) The variance of small-company stocks for 1970 to 1979 is \%. (Round to five decimal places.) The variance of small-company stocks for 1980 to 1989 is \% \%. (Round to five decimal places.) Calculate the standard deviation of small-company stocks for 1950 to 1959,1960 to 1969,1970 to 1979, and 1980 to 1989? The standard deviation of small-company stocks for 1950 to 1959 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1960 to 1969 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1970 to 1979 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1980 to 1989 is %. (Round to three decimal places.) A. U.S. Treasury bills for 1980 to 1989 B. Small-company stocks for 1970 to 1979 C. Small-company stocks for 1960 to 1969 D. Long-term government bonds for 1980 to 1989 Which investment had the lowest variance? (Select the best response.) A. Small-company stocks for 1980 to 1989 B. U.S. Treasury bills for 1960 to 1969 C. Long-term government bonds for 1950 to 1959 D. U.S. Treasury bills for 1950 to 1959 Variance and standard deviation. Calculato the variance and the standard deviation of U S. Treasury bills, long-term goverrment bonds, and smat-company stocks for 1950 to 1959,1960 to 1969, 1970 to 1979, and 1980 to 1989 from Table B.1. Which had the highest variance? Which had the lowest variance? Click on the Spreadsheet Leaming Aid to soe Table a. - Year-by-Year Returns, 1950-1999 Hint Make sure to round all intermediate calculations to at least seven (7) decimal places. The input instruclions, phrases in parenthesis affor each answer box, only apply for the answers you will type. What is the variance of US. Treasury bils foe 1950 to 1959,1900 to 1969 , t970 to 1979 , and 1960 to 1969? The variance of U.S. Treasury bals for 1950 to 1959 is (Round to fre decimal places) The variance of U.s. Treasucy bals for 1960 to 1969 is 5. (Round to five decimal placos) The variance of U.S. Treasury bills for 1970101979 is W. (Round to five decimal places.) The variance of U.S. Treasury bills for 1990 to 1969 is (Round to five decimal places) What is the standard deviation of US. Treanuy bils for 1050 to 1959,1960 to 1909,1970 to 1979 , and 1980 ta 1969? The standard deviation of U.S. Treasury bals for 1950 to 1959 is (4. (Round to three decimal places) The standard deviation of U.S. Treasey bils for 1960 to 1969 it S. (Round to tree decimal placesy The standard deviation of US. Treasury bils for 1970 io 1979 is \%. (Round to three decimal places) The standard deviation of US. Treasury bilis for 1900 to 1999 is is. (Round to evee decmal places) What i the variance of long-term government bonds for 1950 to 1059,1960 to 1909,1070 to torg, and t1000 so toes? The variance of long-term govemment bonss toe 1950 to 1959 is ( P Pound to five decimal piacet.) The variavee of longterm govemmert bonds for 1969 to 1009 is 6. (Round to fve decimal places) The variance of long-term government bonds for 1970 to 1979 is \%. (Round to five decimal places.) The variance of long-term govemment bonds for 1980 to 1989 is \%. (Round to five decimal places.) What is the standard deviation of long-term govemment bonds for 1950 to 1959,1960 to 1969,1970 to 1979 , and 1980 to 1989 ? The standard deviation of long-term govemment bonds for 1950 to 1959 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1960 to 1969 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1970 to 1979 is \%. (Round to three decimal places.) The standard deviation of long-term government bonds for 1980 to 1989 is \%. (Round to three decimal places.) Calculate the variance of small-company stocks for 1950 to 1959,1960 to 1969,1970 to 1979 , and 1980 to 1989? The variance of small-company stocks for 1950 to 1959 is \%. (Round to five decimal places.) The variance of small-company stocks for 1960 to 1969 is \% \%. (Round to five decimal places.) The variance of small-company stocks for 1970 to 1979 is \%. (Round to five decimal places.) The variance of small-company stocks for 1980 to 1989 is \% \%. (Round to five decimal places.) Calculate the standard deviation of small-company stocks for 1950 to 1959,1960 to 1969,1970 to 1979, and 1980 to 1989? The standard deviation of small-company stocks for 1950 to 1959 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1960 to 1969 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1970 to 1979 is %. (Round to three decimal places.) The standard deviation of small-company stocks for 1980 to 1989 is %. (Round to three decimal places.) A. U.S. Treasury bills for 1980 to 1989 B. Small-company stocks for 1970 to 1979 C. Small-company stocks for 1960 to 1969 D. Long-term government bonds for 1980 to 1989 Which investment had the lowest variance? (Select the best response.) A. Small-company stocks for 1980 to 1989 B. U.S. Treasury bills for 1960 to 1969 C. Long-term government bonds for 1950 to 1959 D. U.S. Treasury bills for 1950 to 1959