Question

Various stakeholders for different reasons have interests in the financial performance and financial position of a business. By making use of the data of the

Various stakeholders for different reasons have interests in the financial performance and financial position of a business.

By making use of the data of the above statements on the financial performance and position of the business, you are required the following.

Required:

1.1) The suppliers of goods and services on credit to a business are interested in the liquidity of it. They asked you to calculate two ratios to measure the liquidity and comment briefly on the changes over the year.

1.2) If purchases are 70% of Cost of Sales and 50% of all purchases are on credit, calculate how long the creditors had to wait in 2010 before their accounts were settled.

1.3) On the other hand the business is worried about potential bad debts and the financial manager needs to know how long it must wait before the debtors settle their accounts. Yu are required to calculate the debtor's collection period for the two years and comment on the change over the year. (Accept that all sales were on credit)

1.4) The owners are interested in the profitability of the business and request you to calculate two ratios whereby the profitability of the business could be measured in 2010

1.5) The management is interested how well the inventory was managed. In order to form an opinion about this aspect, yu are required to calculate the inventory turnover ratio for 2010.

1.6 Learning Outcome: To understand practically the concept of (CAPM)

An investor wants to add shares in Starbucks Ltd to her portfolio. Starbucks has beta of 0.5, the risk free rate is 7%, and the return on the market is 12%. Establish the expected return on Starbucks Ltd and comment.

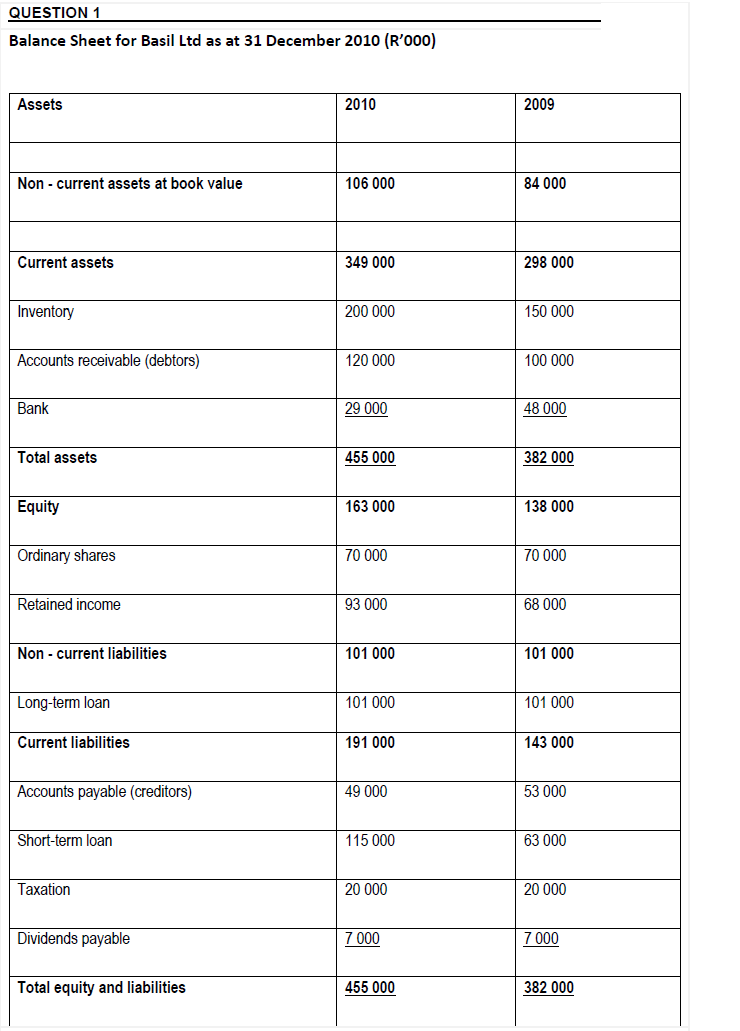

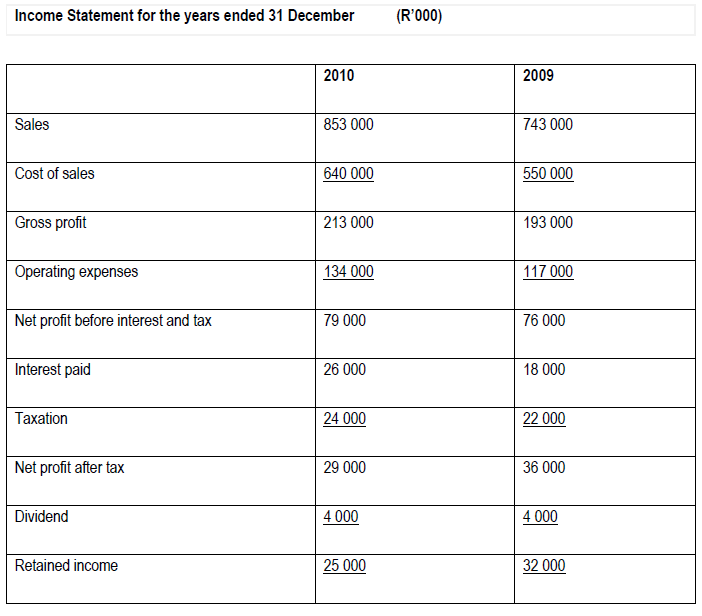

QUESTION 1 Balance Sheet for Basil Ltd as at 31 December 2010 (R'000) Assets 2010 2009 Non - current assets at book value 106 000 84 000 Current assets 349 000 298 000 Inventory 200 000 150 000 Accounts receivable (debtors) 120 000 100 000 Bank 29 000 48 000 Total assets 455 000 382 000 Equity 163 000 138 000 Ordinary shares 70 000 70 000 Retained income 93 000 68 000 Non-current liabilities 101 000 101 000 Long-term loan 101 000 101 000 Current liabilities 191 000 143 000 Accounts payable (creditors) 49 000 53 000 Short-term loan 115 000 63 000 Taxation 20 000 20 000 Dividends payable 7 000 7 000 Total equity and liabilities 455 000 382 000 Income Statement for the years ended 31 December (R000) 2010 2009 Sales 853 000 743 000 Cost of sales 640 000 550 000 Gross profit 213 000 193 000 Operating expenses 134 000 117 000 Net profit before interest and tax 79 000 76 000 Interest paid 26 000 18 000 Taxation 24 000 22 000 Net profit after tax 29 000 36 000 Dividend 4 000 4 000 Retained income 25 000 32 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started