Answered step by step

Verified Expert Solution

Question

1 Approved Answer

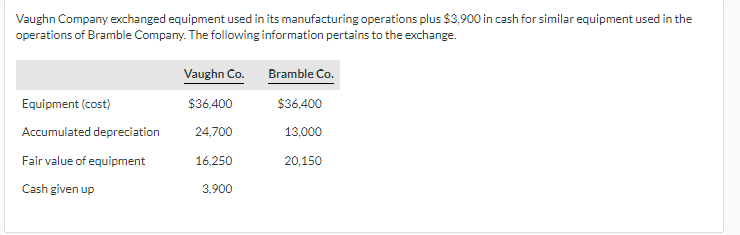

Vaughn Company exchanged equipment used in its manufacturing operations plus $3,900 in cash for similar equipment used in the operations of Bramble Company. The

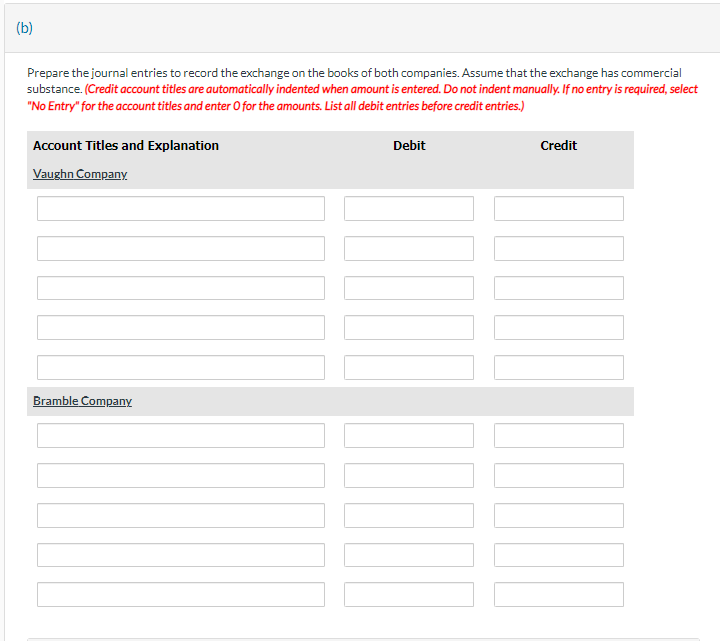

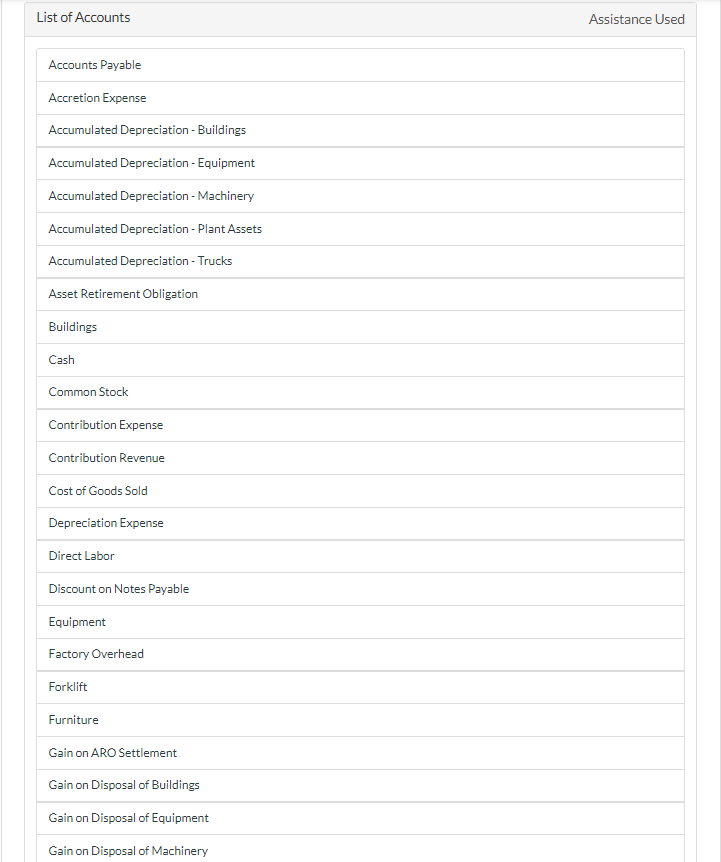

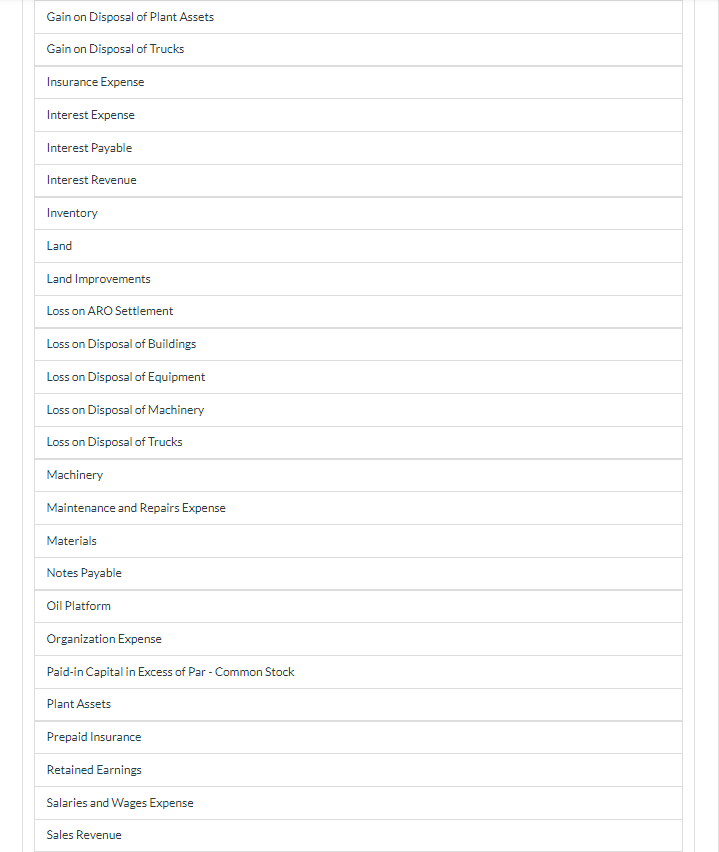

Vaughn Company exchanged equipment used in its manufacturing operations plus $3,900 in cash for similar equipment used in the operations of Bramble Company. The following information pertains to the exchange. Vaughn Co. Bramble Co. Equipment (cost) $36,400 $36,400 Accumulated depreciation 24,700 13,000 Fair value of equipment 16,250 20,150 Cash given up 3,900 (b) Prepare the journal entries to record the exchange on the books of both companies. Assume that the exchange has commercial substance. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation Vaughn Company Debit Credit Bramble Company List of Accounts Accounts Payable Accretion Expense Accumulated Depreciation - Buildings Accumulated Depreciation - Equipment Accumulated Depreciation - Machinery Accumulated Depreciation - Plant Assets Accumulated Depreciation - Trucks Asset Retirement Obligation Buildings Cash Common Stock Contribution Expense Contribution Revenue Cost of Goods Sold Depreciation Expense Direct Labor Discount on Notes Payable Equipment Factory Overhead Forklift Furniture Gain on ARO Settlement Gain on Disposal of Buildings Gain on Disposal of Equipment Gain on Disposal of Machinery Assistance Used Gain on Disposal of Plant Assets Gain on Disposal of Trucks Insurance Expense Interest Expense Interest Payable Interest Revenue Inventory Land Land Improvements Loss on ARO Settlement Loss on Disposal of Buildings Loss on Disposal of Equipment Loss on Disposal of Machinery Loss on Disposal of Trucks Machinery Maintenance and Repairs Expense Materials Notes Payable Oil Platform Organization Expense Paid-in Capital in Excess of Par - Common Stock Plant Assets Prepaid Insurance Retained Earnings Salaries and Wages Expense Sales Revenue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started