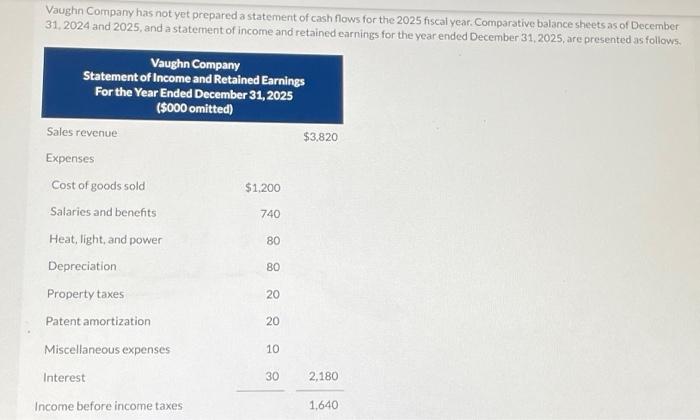

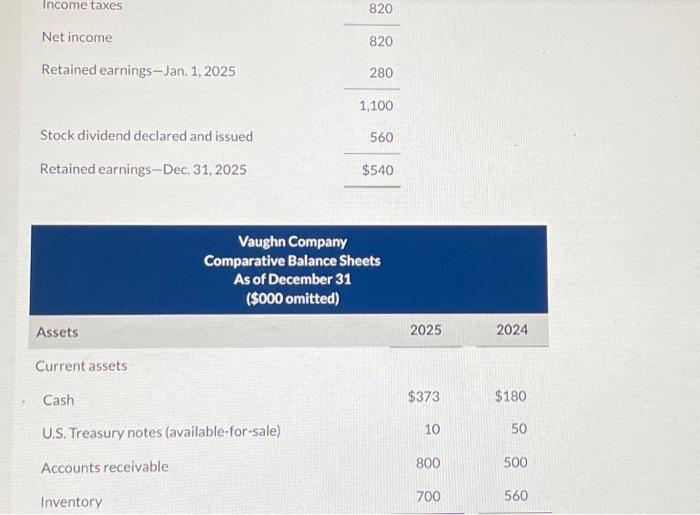

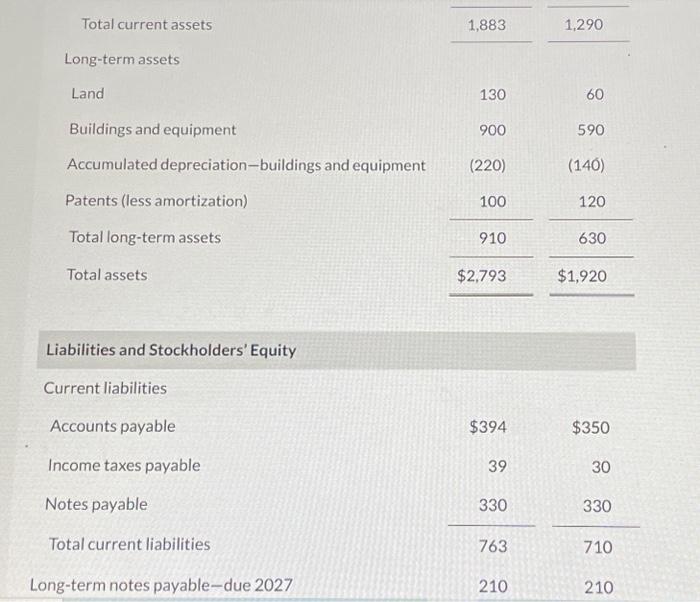

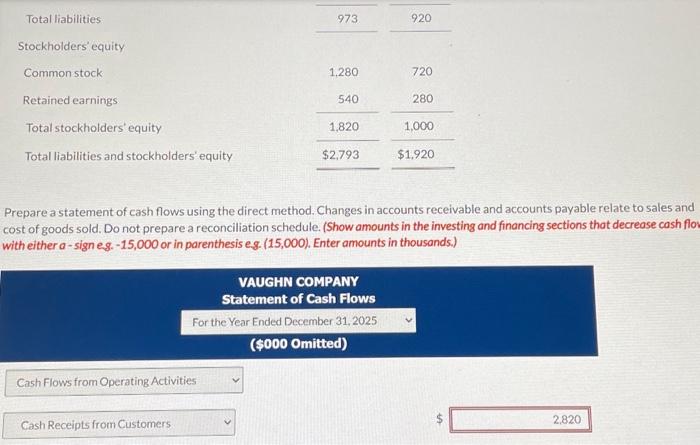

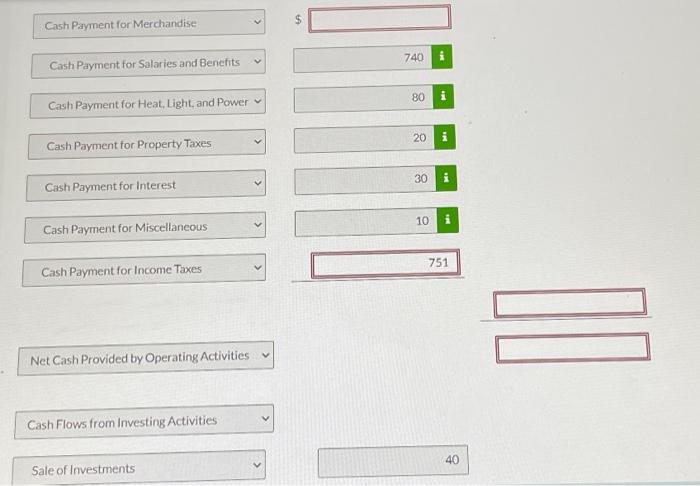

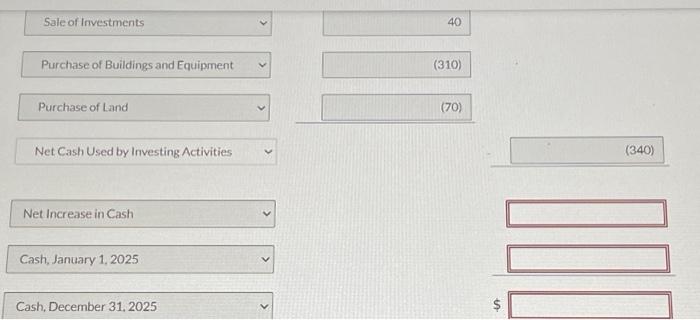

Vaughn Company has not yet prepared a statement of cash flows for the 2025 fiscal year. Comparative balance sheets as of December 31, 2024 and 2025, and a statement of income and retained earnings for the year ended December 31,2025, are presented as follow5. \begin{tabular}{lr} Net income & 820 \\ \hline Retained earnings-Jan. 1,2025 & 820 \\ & 280 \\ \hline Stock dividend declared and issued & 1,100 \\ Retained earnings-Dec. 31,2025 & 560 \\ \hline \end{tabular} \begin{tabular}{|lrr|} \hline & \begin{tabular}{c} Vaughn Company \\ Comparative Balance Sheets \\ As of December 31 \\ (\$000 omitted) \end{tabular} & \\ \hline Assets & 2025 & 2024 \\ \hline Current assets & $373 & $180 \\ Cash & 10 & 50 \\ U.S. Treasury notes (available-for-sale) & 800 & 500 \\ Accounts receivable & 700 & 560 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline Total current assets & 1,883 & 1,290 \\ \hline \multicolumn{3}{|l|}{ Long-term assets } \\ \hline Land & 130 & 60 \\ \hline Buildings and equipment & 900 & 590 \\ \hline Accumulated depreciation-buildings and equipment & (220) & (140) \\ \hline Patents (less amortization) & 100 & 120 \\ \hline Total long-term assets & 910 & 630 \\ \hline Total assets & $2,793 & $1,920 \\ \hline \multicolumn{3}{|l|}{ Liabilities and Stockholders' Equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities } \\ \hline Accounts payable & $394 & $350 \\ \hline Income taxes payable & 39 & 30 \\ \hline Notes payable & 330 & 330 \\ \hline Total current liabilities & 763 & 710 \\ \hline Long-term notes payable-due 2027 & 210 & 210 \\ \hline \end{tabular} Prepare a statement of cash flows using the direct method. Changes in accounts receivable and accounts payable relate to sales and cost of goods sold. Do not prepare a reconciliation schedule. (Show amounts in the investing and financing sections that decrease cash fi vith either a-sign es. - 15,000 or in parenthesis eg. (15,000). Enter amounts in thousands.) Cash Payment for Merchandise $ Cash Payment for Salaries and Bencfits \begin{tabular}{|l|l|} \hline 740 & i \\ \hline \end{tabular} Cash Payment for Heat, Light, and Power \begin{tabular}{|l|l|} \hline 80 & i \\ \hline \end{tabular} Cash Payment for Property Taxes \begin{tabular}{|l|l|} \hline 20 & i \\ \hline \end{tabular} Cash Payment for Interest \begin{tabular}{|l|l|} \hline 30 & i \\ \hline \end{tabular} Cash Payment for Miscellaneous 10 Cash Payment for Income Taxes 751 Net Cash Provided by Operating Activities \begin{tabular}{|r|r|} \hline 10 & i \\ \hline \\ \hline \end{tabular} Cash Flows from Investing Activities Sale of Investments 40 Sale of Investments Purchase of Buildings and Equipment Purchase of Land Net Cash Used by Investing Activities Net Increase in Cash Cash, January 1, 2025 Cash, December 31, 2025