Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vaughn Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2025. The

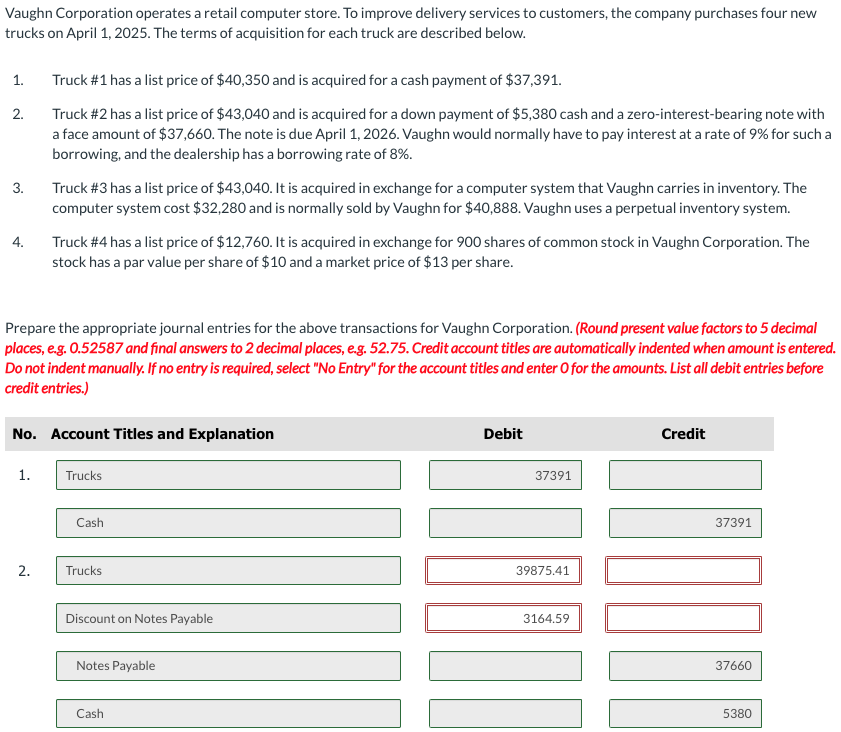

Vaughn Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2025. The terms of acquisition for each truck are described below. 1. Truck # 1 has a list price of $40,350 and is acquired for a cash payment of $37,391. 2. 3. 4. Truck #2 has a list price of $43,040 and is acquired for a down payment of $5,380 cash and a zero-interest-bearing note with a face amount of $37,660. The note is due April 1, 2026. Vaughn would normally have to pay interest at a rate of 9% for such a borrowing, and the dealership has a borrowing rate of 8%. Truck # 3 has a list price of $43,040. It is acquired in exchange for a computer system that Vaughn carries in inventory. The computer system cost $32,280 and is normally sold by Vaughn for $40,888. Vaughn uses a perpetual inventory system. Truck # 4 has a list price of $12,760. It is acquired in exchange for 900 shares of common stock in Vaughn Corporation. The stock has a par value per share of $10 and a market price of $13 per share. Prepare the appropriate journal entries for the above transactions for Vaughn Corporation. (Round present value factors to 5 decimal places, e.g. 0.52587 and final answers to 2 decimal places, e.g. 52.75. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. Trucks Cash 2. Trucks Debit 37391 39875.41 Discount on Notes Payable 3164.59 Notes Payable Cash Credit 37391 37660 5380

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer No Account Titles and Explanation Debit Credit 1 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started