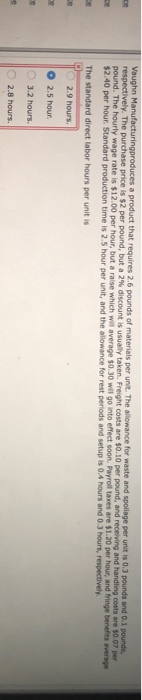

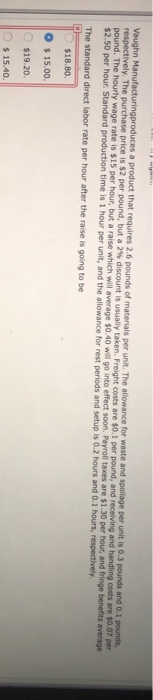

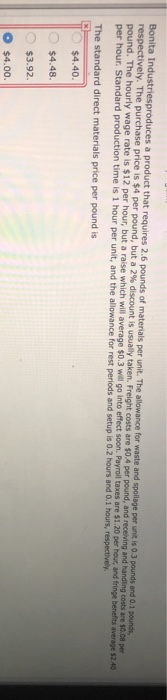

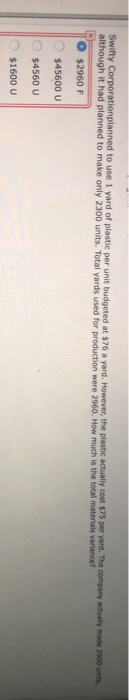

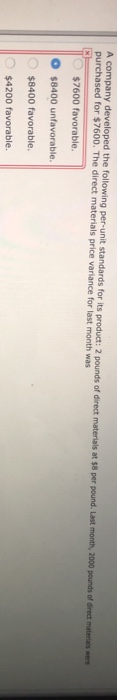

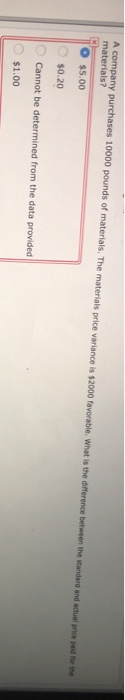

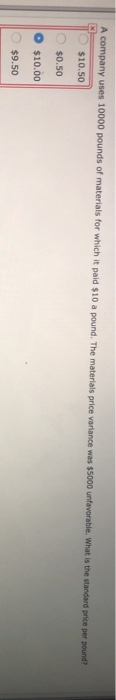

Vaughn Manufacturingproduces a product that requires 2.6 pounds of materials per unit. The allowance for waste and spoilage per unit is 0.3 pounds and 0.1 pounds, respectively. The purchase price is $2 per pound, but a 2% discount is usually taken. Freight costs are $0.10 per pound, and receiving and handling costs are $0.07 per pound. The hourly wage rate is $12.00 per hour, but a raise which will average $0.30 will go into effect soon. Payroll taxes are $1.20 per hour, and fringe benefits average $2.40 per hour. Standard production time is 2.5 hour per unit, and the allowance for rest periods and setup is 0.4 hours and 0.3 hours, respectively. ce ce The standard direct labor hours per unit is ce 2.9 hours e 2.5 hour 3.2 hours 2.8 hours. Vaughn Manufacturingproduces a product that requires 2.6 pounds of materials per unit. The allowance for waste and spoilage per unit is 0.3 pounds and 0.1 pounds, respectively. The purchase price is $2 per pound, but a 2% discount is usually taken. Freight costs are $0.1 per pound, and receiving and handling costs are $0.07 per pound. The hourly wage rate is $15 per hour, but a raise which will average $0.40 will go into effect soon. Payroll taxes are $1.30 per hour, and fringe benefits average $2.50 per hour. Standard production time is 1 hour per unit, and the allowance for rest periods and setup is 0.2 hours and 0.1 hours, respectively The standard direct labor rate per hour after the raise is going to be $18.80 $15.00. $19.20 $15.40 Bonita Industriesproduces a product that requires 2.6 pounds of materials per unit. The allowance for waste and spollage per unit is 0.3 pounds and 0.1 pounds, respectively. The purchase price is $4 per pound, but a 2% discount is usually taken, Freight costs are $0.4 per pound, and receiving and handling costs are $0.08 per pound. The hourly wage rate is $12 per hour, but a raise which will average $0.3 will go into effect soon. Payroll taxes are $1.20 per hour, and fringe benefits average $2.40 per hour. Standard production time is 1 hour per unit, and the allowance for rest periods and setup is 0.2 hours and 0.1 hours, respectively. The standard direct materials price per pound is $4.40. $4.48. $3.92 $4.00. Swifty Corporationplanned to use 1 yard of plastic per unit budgeted at $76 a yard. However, the plastic actually cost $75 per yard. The company actually made 2900 units, although it had planned to make only 2300 units. Total yards used for production were 2960. How much is the total materials variance? O $2960 F $45600 U $4560 U $1600 U A company developed the following per-unit standards for its product: 2 pounds of direct materials at $8 per pound. Last month, 2000 pounds of direct materials were purchased for $7600. The direct materials price variance for last month was $7600 favorable. $8400 unfavorable. $8400 favorable. $4200 favorable. A company materials? purchases 10000 pounds of materials. The materials price variance is $2000 favorable. What is the difference between the standerd and actual price paid for the $5.00 $0.20 Cannot be determined from the data provided $1.00 A company uses 10000 pounds of materials for which it paid $10 a pound. The materials price variance was $5000 unfavorable. What is the standard price per pound?" $10.50 $0.50 $10.00 $9.50