Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vaughn treats its divisions as profit centers and allows division managers to choose whether to sell or to buy from internal division. Corporate policy

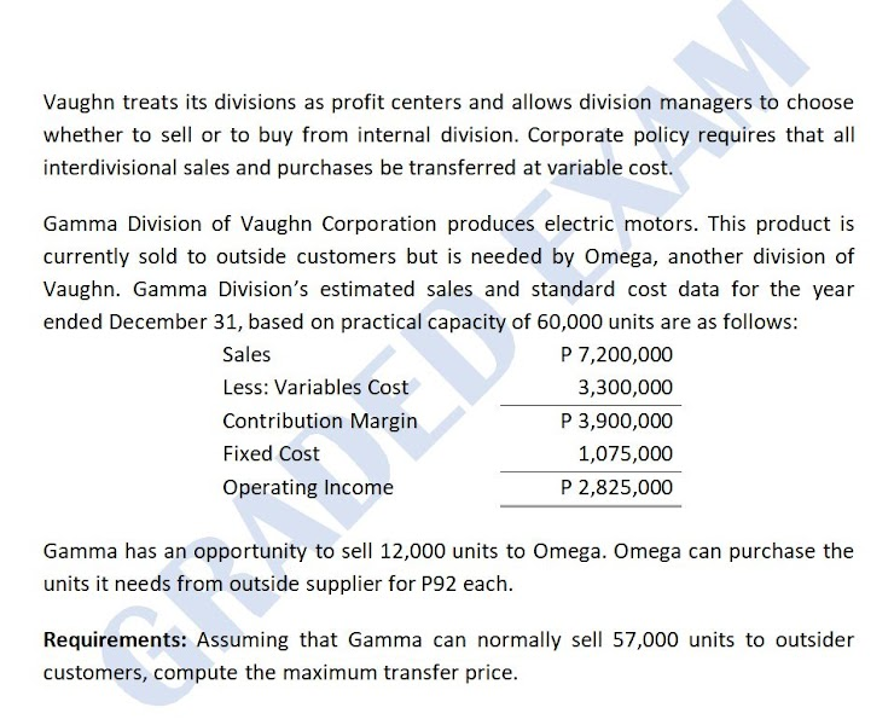

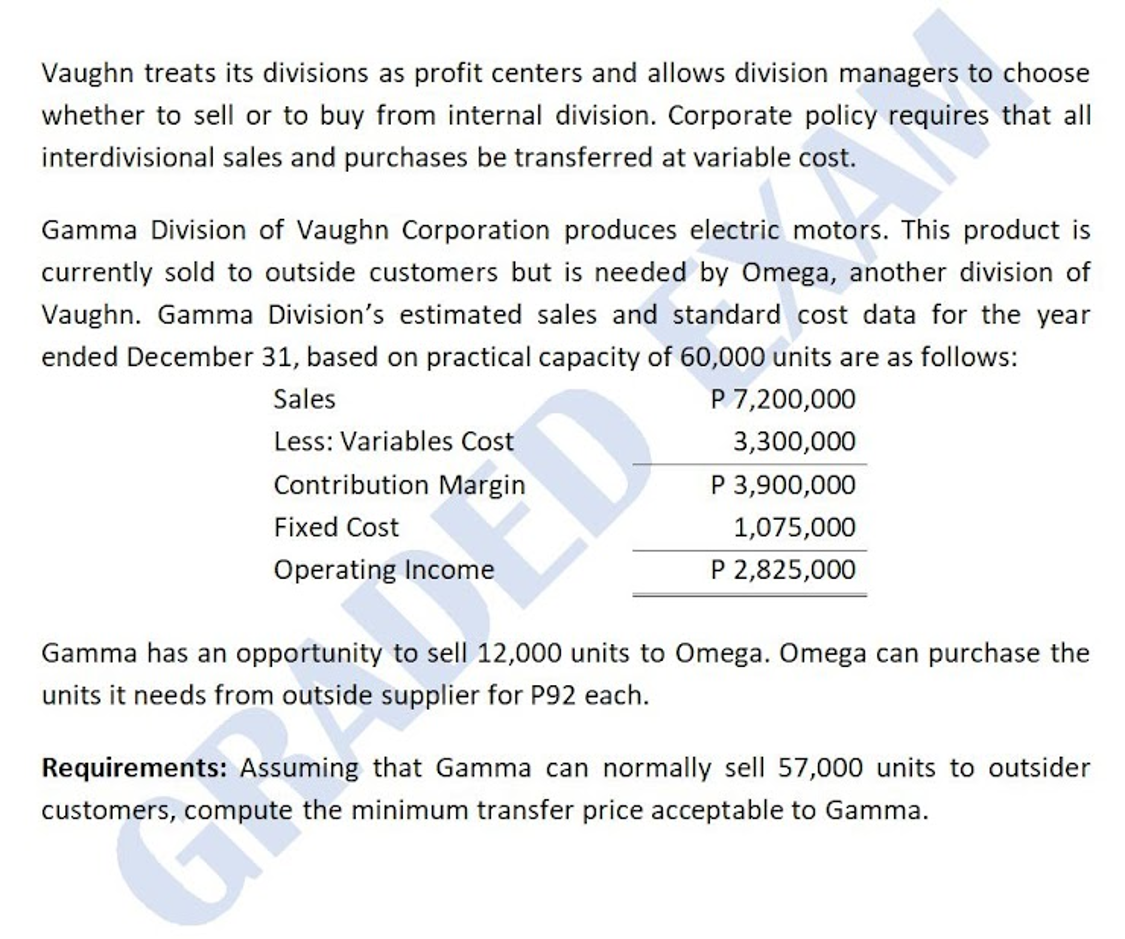

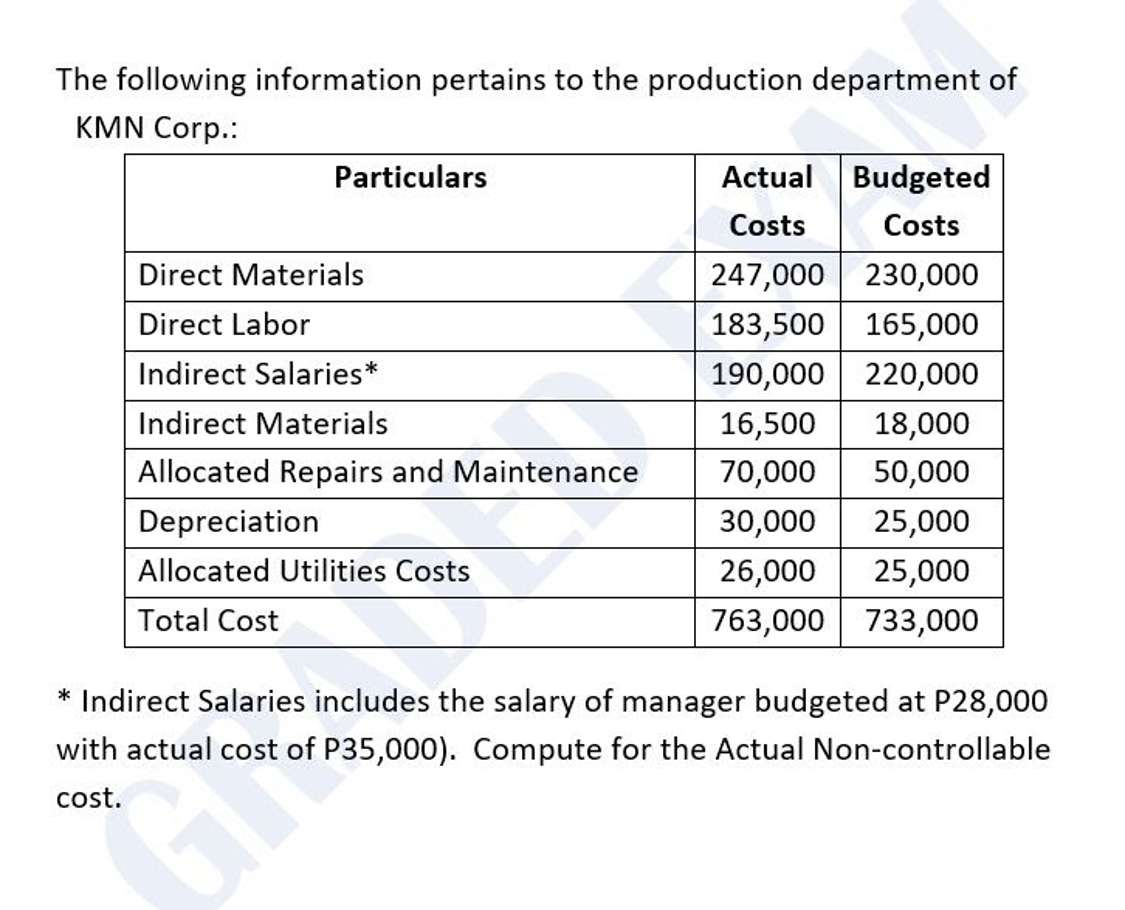

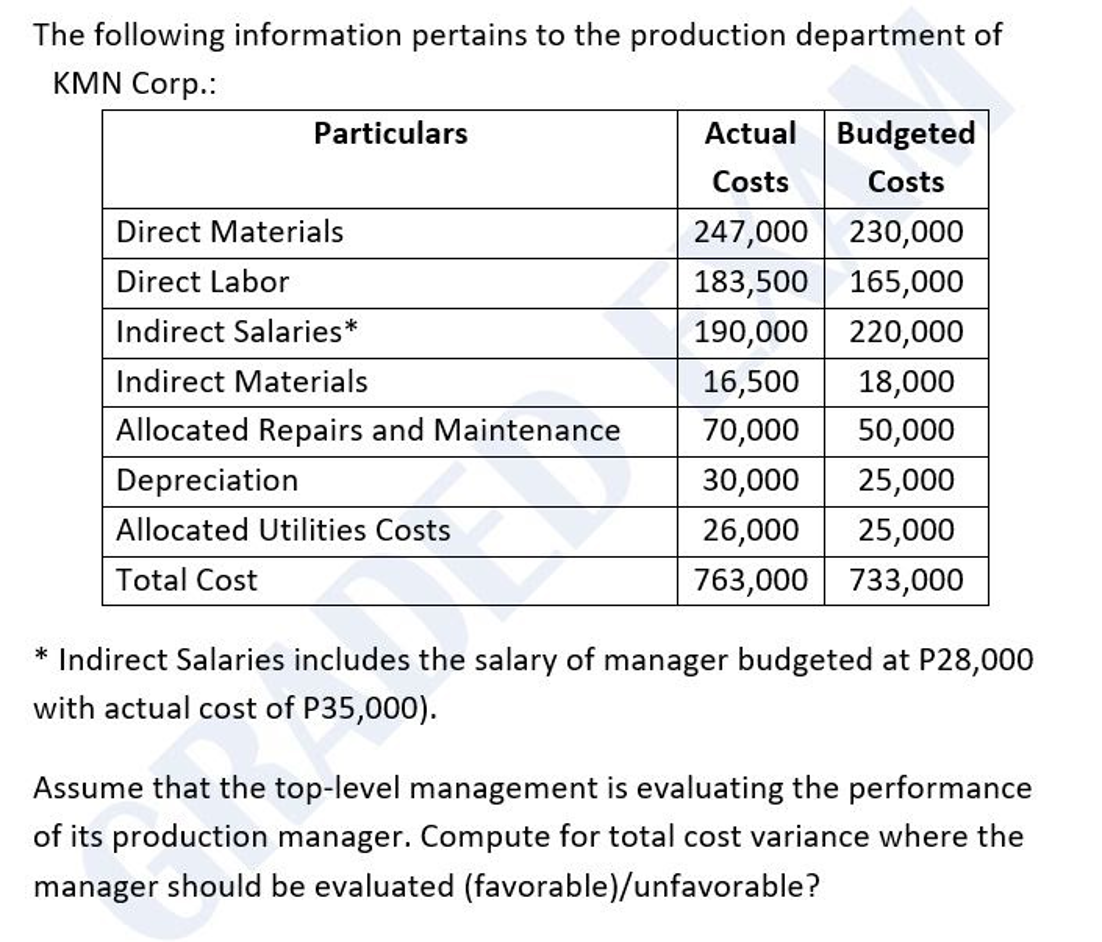

Vaughn treats its divisions as profit centers and allows division managers to choose whether to sell or to buy from internal division. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division of Vaughn Corporation produces electric motors. This product is currently sold to outside customers but is needed by Omega, another division of Vaughn. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on practical capacity of 60,000 units are as follows: Sales Less: Variables Cost Contribution Margin Fixed Cost Operating Income P 7,200,000 3,300,000 P 3,900,000 1,075,000 P 2,825,000 Gamma has an opportunity to sell 12,000 units to Omega. Omega can purchase the units it needs from outside supplier for P92 each. Requirements: Assuming that Gamma can normally sell 57,000 units to outsider customers, compute the maximum transfer price. Vaughn treats its divisions as profit centers and allows division managers to choose whether to sell or to buy from internal division. Corporate policy requires that all interdivisional sales and purchases be transferred at variable cost. Gamma Division of Vaughn Corporation produces electric motors. This product is currently sold to outside customers but is needed by Omega, another division of Vaughn. Gamma Division's estimated sales and standard cost data for the year ended December 31, based on practical capacity of 60,000 units are as follows: Sales Less: Variables Cost D Contribution Margin Fixed Cost Operating Income P 7,200,000 3,300,000 P 3,900,000 1,075,000 P 2,825,000 Gamma has an opportunity to sell 12,000 units to Omega. Omega can purchase the units it needs from outside supplier for P92 each. Requirements: Assuming that Gamma can normally sell 57,000 units to outsider customers, compute the minimum transfer price acceptable to Gamma. The following information pertains to the production department of KMN Corp.: Particulars Actual Budgeted Costs Costs Direct Materials 247,000 230,000 Direct Labor 183,500 165,000 Indirect Salaries* 190,000 220,000 Indirect Materials 16,500 18,000 Allocated Repairs and Maintenance 70,000 50,000 Depreciation Allocated Utilities Costs 30,000 25,000 26,000 25,000 Total Cost 763,000 733,000 * Indirect Salaries includes the salary of manager budgeted at P28,000 with actual cost of P35,000). Compute for the Actual Non-controllable cost. KMN Corp.: Particulars Direct Materials Direct Labor Allocated Repairs and Maintenance The following information pertains to the production department of Indirect Salaries* Indirect Materials ment Actual Budgeted Costs Costs 247,000 230,000 183,500 165,000 190,000 220,000 16,500 18,000 70,000 50,000 Depreciation Allocated Utilities Costs Total Cost *Indirect Salaries includes the salary of manager budgeted at P28,000 with actual cost of P35,000). Assume that the top-level management is evaluating the performance of its production manager. Compute for total cost variance where the manager should be evaluated (favorable)/unfavorable? 30,000 25,000 26,000 25,000 763,000 733,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started