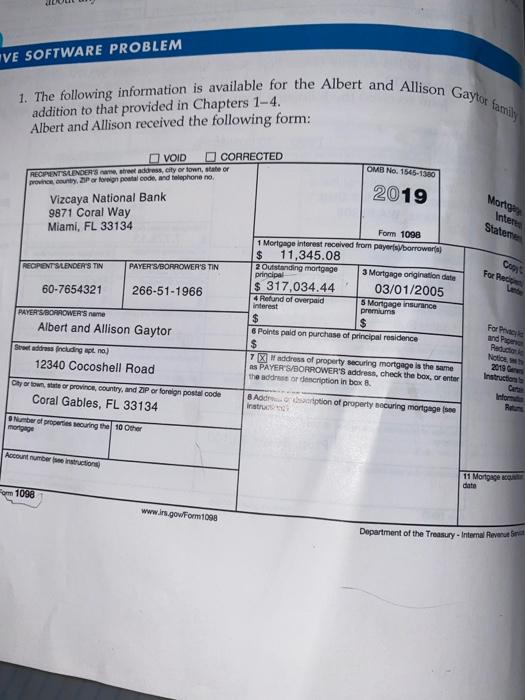

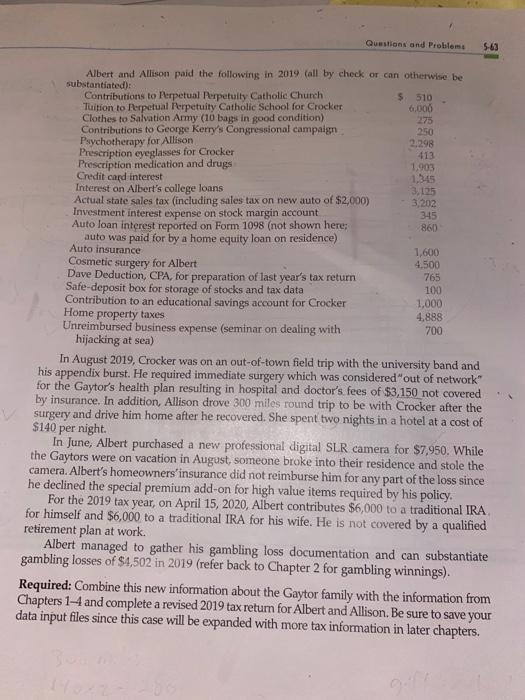

VE SOFTWARE PROBLEM 1. The following information is available for the Albert and Allison Gayton family addition to that provided in Chapters 1-4. Albert and Allison received the following form: OM NO. 1545-1380 VOID CORRECTED RECENT SLENDERS, street adress, city or town, state or provide country or foreign postal code and telephone ne Vizcaya National Bank 9871 Coral Way Miami, FL 33134 2019 Mortga Stateme REOPENT SLENDER'S TIN PAYER'S BORROWER'S TIN For Bed 60-7654321 266-51-1966 Form 1098 1 Mortgage Interest received from payers borrowers $ 11,345.08 2 Outstanding mortgage 3 Mortgage origination date principal $ 317,034.44 03/01/2005 4 Refund of verpaid s Mortgage Insurance interest premiums $ $ & Points paid on purchase of principal residence $ 7 X address of property securing mortgage is the same as PAYER S/BORROWER'S address, check the bax, or enter the address or description in box PAYERS/BORROWER'S name Albert and Allison Gaytor For Page and Piger Redactie Se address including at.no) 12340 Cocoshell Road 2019 Instruction Oy or own state or province, country, and ZIP or foreign postal code Coral Gables, FL 33134 8 Addettion of property securing mortgages Wor Number of properties oring the 10 Omer mortgage Account number instructions 11 Mortgages data Form 1098 www.in.gowForm1098 Department of the Treasury - Internal Revenue Siria Questions and Problems 5-63 Albert and Allison paid the following in 2019 Call by check or can otherwise be substantiated): Contributions to Perpetual Perpetulty Catholic Church $ 510 Tuition to Perpetual Perpetuity Catholic School for Crocker 6.000 Clothes to Salvation Army (10 bags in good condition) Contributions to George Kerry's Congressional campaign 250 Psychotherapy for Allison 2.298 Prescription eyeglasses for Crocker 413 Prescription medication and drugs 1,903 Credit card interest 1,345 Interest on Albert's college loans 3,125 Actual state sales tax (including sales tax on new auto of $2,000) 3,212 Investment interest expense on stock margin account 345 Auto loan interest reported on Form 1098 (not shown here: auto was paid for by a home equity loan on residence) Auto insurance 1,600 Cosmetic surgery for Albert 4.500 Dave Deduction, CPA, for preparation of last year's tax return 765 Safe-deposit box for storage of stocks and tax data 100 Contribution to an educational savings account for Crocker 1,000 Home property taxes 4.888 Unreimbursed business expense (seminar on dealing with 700 hijacking at sea) In August 2019, Crocker was on an out-of-town field trip with the university band and his appendix burst. He required immediate surgery which was considered "out of network for the Gaytor's health plan resulting in hospital and doctor's fees of $3,150 not covered by insurance. In addition, Allison drove 300 miles round trip to be with Crocker after the surgery and drive him home after he recovered. She spent two nights in a hotel at a cost of $140 per night. In June, Albert purchased a new professional digital SLR camera for $7.950. While the Gaytors were on vacation in August, someone broke into their residence and stole the camera, Albert's homeowners'insurance did not reimburse him for any part of the loss since he declined the special premium add-on for high value items required by his policy. For the 2019 tax year, on April 15, 2020, Albert contributes $6,000 to a traditional IRA for himself and $6,000 to a traditional IRA for his wife. He is not covered by a qualified retirement plan at work. Albert managed to gather his gambling loss documentation and can substantiate gambling losses of $4,502 in 2019 (refer back to Chapter 2 for gambling winnings). Required: Combine this new information about the Gaytor family with the information from Chapters 1-4 and complete a revised 2019 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters. VE SOFTWARE PROBLEM 1. The following information is available for the Albert and Allison Gayton family addition to that provided in Chapters 1-4. Albert and Allison received the following form: OM NO. 1545-1380 VOID CORRECTED RECENT SLENDERS, street adress, city or town, state or provide country or foreign postal code and telephone ne Vizcaya National Bank 9871 Coral Way Miami, FL 33134 2019 Mortga Stateme REOPENT SLENDER'S TIN PAYER'S BORROWER'S TIN For Bed 60-7654321 266-51-1966 Form 1098 1 Mortgage Interest received from payers borrowers $ 11,345.08 2 Outstanding mortgage 3 Mortgage origination date principal $ 317,034.44 03/01/2005 4 Refund of verpaid s Mortgage Insurance interest premiums $ $ & Points paid on purchase of principal residence $ 7 X address of property securing mortgage is the same as PAYER S/BORROWER'S address, check the bax, or enter the address or description in box PAYERS/BORROWER'S name Albert and Allison Gaytor For Page and Piger Redactie Se address including at.no) 12340 Cocoshell Road 2019 Instruction Oy or own state or province, country, and ZIP or foreign postal code Coral Gables, FL 33134 8 Addettion of property securing mortgages Wor Number of properties oring the 10 Omer mortgage Account number instructions 11 Mortgages data Form 1098 www.in.gowForm1098 Department of the Treasury - Internal Revenue Siria Questions and Problems 5-63 Albert and Allison paid the following in 2019 Call by check or can otherwise be substantiated): Contributions to Perpetual Perpetulty Catholic Church $ 510 Tuition to Perpetual Perpetuity Catholic School for Crocker 6.000 Clothes to Salvation Army (10 bags in good condition) Contributions to George Kerry's Congressional campaign 250 Psychotherapy for Allison 2.298 Prescription eyeglasses for Crocker 413 Prescription medication and drugs 1,903 Credit card interest 1,345 Interest on Albert's college loans 3,125 Actual state sales tax (including sales tax on new auto of $2,000) 3,212 Investment interest expense on stock margin account 345 Auto loan interest reported on Form 1098 (not shown here: auto was paid for by a home equity loan on residence) Auto insurance 1,600 Cosmetic surgery for Albert 4.500 Dave Deduction, CPA, for preparation of last year's tax return 765 Safe-deposit box for storage of stocks and tax data 100 Contribution to an educational savings account for Crocker 1,000 Home property taxes 4.888 Unreimbursed business expense (seminar on dealing with 700 hijacking at sea) In August 2019, Crocker was on an out-of-town field trip with the university band and his appendix burst. He required immediate surgery which was considered "out of network for the Gaytor's health plan resulting in hospital and doctor's fees of $3,150 not covered by insurance. In addition, Allison drove 300 miles round trip to be with Crocker after the surgery and drive him home after he recovered. She spent two nights in a hotel at a cost of $140 per night. In June, Albert purchased a new professional digital SLR camera for $7.950. While the Gaytors were on vacation in August, someone broke into their residence and stole the camera, Albert's homeowners'insurance did not reimburse him for any part of the loss since he declined the special premium add-on for high value items required by his policy. For the 2019 tax year, on April 15, 2020, Albert contributes $6,000 to a traditional IRA for himself and $6,000 to a traditional IRA for his wife. He is not covered by a qualified retirement plan at work. Albert managed to gather his gambling loss documentation and can substantiate gambling losses of $4,502 in 2019 (refer back to Chapter 2 for gambling winnings). Required: Combine this new information about the Gaytor family with the information from Chapters 1-4 and complete a revised 2019 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters