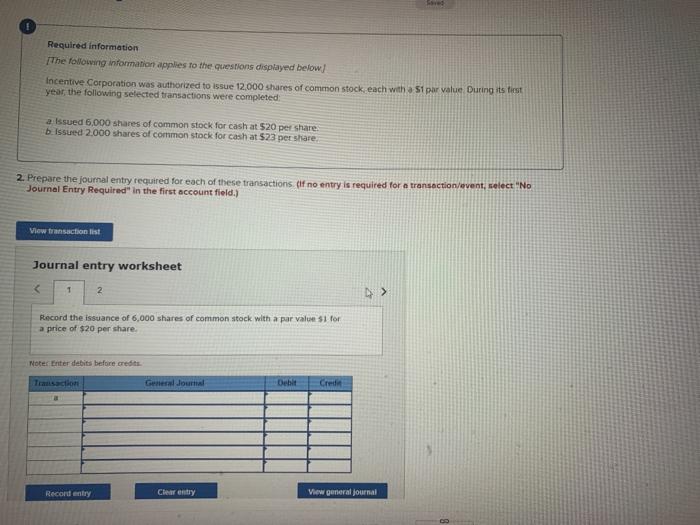

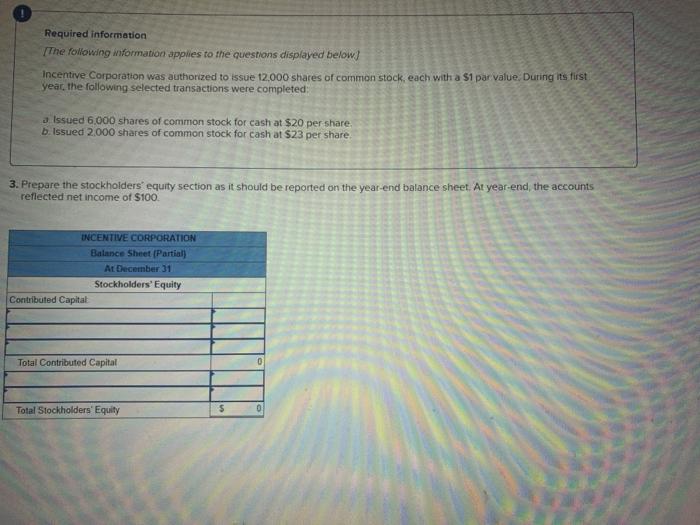

ved Required information The following information applies to the questions displayed below! Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a sipar value During its first year the following selected transactions were completed a Issued 6,000 shares of common stock for cash at 520 per share b Issued 2,000 shares of common stock for cash at 523 pet share. 2. Prepare the journal entry required for each of these transactions (if no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Record the issuance of 6,000 shares of common stock with a par value 1 for a price of $20 per share. Noter Enter debits before credits Transaction General Journal Debit Crede Record entry Clear entry View general journal Required information The following information applies to the questions displayed below! Incentive Corporation was authorized to issue 12.000 shares of common stock, each with a S1 par value. During its first year, the following selected transactions were completed: Issued 6.000 shares of common stock for cash at $20 per share b. Issued 2.000 shares of common stock for cash at $23 per share 3. Prepare the stockholders' equity section as it should be reported on the year-end balance sheet At year-end, the accounts reflected net income of $100. INCENTIVE CORPORATION Balance Sheet (Partial) At December 31 Stockholders' Equity Contributed Capital Total Contributed Capital 0 Total Stockholders' Equity $ 0 Required information The following information applies to the questions displayed below! Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a si par value. During its first year, the following selected transactions were completed a. Issued 6,000 shares of common stock for cash at $20 per share b. Issued 2,000 shares of common stock for cash at $23 per share. 4. Incentive Corporation has $30,000 in the company's bank account. At year-end, the accounts reflected a profit of $100. What is the maximum amount of cash dividends the company can declare and distribute um amount of the dividende