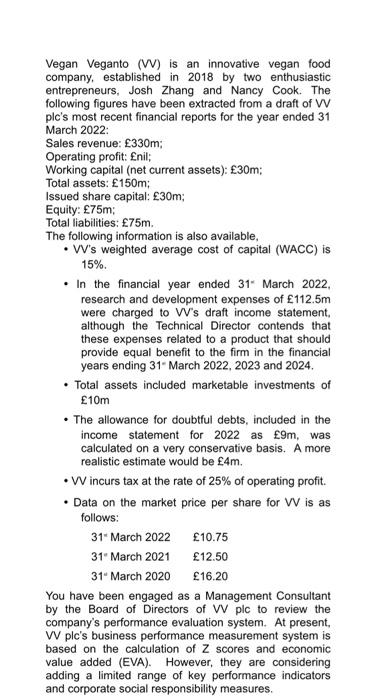

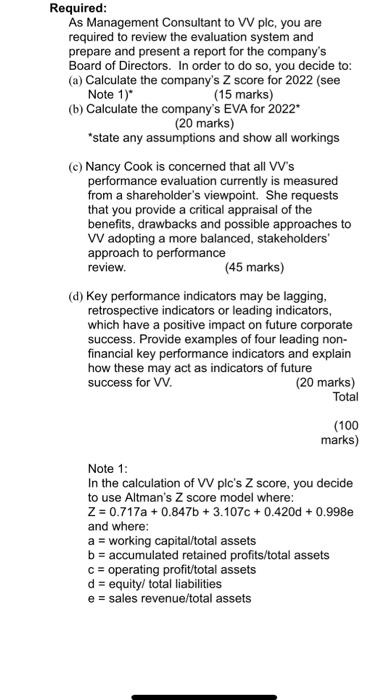

Vegan Veganto (W) is an innovative vegan food company, established in 2018 by two enthusiastic entrepreneurs, Josh Zhang and Nancy Cook. The following figures have been extracted from a draft of W plc's most recent financial reports for the year ended 31 March 2022 Sales revenue: 330m; Operating profit: Enil; Working capital (net current assets): 30m; Total assets: 150m; Issued share capital: 30m; Equity: 75m; Total liabilities: 75m. The following information is also available, W's weighted average cost of capital (WACC) is 15% . In the financial year ended 31 March 2022, research and development expenses of 112.5m were charged to W's draft income statement although the Technical Director contends that these expenses related to a product that should provide equal benefit to the firm in the financial years ending 31 March 2022 2023 and 2024. Total assets included marketable investments of 10m The allowance for doubtful debts, included in the income statement for 2022 as 9m, was calculated on a very conservative basis. A more realistic estimate would be 4m. Wincurs tax at the rate of 25% of operating profit. Data on the market price per share for W is as follows: 31- March 2022 10.75 31 March 2021 12.50 31 March 2020 16.20 You have been engaged as a Management Consultant by the Board of Directors of Wplc to review the company's performance evaluation system. At present, W ple's business performance measurement system is based on the calculation of Z scores and economic value added (EVA). However, they are considering adding a limited range of key performance indicators and corporate social responsibility measures. Required: As Management Consultant to Wplc, you are required to review the evaluation system and prepare and present a report for the company's Board of Directors. In order to do so, you decide to: (a) Calculate the company's Z score for 2022 (see Note 1) (15 marks) (b) Calculate the company's EVA for 2022* (20 marks) *state any assumptions and show all workings (c) Nancy Cook is concerned that all VV's performance evaluation currently is measured from a shareholder's viewpoint. She requests that you provide a critical appraisal of the benefits, drawbacks and possible approaches to W adopting a more balanced, stakeholders' approach to performance review. (45 marks) (d) Key performance indicators may be lagging, retrospective indicators or leading indicators, which have a positive impact on future corporate success. Provide examples of four leading non- financial key performance indicators and explain how these may act as indicators of future success for W. (20 marks) Total (100 marks) Note 1: In the calculation of W ple's Z score, you decide to use Altman's Z score model where: Z = 0.717a + 0.847b + 3.107c +0.420d + 0.998e and where: a = working capital/total assets b = accumulated retained profits/total assets c = operating profit/total assets d = equity/ total liabilities e = sales revenue/total assets