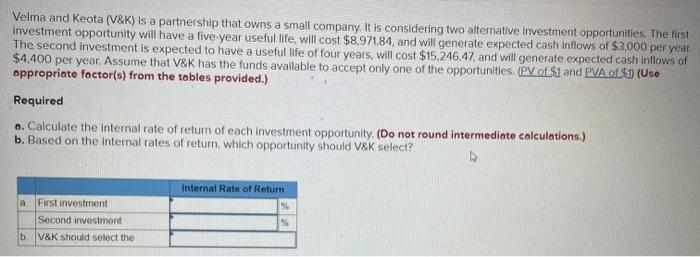

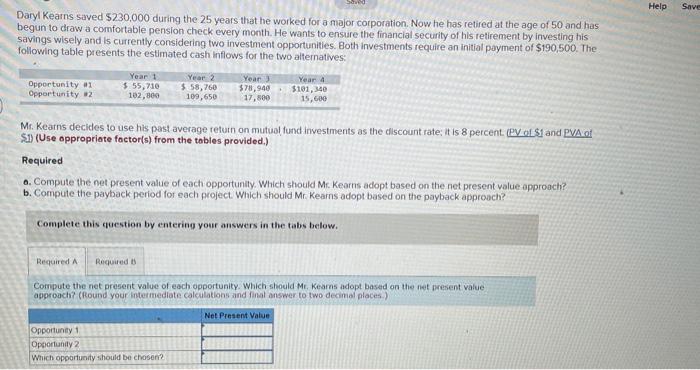

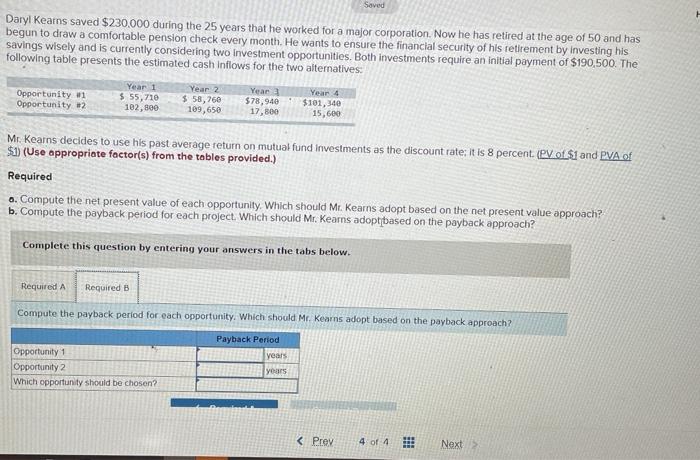

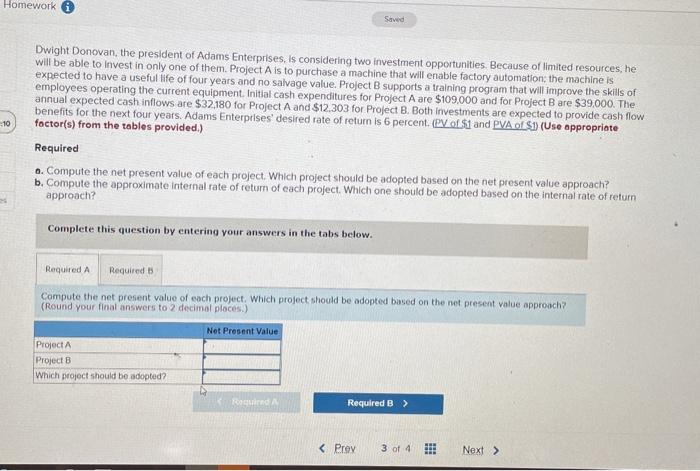

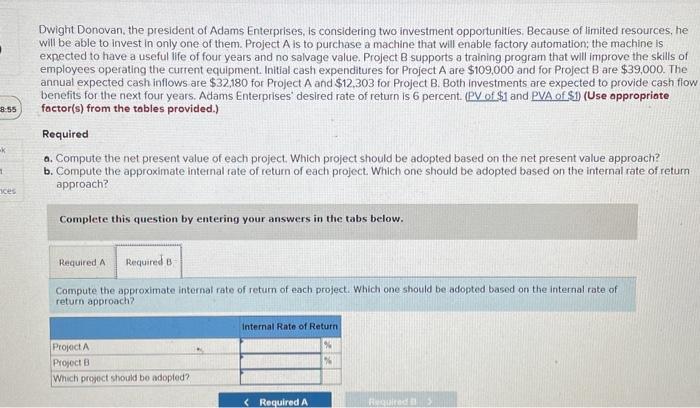

Velma and Keota (V&K) is a partnership that owns a small company. It is considering two alternative Investment opportunities. The first Investment opportunity will have a five-year useful life will cost $8.971.84, and will generate expected cash inflows of $3,000 per year. The second investment is expected to have a useful life of four years, will cost $15.246.47. and will generate expected cash inflows of $4,400 per year. Assume that V&K has the funds available to accept only one of the opportunities. (PV of $1 and PVA of $1 (Use appropriate factor(s) from the tables provided.) Required o. Calculate the internal rate of return of each investment opportunity. (Do not round intermediate calculations.) b. Based on the internal rates of return, which opportunity should V&K select? Internal Rate of Return a First investment Second investment V&K should select the % Help Save Daryl Kearns saved $230,000 during the 25 years that he worked for a major corporation. Now he has retired at the age of 50 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by investing his savings wisely and is currently considering two investment opportunities. Both investments require an initial payment of $190,500. The following table presents the estimated cash inflows for the two alternatives: Opportunity #1 Opportunity 2 Year 1 $ 55,710 102,800 Year 2 $ 58,760 100,650 Year) Year 4 $78,9405101,340 17,800 15,600 Mr. Kearns decides to use his past average return on mutual fund investments as the discount rate; it is 8 percent. (PV OLS1 and PVA of $.1) (Use appropriate factor(s) from the tables provided.) Required . Compute the net present value of each opportunity. Which should Me Kearns adopt based on the net present value approach? b. Compute the payback period for each project. Which should Mr Kearns adopt based on the payback approach? Complete this question by entering your answers in the tabs below. Required A Required Compute the net present value of each opportunity. Which should Me Kearns adopt based on the net present value approach? (Round your intermediate calculations and final answer to two decimal places) Net Present Value Opportunity 1 Opportunity 2 Which opportunity should be chosen? Saved Daryl Kearns saved $230,000 during the 25 years that he worked for a major corporation. Now he has retired at the age of 50 and has begun to draw a comfortable pension check every month. He wants to ensure the financial security of his retirement by investing his savings wisely and is currently considering two investment opportunities. Both investments require an initial payment of $190,500. The following table presents the estimated cash inflows for the two alternatives. Opportunity w Opportunity #2 Year 1 $ 55,710 102,800 Year 2 $ 58,760 109,650 Year $78,940 17,800 Year 4 $101,340 15,600 Mr Kearns decides to use his past average return on mutual fund investments as the discount rate; it is 8 percent (PV of $i and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required o. Compute the net present value of each opportunity. Which should Mr. Kearns adopt based on the net present value approach? b. Compute the payback period for each project. Which should Mr. Kearns adoptbased on the payback approach? Complete this question by entering your answers in the tabs below. Required A Required B Compute the payback period for each opportunity. Which should Mr. Kearns adopt based on the payback approach? Opportunity 1 Opportunity 2 Which opportunity should be chosen? Payback Period years years 8:55 Dwight Donovan, the president of Adams Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation, the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment. Initial cash expenditures for Project A are $109,000 and for Project B are $39,000. The annual expected cash inflows are $32,180 for Project A and $12,303 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Adams Enterprises desired rate of return is 6 percent. (PV of $1 and PVA of S-1) (Use appropriate factor(s) from the tables provided.) Required a. Compute the net present value of each project. Which project should be adopted based on the net present value approach? b. Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of retum approach? - 1 es Complete this question by entering your answers in the tabs below. Required A Required B Compute the approximate internal rate of return of each project. Which one should be adopted based on the internal rate of return approach Internal Rate of Return Project Project B Which project should be adopted? *