Answered step by step

Verified Expert Solution

Question

1 Approved Answer

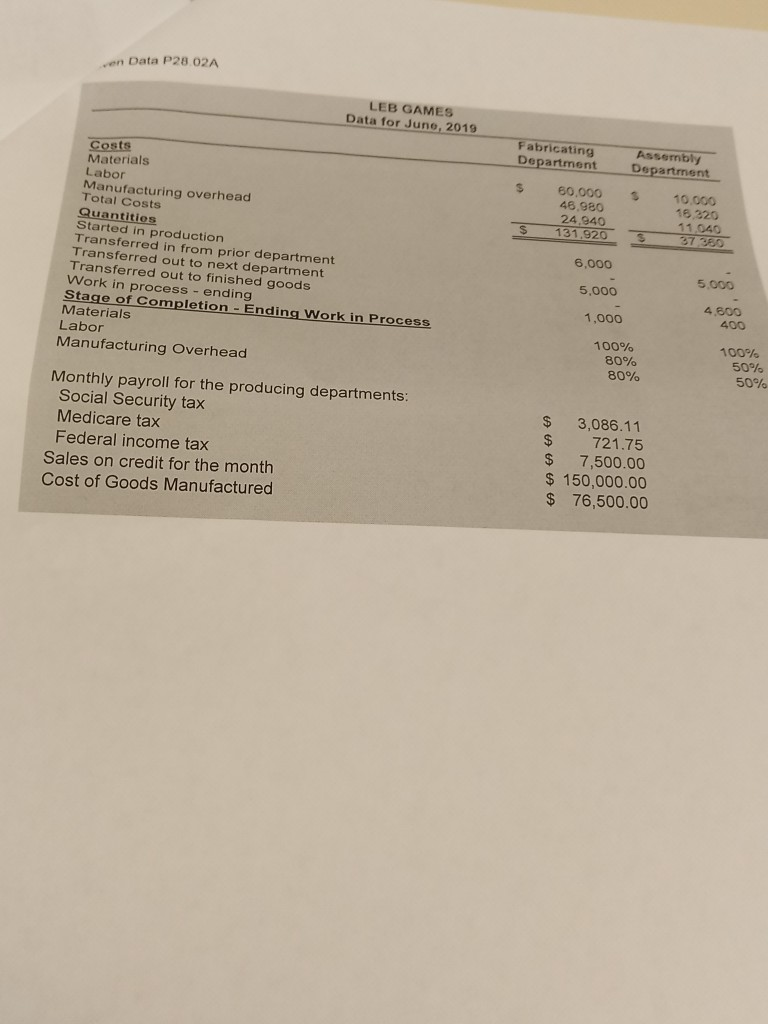

ven Data P28.02A LEB GAMES Data for June, 2019 Fabricating Department Assembly Department Costs Materials S 60,000 46.980 24,940 131,920 10.000 16,320 11.040 37 360

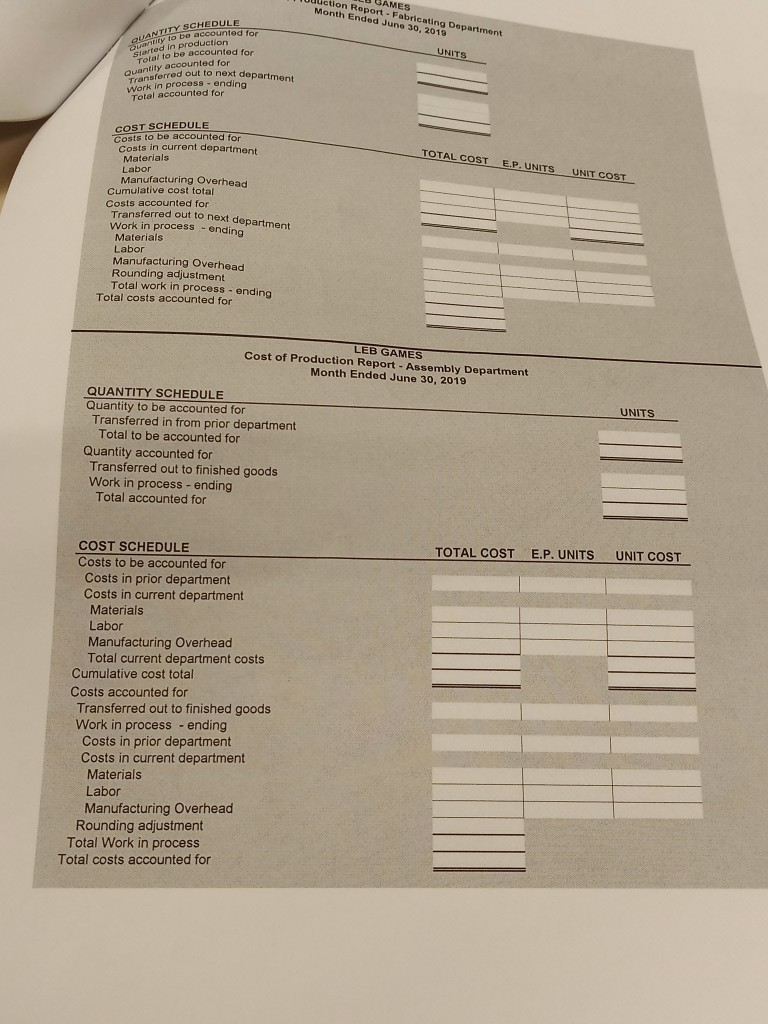

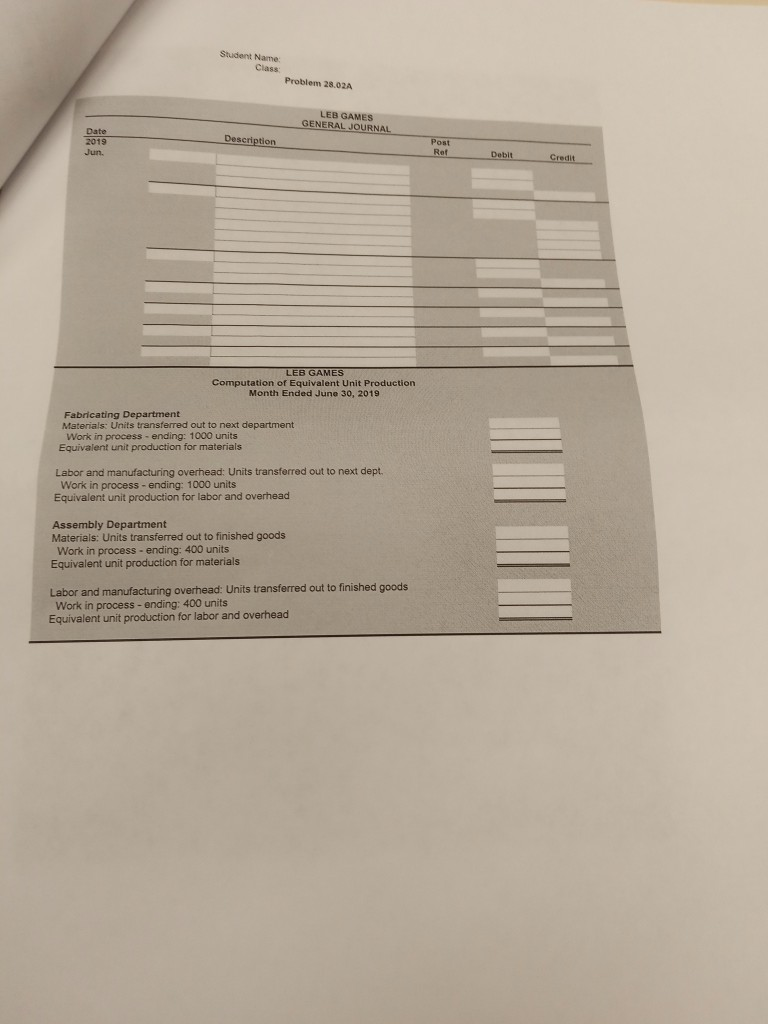

ven Data P28.02A LEB GAMES Data for June, 2019 Fabricating Department Assembly Department Costs Materials S 60,000 46.980 24,940 131,920 10.000 16,320 11.040 37 360 Labor Manufacturing overhead Total Costs Quantities arted in production Tra sferred in from prior department Transferred out to next department Transfer 6,000 5,000 5,000 out to finished goods ss ending 4,600 400 Work in proc 1,000 Stage of Completion - Ending Materials Work in Process 100% 100% Labor 50% 80% Manufacturing Overhead 80% 50% Monthly payroll for the producing departments: Social Security tax Medicare tax Federal income tax Sales on cred Cost of Goods Manufactured 3,086.11 721.75 7,500.00 $ 150,000.00 $ 76,500.00 for the month ES Report- Fal Month Ended June 30, 2 Department d for TITY SCHEDULE gntity oroduction fo UNITS Total to Quaerred out to next department nding Work unted for Total COST SCHEDULE Costs to be accounted for rrent department TOTAL COST Materials Labor E.P. UNITS UNIT COST C ative cost totalhead Costs accounted for Transferred out to next department process ending Materials Labor Manufacturing Overhead Total work i tment ending Total costs accounted for LEB GAMES Cost of Production Report- Assembly Month Ended June 30, 2010 partment QUANTITY SCHEDULE Quantity to be accounted for Transferred in from prior department Total to be accounted for UNITS Quantity accounted for Transferred out to finished goods Work in process - ending Total accounted for TOTAL COST E.P. UNITS UNIT COST COST SCHEDULE Costs to be accounted for Costs in prior department Costs in current department Materials Labor Manufacturing Overhead Total current department costs Cumulative cost total Costs accounted for Transferred out to finished goods Work in process ending Costs in prior department Costs in current department Materials Labor Manufacturing Overhead Rounding adjustment Total Work in process Total costs accounted for Student Name Class Problem 28.02A GENERAL JOURNAL Post Rel Description Debit Credit Jun. Computation of Equivalent Unit Production Month Ended June 30, 2019 Fabricating Department Materials: Units transferred out to next department tion or materials Work in pr Equivaler it production Labor and manufacturing overhead: Units transferred out to next dept. Work in process - ending: 1000 units Equivalent unit production for labor and overhead Assembly Department Materials: Units transferred out to finished goods Work in process - ending: 400 units Equivalent unit production for materials ad: Units transferred out to finished goods I abor and manufacturing o nits Fauivalent unit production for labor and overhead

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started