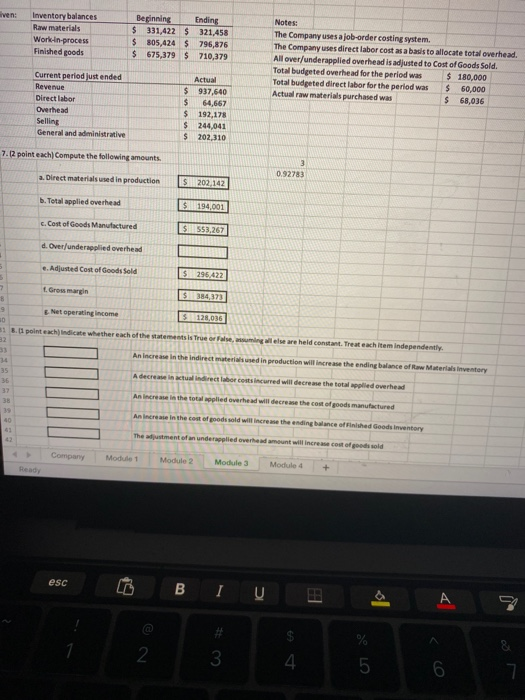

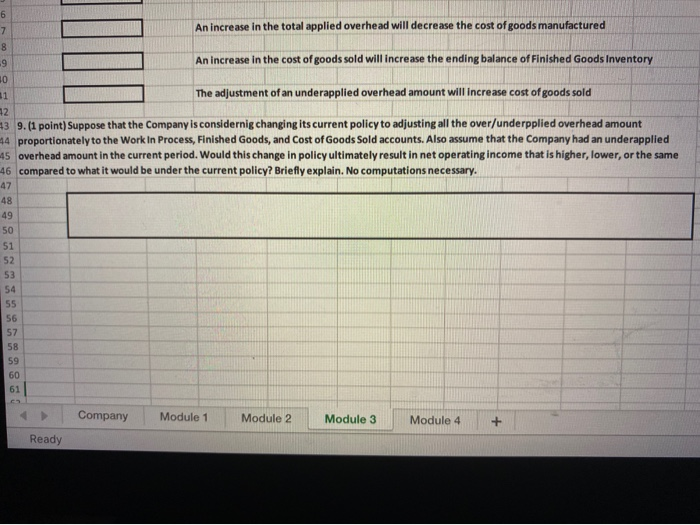

ven: Inventory balances Raw materials Work in process Finished goods Beginning Ending $ 331,4225 321,458 $ 805,424 $ 796,876 $ 675,379 $ 710,379 Notes: The Company uses a job-order costing system. The Company uses direct labor cost as a basis to allocate total overhead. All over/underapplied overhead is adjusted to Cost of Goods Sold. Total budgeted overhead for the period was $ 180,000 Total budgeted direct labor for the period was $ 60,000 Actual raw materials purchased was $ 68,036 Current period just ended Revenue Direct labor Overhead Selling General and administrative Actual $ 937,640 $ 64,667 $ 192,178 $ 244,041 $ 202,310 7.12 point each) Compute the following amounts 3 0.92783 a. Direct materials used in production $ 202, 142 b. Total applied overhead $ 194,001 c. Cost of Goods Manufactured $ 553.267 d. Over/underapplied overhead e. Adjusted Cost of Goods Sold S 295 422 7 8 Gross margin $ 384,373 9 Net operating income $ 128,036 30 31 8.11 point each indicate whether each of the statement is true or Falemingai are held constant. Treat each item independently 33 An increase in the Indirect materials used in production will increase the ending balance of Raw Materials inventory 35 A decrease in actul indirect labor costs incurred will decrease the total applied overhead 36 37 An increase in the total oplied overhead will decrease the cost of goods manufactured 38 39 An increase in the cost of goods sold will increase the ending balance of Fished Goods mentary The adjustment of an undergplied overhead amount will increase cost of good old Company Module 1 Module 2 Module 3 Module 4 40 esc BI U . 2 3 4 5 6 6 An increase in the total applied overhead will decrease the cost of goods manufactured 7 8 -9 10 11 An increase in the cost of goods sold will increase the ending balance of Finished Goods Inventory The adjustment of an underapplied overhead amount will increase cost of goods sold 13 9. (1 point) Suppose that the Company is considernig changing its current policy to adjusting all the over/underpplied overhead amount 44 proportionately to the Work In Process, Finished Goods, and Cost of Goods Sold accounts. Also assume that the Company had an underapplied 45 overhead amount in the current period. Would this change in policy ultimately result in net operating income that is higher, lower, or the same 46 compared to what it would be under the current policy? Briefly explain. No computations necessary. 12. 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 Company Module 1 Module 2 Module 3 Module 4 + Ready