Answered step by step

Verified Expert Solution

Question

1 Approved Answer

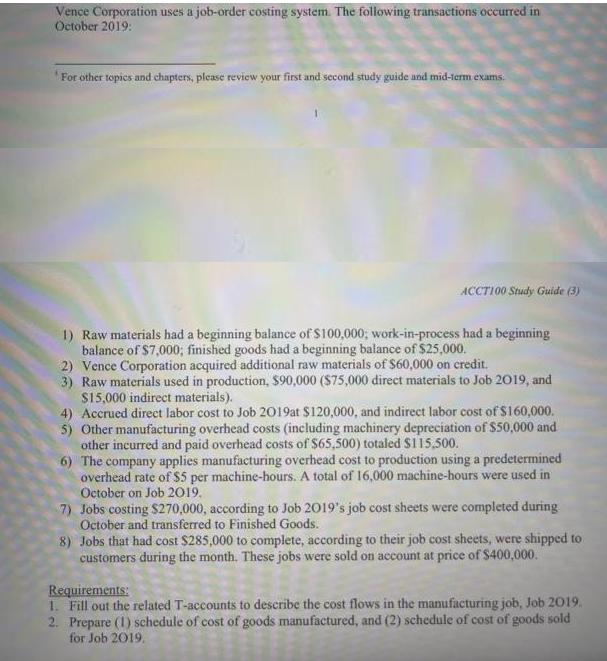

Vence Corporation uses a job-order costing system. The following transactions occurred in October 2019: For other topics and chapters, please review your first and

Vence Corporation uses a job-order costing system. The following transactions occurred in October 2019: For other topics and chapters, please review your first and second study guide and mid-term exams. ACCT100 Study Guide (3) 1) Raw materials had a beginning balance of $100,000; work-in-process had a beginning balance of $7,000; finished goods had a beginning balance of $25,000. 2) Vence Corporation acquired additional raw materials of $60,000 on credit. 3) Raw materials used in production, $90,000 ($75,000 direct materials to Job 2019, and $15,000 indirect materials). 4) Accrued direct labor cost to Job 2019at $120,000, and indirect labor cost of $160,000. 5) Other manufacturing overhead costs (including machinery depreciation of $50,000 and other incurred and paid overhead costs of $65,500) totaled $115,500. 6) The company applies manufacturing overhead cost to production using a predetermined overhead rate of $5 per machine-hours. A total of 16,000 machine-hours were used in October on Job 2019. 7) Jobs costing $270,000, according to Job 2019's job cost sheets were completed during October and transferred to Finished Goods. 8) Jobs that had cost $285,000 to complete, according to their job cost sheets, were shipped to customers during the month. These jobs were sold on account at price of $400,000. Requirements: 1. Fill out the related T-accounts to describe the cost flows in the manufacturing job, Job 2019. 2. Prepare (1) schedule of cost of goods manufactured, and (2) schedule of cost of goods sold for Job 2019.

Step by Step Solution

★★★★★

3.26 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started