Answered step by step

Verified Expert Solution

Question

1 Approved Answer

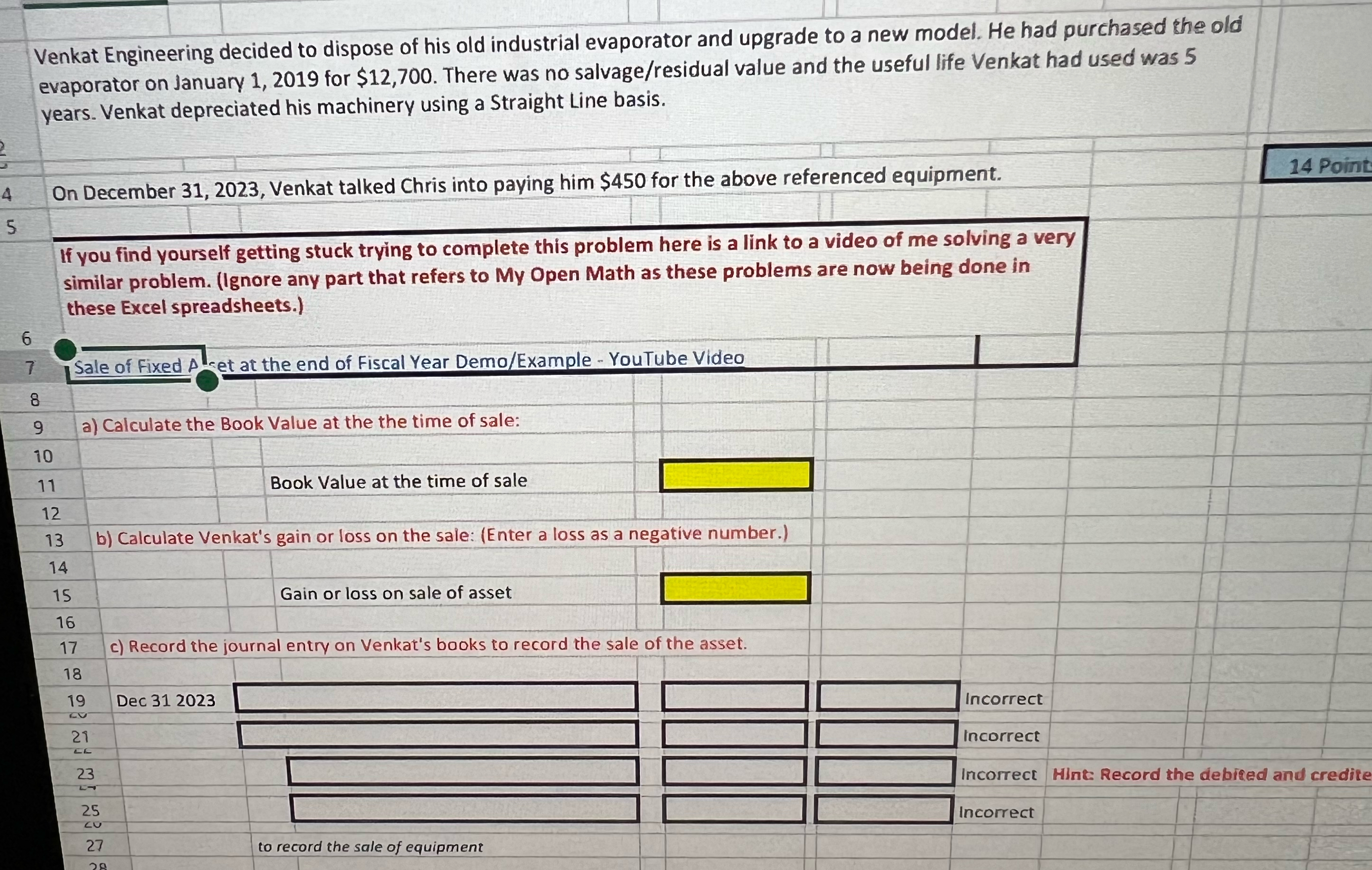

Venkat Engineering decided to dispose of his old industrial evaporator and upgrade to a new model. He had purchased the old evaporator on January 1

Venkat Engineering decided to dispose of his old industrial evaporator and upgrade to a new model. He had purchased the old evaporator on January for $ There was no salvageresidual value and the useful life Venkat had used was years. Venkat depreciated his machinery using a Straight Line basis.

On December Venkat talked Chris into paying him $ for the above referenced equipment.

If you find yourself getting stuck trying to complete this problem here is a link to a video of me solving a very similar problem. Ignore any part that refers to My Open Math as these problems are now being done in these Excel spreadsheets.

Sale of Fixed et at the end of Fiscal Year DemoExample YouTube Video

a Calculate the Book Value at the the time of sale:

Book Value at the time of sale

b Calculate Venkat's gain or loss on the sale: Enter a loss as a negative number.

Gain or loss on sale of asset

c Record the journal entry on Venkat's books to record the sale of the asset.

Dec

Incorrect

cu

to record the sale of equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started