. Venture Inc. is sitting on $100 million in liquidity and considering investing in two different start-ups: Company A and Company B. After 3

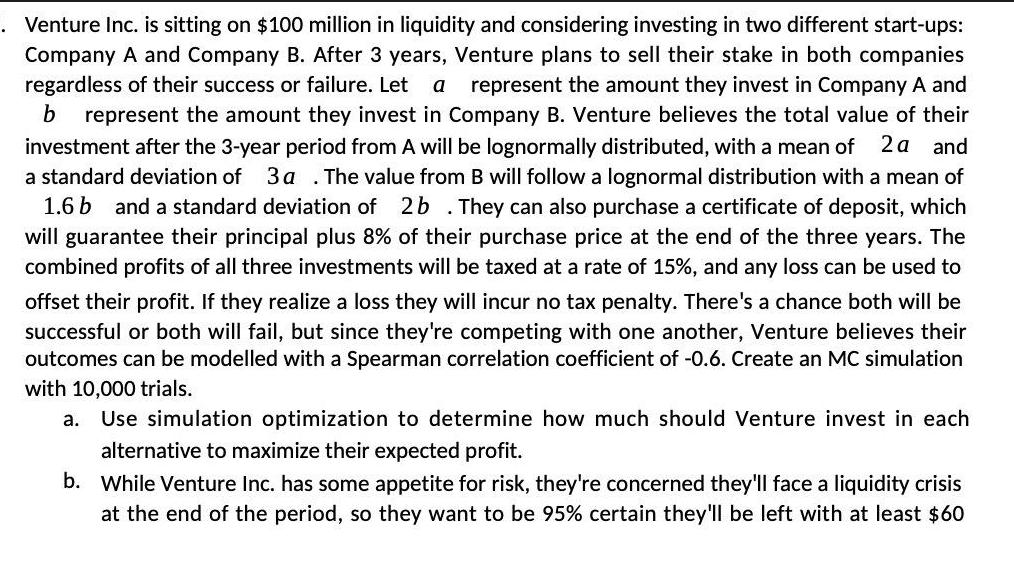

. Venture Inc. is sitting on $100 million in liquidity and considering investing in two different start-ups: Company A and Company B. After 3 years, Venture plans to sell their stake in both companies regardless of their success or failure. Let a represent the amount they invest in Company A and b represent the amount they invest in Company B. Venture believes the total value of their investment after the 3-year period from A will be lognormally distributed, with a mean of 2a and a standard deviation of 3a . The value from B will follow a lognormal distribution with a mean of 1.6 b and a standard deviation of 2b. They can also purchase a certificate of deposit, which will guarantee their principal plus 8% of their purchase price at the end of the three years. The combined profits of all three investments will be taxed at a rate of 15%, and any loss can be used to offset their profit. If they realize a loss they will incur no tax penalty. There's a chance both will be successful or both will fail, but since they're competing with one another, Venture believes their outcomes can be modelled with a Spearman correlation coefficient of -0.6. Create an MC simulation with 10,000 trials. a. Use simulation optimization to determine how much should Venture invest in each alternative to maximize their expected profit. b. While Venture Inc. has some appetite for risk, they're concerned they'll face a liquidity crisis at the end of the period, so they want to be 95% certain they'll be left with at least $60

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To solve this problem using simulation optimization we can follow these steps Step 1 Generate random samples for the investment amounts in Company A a ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started