Question

(Ventures and Fund. Examination) 3) Now guess that the financial backer needs just to purchase A (whose normal return and fluctuation is given in Q1)

(Ventures and Fund. Examination)

3) Now guess that the financial backer needs just to purchase A (whose normal return and fluctuation is given in Q1) yet in addition needs to contribute 40% of his/her cash in a danger free T-Bill whose return is 12%. The relationship coefficient between a T-Bill and stock An is +0.2. Given this discover the portfolio anticipated return and portfolio change.

1/1

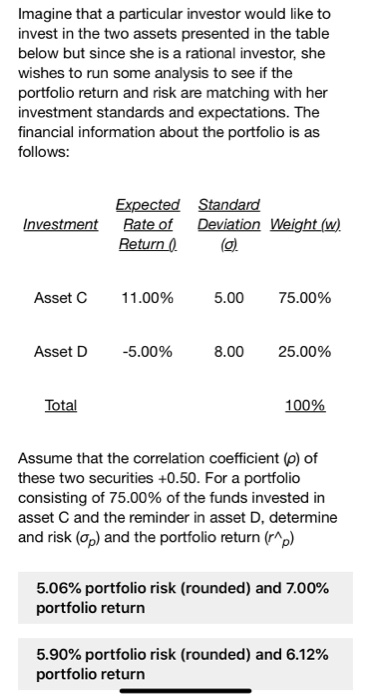

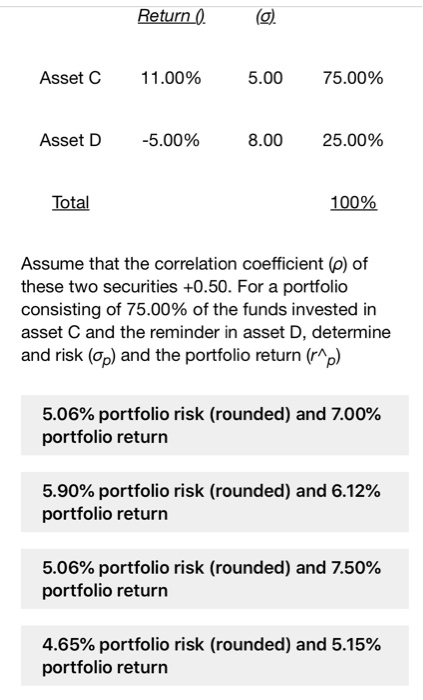

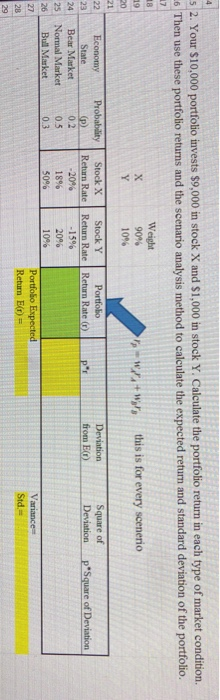

1) There are two stocks which a financial backer needs to purchase. The stock has a normal return of 25% and a normal fluctuation of 16% while stock B has a normal return of 15% and expected change of 9%. Discover the portfolio return and portfolio change accepting that the connection coefficient among An and B is + 0.4 and expecting that financial backer contributes 60% of his/her cash in stock A.

1) Is the Morkowitz Theory the best Approach for all Portfolios?

Clarify Markowitz's line of reasoning regarding why financial backers should look for a proficient portfolio.

2) How Low Can Standard Deviation Go?

Is it genuine that the target of proficient portfolio enhancement is to decide a standard deviation that is lower than the individual security's standard deviation?

3) Is there a True Risk-Free Portfolio?

As you would see it, will be it conceivable to build a danger free portfolio?

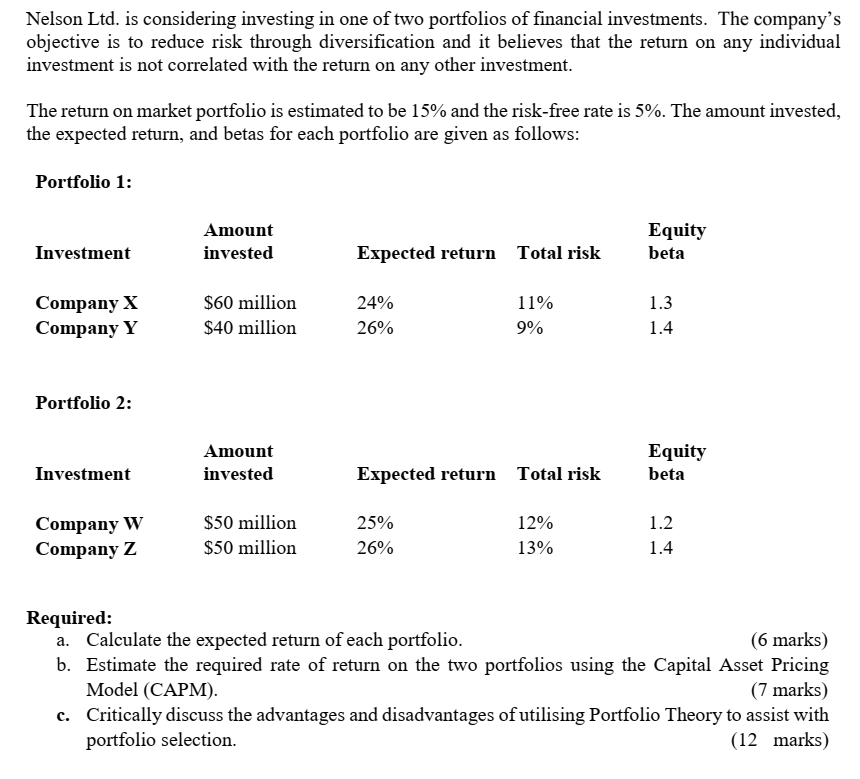

Current portfolio hypothesis

b.Assume ACES offers' beta is 1.45, the year hazard free pace of return is 5.3%p.a and the market hazard premium is 4% p.a. Diagram a system for a sane financial backer if BHP's offers are as of now valued to accomplish a 10% p.a. anticipated pace of return.

c.If a value store supervisor accepts the Indonesian financial exchange will start to go downwards over the course of the following year, how should the chief 'adjust' his/her value portfolio to help protect financial backers' abundance under his/her administration? Expect that the asset just puts resources into values.

d.Diversification can't take out all portfolio hazard. Do you concur with the assertion? Clarify your reasons

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started