Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Venus Inc. (VI) operates a passenger train service in the country of Galaxy. VI is the sole operator of the train service in Galaxy.

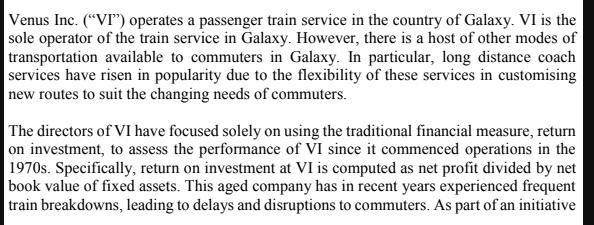

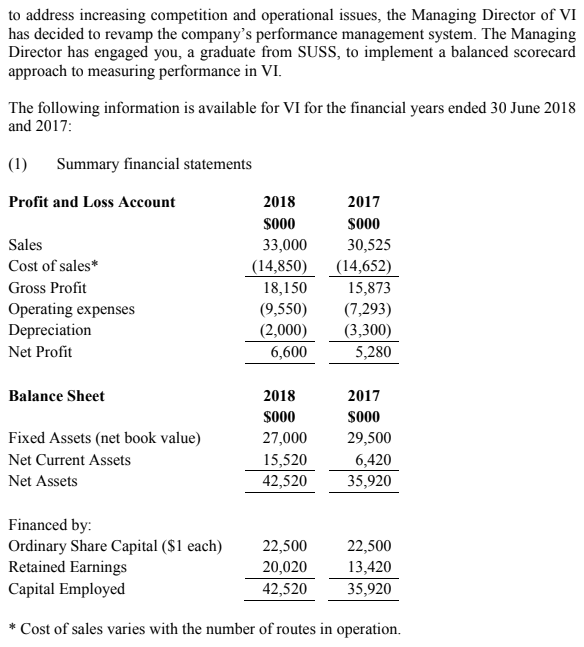

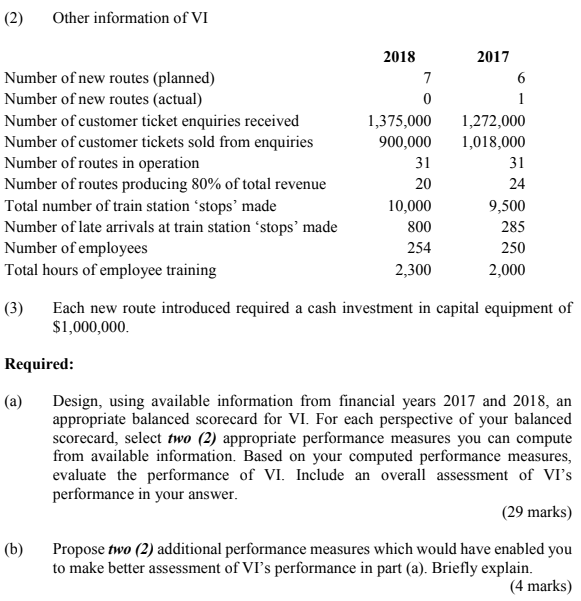

Venus Inc. ("VI") operates a passenger train service in the country of Galaxy. VI is the sole operator of the train service in Galaxy. However, there is a host of other modes of transportation available to commuters in Galaxy. In particular, long distance coach services have risen in popularity due to the flexibility of these services in customising new routes to suit the changing needs of commuters. The directors of VI have focused solely on using the traditional financial measure, return on investment, to assess the performance of VI since it commenced operations in the 1970s. Specifically, return on investment at VI is computed as net profit divided by net book value of fixed assets. This aged company has in recent years experienced frequent train breakdowns, leading to delays and disruptions to commuters. As part of an initiative to address increasing competition and operational issues, the Managing Director of VI has decided to revamp the company's performance management system. The Managing Director has engaged you, a graduate from SUSS, to implement a balanced scorecard approach to measuring performance in VI. The following information is available for VI for the financial years ended 30 June 2018 and 2017: (1) Summary financial statements Profit and Loss Account Sales Cost of sales* Gross Profit Operating expenses Depreciation Net Profit Balance Sheet Fixed Assets (net book value) Net Current Assets Net Assets 2018 $000 33,000 (14,850) 18,150 (9,550) (2,000) 6,600 2018 $000 27,000 15,520 42,520 2017 $000 30,525 (14,652) 22,500 20,020 42,520 15,873 (7,293) (3,300) 5,280 2017 $000 29,500 6,420 35,920 Financed by: Ordinary Share Capital ($1 each) Retained Earnings Capital Employed Cost of sales varies with the number of routes in operation. 22,500 13,420 35,920 (2) Other information of VI Number of new routes (planned) Number of new routes (actual) Number of customer ticket enquiries received Number of customer tickets sold from enquiries Number of routes in operation Number of routes producing 80% of total revenue Total number of train station 'stops' made Number of late arrivals at train station 'stops' made Number of employees Total hours of employee training Required: (a) 2018 (b) 7 0 1,375,000 900,000 31 20 10,000 800 254 2,300 2017 6 1 1,272,000 1,018,000 (3) Each new route introduced required a cash investment in capital equipment of $1,000,000. 31 24 9,500 285 250 2,000 Design, using available information from financial years 2017 and 2018, an appropriate balanced scorecard for VI. For each perspective of your balanced scorecard, select two (2) appropriate performance measures you can compute from available information. Based on your computed performance measures, evaluate the performance of VI. Include an overall assessment of VI's performance in your answer. (29 marks) Propose two (2) additional performance measures which would have enabled you to make better assessment of VI's performance in part (a). Briefly explain. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Balanced Scorecard for Venus Inc VI Perspective Financial 1 Performance Measure Net Profit Margin Formula Net Profit Sales 2018 6600 33000 20 2017 5280 30525 173 Evaluation The net profit margin inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started