Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Do you receive a deduction on your personal Income tax? Question RRSP TFSA Do you receive a deduction on your personal Income tax YES NO

Do you receive a deduction on your personal Income tax?

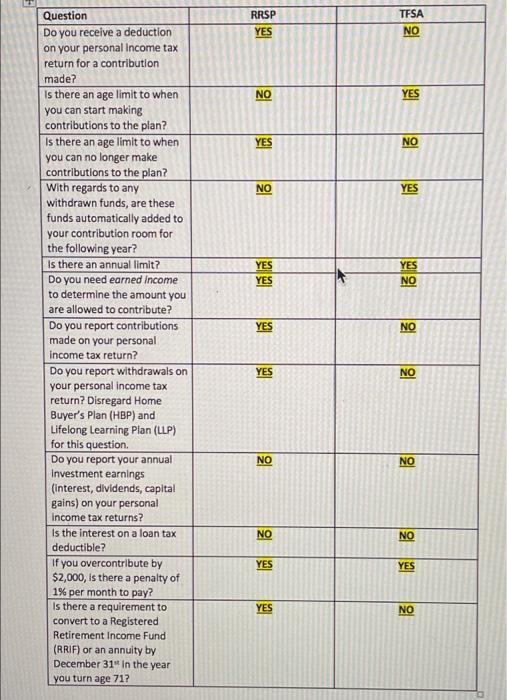

Question RRSP TFSA Do you receive a deduction on your personal Income tax YES NO return for a contribution made? YES Is there an age limit to when you can start making contributions to the plan? Is there an age limit to when you can no longer make contributions to the plan? With regards to any NO YES NO NO YES withdrawn funds, are these funds automatically added to your contribution room for the following year? Is there an annual limit? Do you need earned income to determine the amount you YES YES YES NO are allowed to contribute? Do you report contributions made on your personal YES NO income tax return? Do you report withdrawals on your personal income tax return? Disregard Home Buyer's Plan (HBP) and Lifelong Learning Plan (LLP) for this question. YES NO Do you report your annual Investment earnings (interest, dividends, capital gains) on your personal Income tax returns? NO NO Is the interest on a loan tax NO NO deductible? If you overcontribute by $2,000, Is there a penalty of 1% per month to pay? Is there a requirement to convert to a Registered Retirement Income Fund (RRIF) or an annuity by December 31"t in the year YES YES YES NO you turn age 71?

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

1 Correct Contribution to RRSP is allowed as deduction whereas contribution made to TFSA is not dedu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started