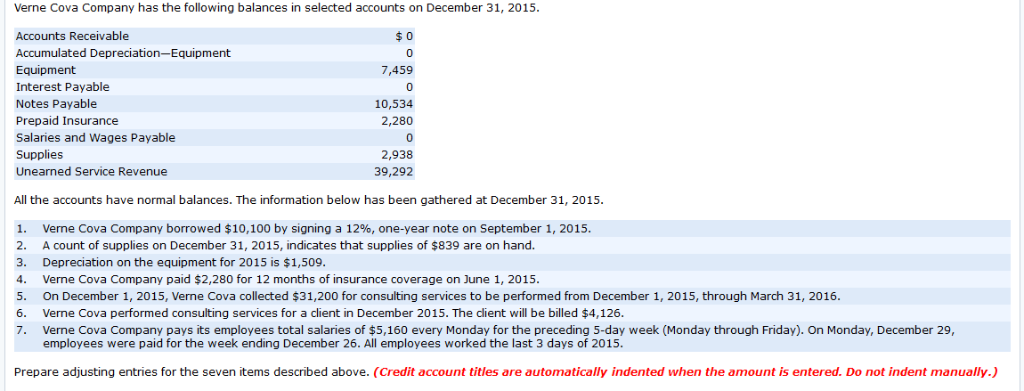

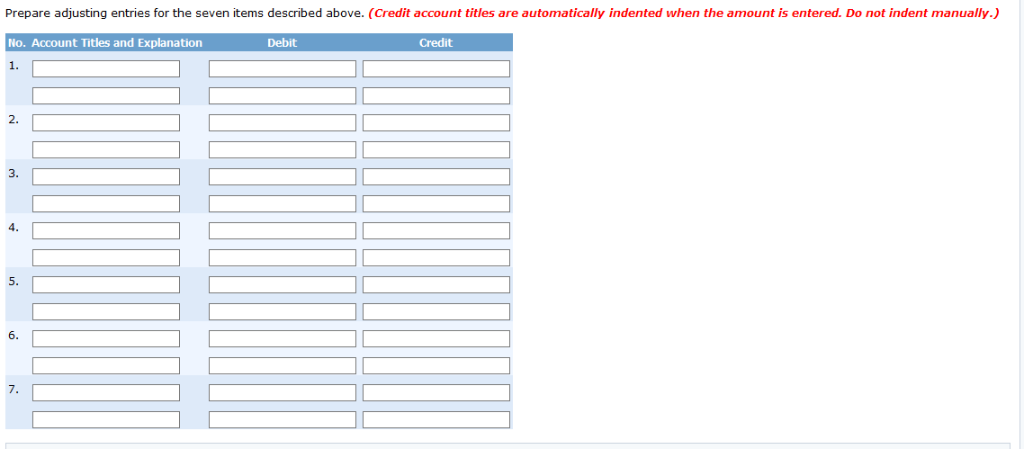

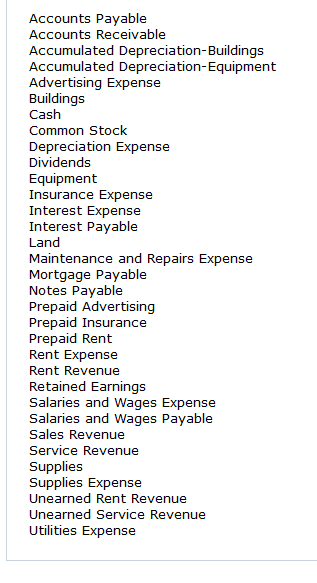

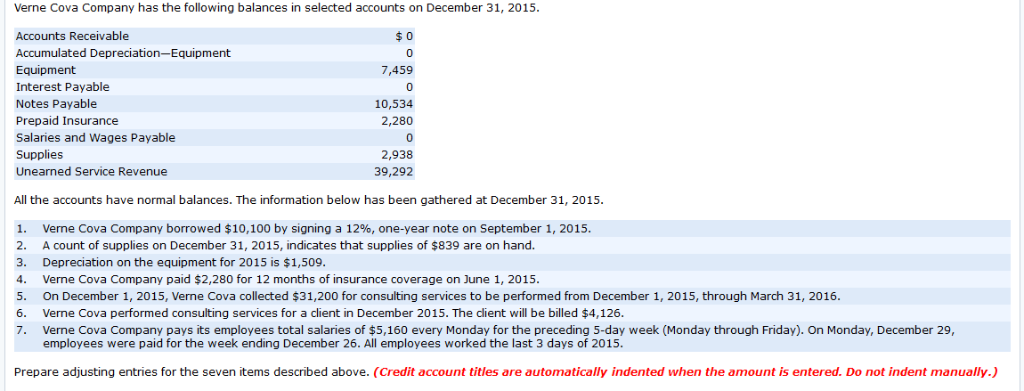

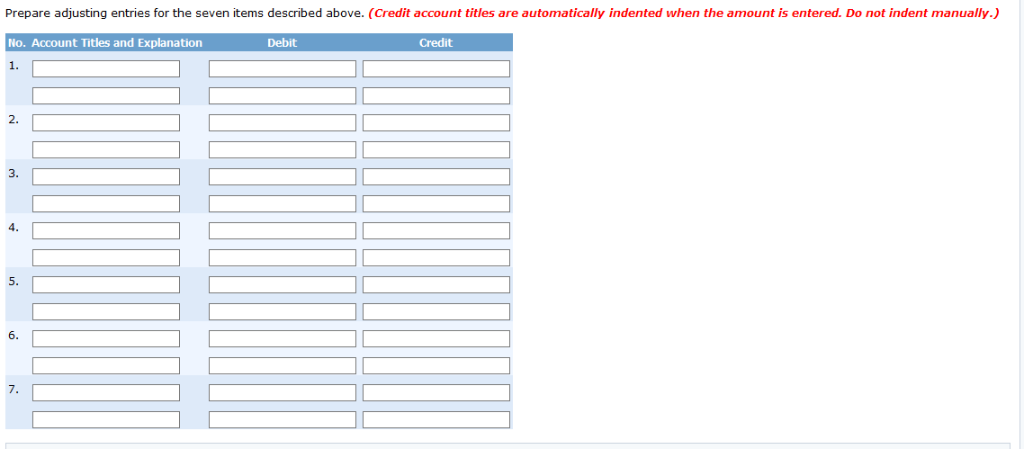

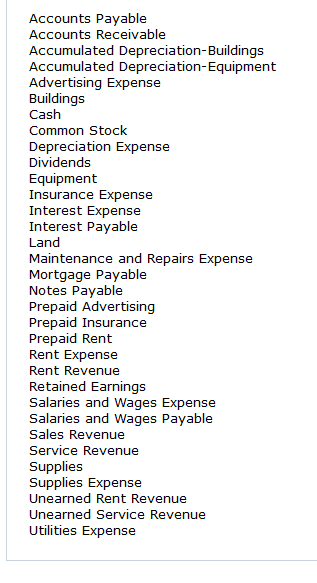

Verne Cova Company has the following balances in selected accounts on December 31, 2015 Accounts Receivable Accumulated Depreciation-Equipment Equipment Interest Payable Notes Payable Prepaid Insurance Salaries and Wages Payable Supplies Unearned Service Revenue 0 7,459 0 10,534 2,280 0 2,938 39,292 All the accounts have normal balances. The information below has been gathered at December 31, 2015 Verne Cova Company borrowed $10,100 by signing a 12%, one-year note on September 1, 2015 2. A count of supplies on December 31, 2015, indicates that supplies of $839 are on hand. 3. Depreciation on the equipment for 2015 is $1,509 4. Verne Cova Company paid $2,280 for 12 months of insurance coverage on June 1, 2015 5. On December 1, 2015, Verne Cova collected $31,200 for consulting services to be performed from December 1, 2015, through March 31, 2016 6. Verne Cova performed consulting services for a client in December 2015. The client will be billed $4,126. 7. Verne Cova Company pays its employees total salaries of $5,160 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2015 Prepare adjusting entries for the seven items described above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Prepare adjusting entries for the seven items described above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. No. Account Titles and Explanation Debit Credit 2. 4. 5. 6. 7 Accounts Payable Accounts Receivable Accumulated Depreciation-Building:s Accumulated Depreciation-Equipment Advertising Expense Buildings Cash Common Stock Depreciation Expense Dividends Equipment Insurance Expense Interest Expense Interest Payable Land Maintenance and Repairs Expense Mortgage Payable Notes Payable Prepaid Advertising repaid Insurance Prepaid Rent Rent Expense Rent Revenue Retained Earnings Salaies and Wages Expense Salaies and Wages Payable Sales Revenue Service Revenue Supplies Supplies Expense Unearned Rent Revenue Unearned Service Revenue Utilities Expense