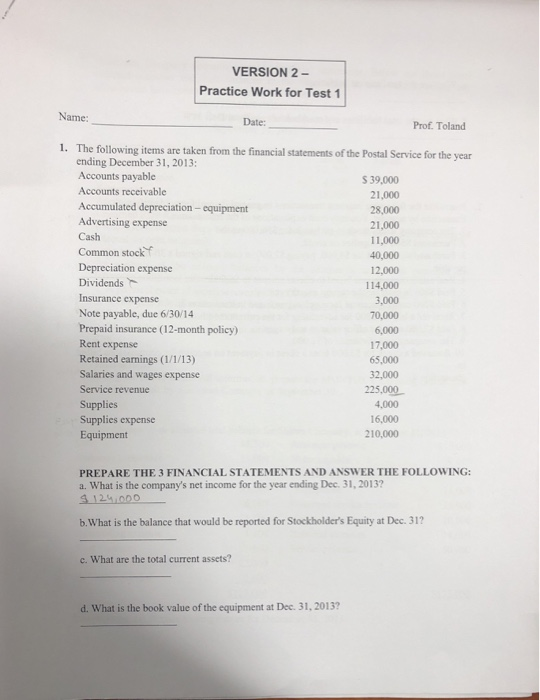

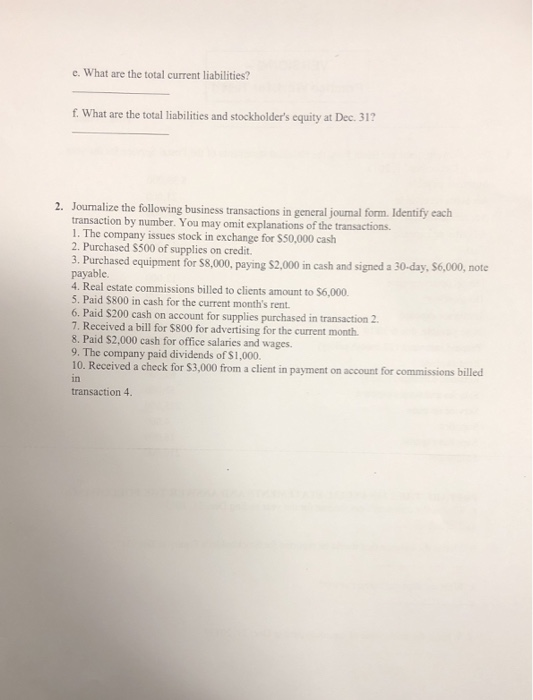

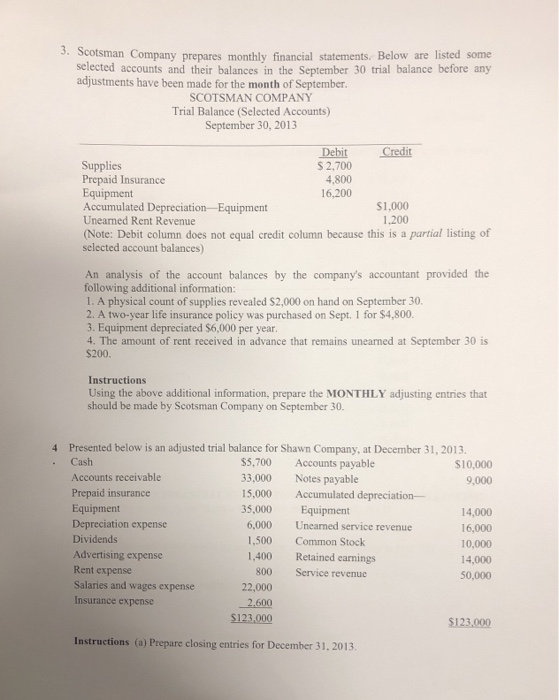

VERSION 2- Practice Work for Test 1 Name: Date: Prof. Toland 1 The following items are taken from the financial statements of the Postal Service for the year ending December 31, 2013: Accounts payable Accounts receivable Accumulated depreciation- equipment Advertising expense Cash Common stock Depreciation expense Dividends h Insurance expense Note payable, due 6/30/14 Prepaid insurance (12-month policy) Rent expense Retained earnings (1/1/13) Salaries and wages expense Service revenue Supplies Supplies expense Equipment $ 39,000 21,000 28,000 21,000 11,000 40,000 12,000 114,000 3,000 70,000 6,000 17,000 65,000 32,000 225,000 4,000 16,000 210,000 PREPARE THE 3 FINANCIAL STATEMENTS AND ANSWER THE FOLLOWING: a. What is the company's net income for the year ending Dec. 31, 2013? b. What is the balance that would be reported for Stockholder's Equity at Dec. 31? c. What are the total current assets? d. What is the book value of the equipment at Dec. 31, 2013? e. What are the total current liabilities? f What are the total liabilities and stockholder's equity at Dec. 31 2. Jourmalize the following business transactions in general jounal form. Identify cach transaction by number. You may omit explanations of the transactions 1. The company issues stock in exchange for $50,000 cash 2. Purchased $500 of supplies on credit. 3. Purchased equipment for S8,000, paying $2,000 in cash and signed a 30-day, $6,000, note payable 4. Real estate commissions billed to clients amount to $6,000 5. Paid $800 in cash for the current month's rent. 6. Paid $200 cash on account for supplies purchased in transaction 2 7. Received a bill for $800 for advertising for the current month 8. Paid $2,000 cash for office salaries and wages. 9. The company paid dividends of S1,000. 10. Received a check for $3,000 from a client in paym in transaction 4. ent on account for commissions billed 3. Scotsman Company prepares monthly financial statements. Below are listed some selected accounts and their balances in the September 30 trial balance before any adjustments have been made for the month of September. SCOTSMAN COMPANY Trial Balance (Selected Accounts) September 30, 2013 Debit Credit S 2,700 4,800 16,200 Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Unearned Rent Revenue (Note: Debit column does not equal credit column because this is a partial listing of selected account balances) $1,000 1,200 An analysis of the account balances by the company's accountant provided the following additional information: 1. A physical count of supplies revealed $2,000 on hand on September 30. 2. A two-year life insurance policy was purchased on Sept. 1 for $4,800. 3. Equipment depreciated $6,000 per year 4. The amount of rent received in advance that remains unearned at September 30 is $200 Instructions Using the above additional information, prepare the MONTHLY adjusting entries that should be made by Scotsman Company on September 30 4 Presented below is an adjusted trial balance for Shawn Company, at December 31, 2013. ACash s receis 5,700 Accounts payable 33,000 Notes payable 15,000 Accumulated depreciation- 35,000 Equipment ,000 Unearned service revenue 1,500 Common Stock 1,400 Retained carnings $10,000 9,000 Accounts receivable Prepaid insurance Equipment Depreciation expense Dividends Advertising expense Rent expense Salaries and wages expense Insurance expense 14,000 16,000 10,000 14,000 50,000 800 Service revenue 22,000 2,600 $123,000 $123,000 Instructions (a) Prepare closing entries for December 31, 2013